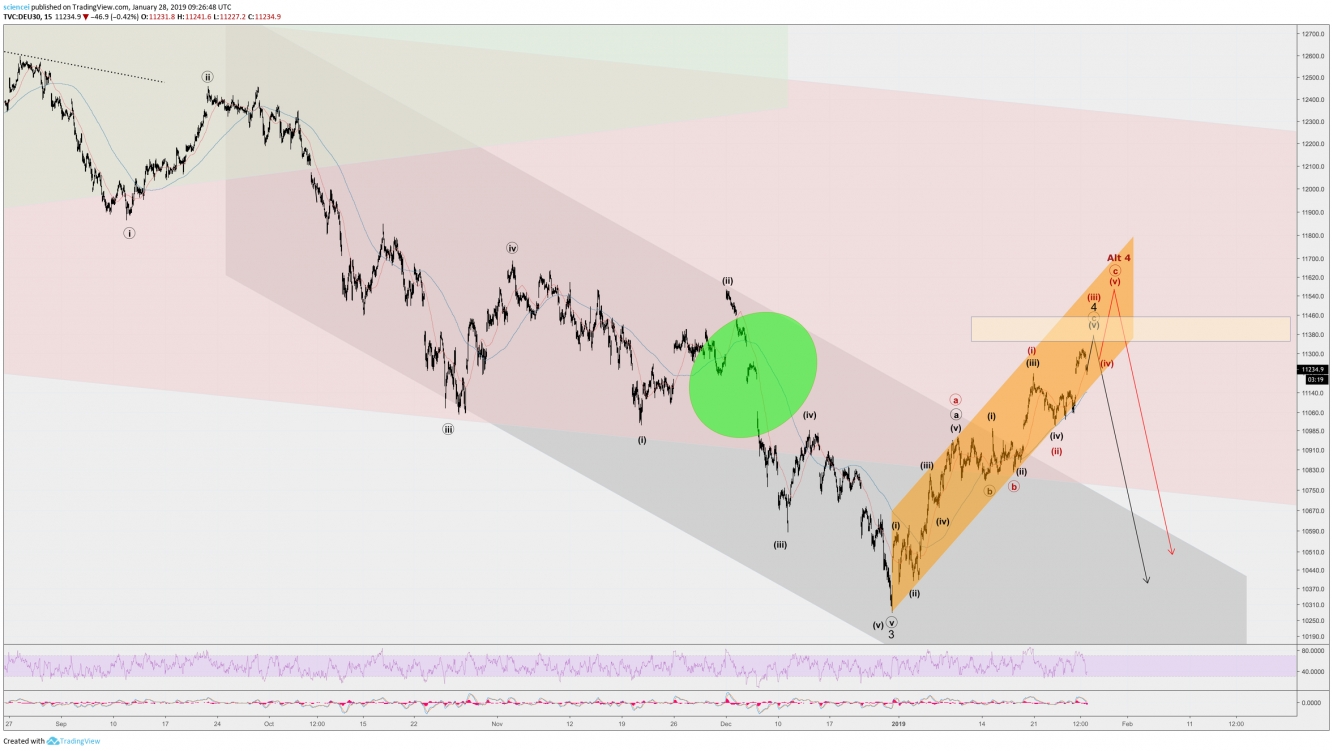

The DAX probably traces a zig-zag correction within a 4th wave of minor degree. The zig-zag correction is encapsulated by the orange upside trend channel, which started at the late December 2018 low. This fits the complex second wave of minor degree, which is described within the Elliott wave alternation guidelines.

The German index advanced into what mountaineers call “the death zone”. This means that it could reverse at any moment and finish minor wave 4. A decisive break of the orange trend channel is the first indication that the DAX topped. There is a confluence cluster in the area between 11,350-11,450 points. An equidistant zig-zag relationship, a 38% retracement, the green opening gap, and S/R levels are inside that area. Most likely, technically oriented traders will supply the market around that area. It is the next important junction that is likely to lead into a reversal.

All in all, the DAX is probably within a bear market rally.