The DAX has been extremely volatile for the past several months as the Greek crisis bashed the German stock market around. The index has broken out of the bearish trend it was following during the crisis but has met some firm resistance. That resistance is likely to push the DAX lower, in search of support before a strong bull trend that could put the recent highs under pressure.

It’s been a rugged time for the DAX since the highs hit in Mid-April. Since then the trouble in Greece has seen a broad selloff thanks to the fear that Greece will leave the Eurozone and contagion will spread to other struggling Eurozone countries. Thankfully, disaster was averted, for now, and that has seen the DAX claw back most of the recent losses. The DAX even managed to break out of the bearish trend that it had been stuck under since the April highs.

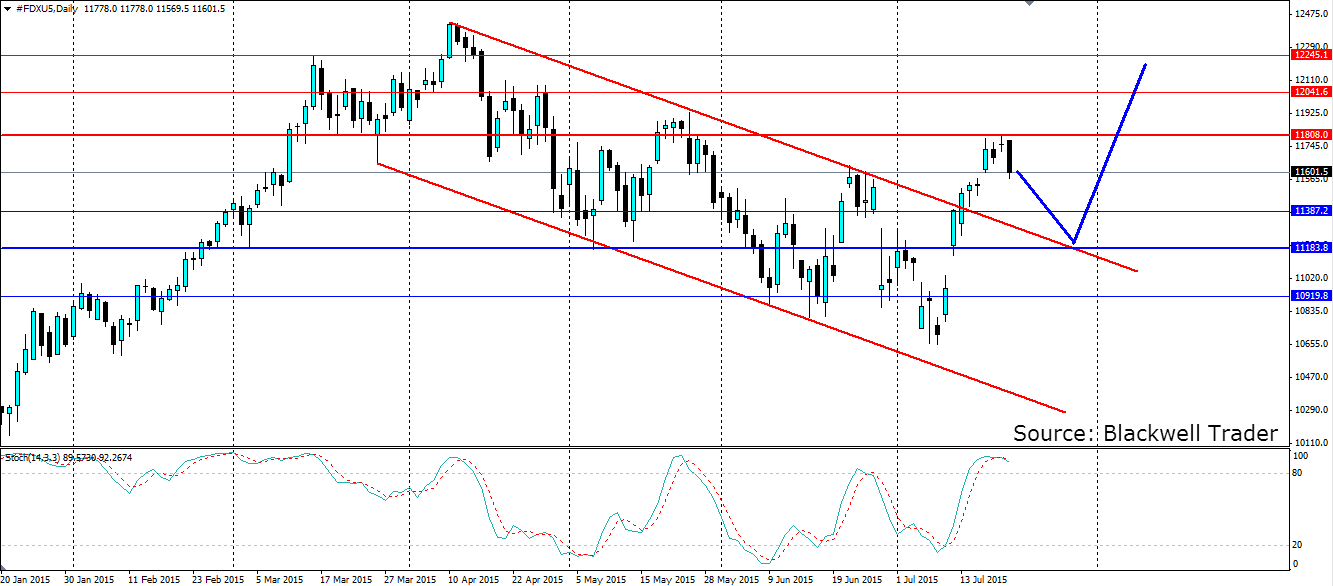

That breakout has seen momentum push it up to an interesting level of resistance at the 11808 handle. That formed the neckline of the top structure that formed around the April highs and has been a point of interest for the index ever since. So far the resistance has held firm with a large bearish engulfing candle forming as the index rejects off it. That is likely to see the DAX turn bearish over the coming week as it searches for some support.

The Stochastic Oscillator has pushed into oversold territory which has left plenty of room for a downside swing. Momentum in the Stoch is now looking to reverse and head lower which is likely to drag price with it. From here I would expect the DAX to drift lower over the coming days and it is likely to find support at the top of the bearish channel that it broke out of. That could well coincide with the firm support found at the 11183.8 level, which has acted as a swing point in previous down legs. Once this level has been hit, we can expect the bullish run to resume and for resistance to come under pressure with an eye to the all-time high at 12428.0 as a target.

Watch for minor support at 11387.2 and 10919.8 either side of the more solid looking 11183.8. As stated above, watch for dynamic support along the failed bearish channel. Resistance is found at the most recent high at 11808.0, with further resistance found at 12041.6 and 12245.1.