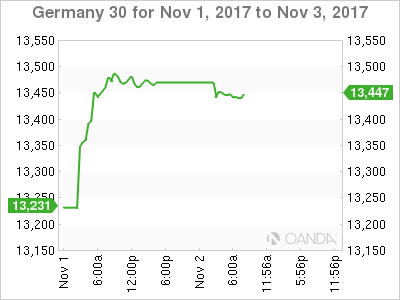

The DAX has posted considerable gains in the Wednesday session. Currently, the DAX is at 13,442.00, down 0.21% on the day. On the release front, German numbers were within expectations. Final Manufacturing PMI remained unchanged at 60.5, just shy of the estimate of 60.6 points. Unemployment Change declined by 10 thousand, close to the estimate of -11 thousand. Eurozone Final Manufacturing PMI improved to 58.5, close to the forecast of 58.6 points.

The DAX posted strong gains on Wednesday, climbing as high as 1.6%, before closing the session up 0.09%. This was in response to positive corporate earnings releases. Automobile sector posted strong gains, led by BMW, Daimler and Volkswagen (DE:VOWG_p). The DAX continues to set record highs, and has climbed 3.2% since October 23. The robust German economy has helped boost German stock markets, and with the economy expected to record a strong fourth quarter, the DAX rally could continue.

Strong manufacturing indicators in both Germany and the eurozone have boosted the eurozone economy this year. The positive trend continued in September, as Manufacturing PMIs pointed to expansion early in the fourth quarter. German Manufacturing PMI held at 60.6, its highest level since April 2011. Eurozone Manufacturing PMI isn’t far behind at 58.6, and accelerated for a third straight month. The German employment market remains robust, as unemployment rolls have declined for three straight months. Unemployment has now dropped in all but two readings since June 2015.

The markets have priced in a December rate hike in the US at 96 percent, but what can we expect in 2018? This will depend to a large degree on the new chair of the Fed, who will take over from Janet Yellen in February. Janet Yellen will wind up her 3-year term in February, and she is not expected to be reappointed by President Trump. The front runner is economist Jerome Powell, who is expected to maintain the Fed’s current policy of incremental rates. Trump is expected to make his choice on Thursday, ahead of his trip to Asia.

Economic Calendar

Thursday (November 2)

- 4:55 German Final Manufacturing PMI. Estimate 60.5. Actual 60.6

- 4:55 German Unemployment Change. Estimate -10K. Actual -11K

- 5:00 Eurozone Final Manufacturing PMI. Estimate 58.6. Actual 58.5

Friday (November 3)

- 8:30 US Nonfarm Employment Change. Estimate 311K

*All release times are GMT

*Key events are in bold

DAX, Thursday, November 2 at 7:05 EDT

Open: 13,451.50 High: 13,463.00 Low: 13,436.50 Close: 13,442.00