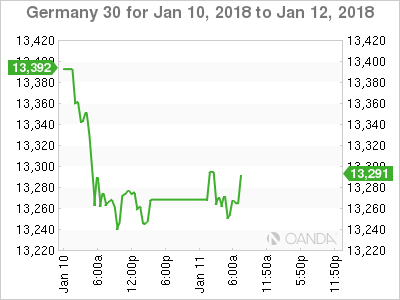

The DAX has posted considerable losses in the Wednesday session. Currently, the index is at 13,261.50, down 0.15% on the day. On the release front, Eurozone Industrial Production posted a strong gain of 1.0%, above the estimate of 0.8%. Later in the day, ECB will release the minutes of the December policy meeting.

The ECB has started a taper of its asset purchase program (QE), cutting monthly purchases from EUR 60 billion to EUR 30 billion. When the ECB announced the taper in late 2017, it extended the program until to September 2018. However, the eurozone economy continuing to look sharp, there are signals that QE may not be extended beyond September. On December 30, Benoit Coeure, who is in charge of the program, said on Dec. 30 there was a “reasonable chance” it would not be extended. On Sunday, Bundesbank President Jens Weidmann said the ECB should set a date to end QE. Talk of an end to QE has raised speculation that the ECB could follow up with a rate hike late in 2018. This would be a monumental move, as the ECB hasn’t raised rates since 2011.

Stronger growth in the Eurozone has also led to a steady decline in unemployment over the course of 2017. In December, the reading dropped to 8.7%. This marked its lowest level since March 2009, when the rate stood at 8.5%. This is yet another indication of the impressive rebound in the eurozone economy, as growth has been steady and the employment picture has improved. Retail Sales, the primary gauge of consumer spending, posted a strong gain of 1.5% in December, after a decline of 1.1% in November. The DAX has received a boost from the strong numbers, and has gained 2.2% since the New Year. If the eurozone economy continues to improve, the DAX rally should continue.

Economic Calendar

Thursday (January 11)

- 5:00 Eurozone Industrial Production. Estimate 0.8%

- 7:30 ECB Monetary Policy Meeting Accounts

Friday (January 12)

- 11:30 German Buba President Weidmann Speaks

*All release times are GMT

*Key events are in bold

DAX, Thursday, January 11 at 6:40 EDT

Open: 13,293.50 High: 13,300.50 Low: 13,243.50 Close: 13,261.50