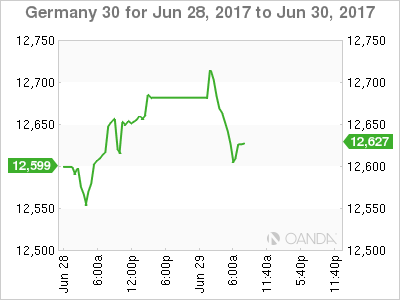

The DAX index has reversed directions in the Thursday session, dropping 0.36%. Currently, the DAX is at 12,607.50. On the release front, German GfK Consumer Climate improved to 10.6, beating the estimate of 10.4. Later in the day, Germany releases Preliminary CPI, with an estimate of a flat 0.0%.

In the US, today’s key event is Final GDP, which is expected to gain, 1.2%. As well, unemployment claims are expected to remain at 241 thousand. On Friday, Germany releases Retail Sales and the eurozone publishes CPI Flash Estimate. The US will publish UoM Consumer Sentiment.

Mario Draghi was likely unprepared for the sharp reaction on the currency markets to his remarks at the ECB forum in Portugal. EUR/USD has rallied this week, climbing 1.9% on Draghi’s hawkish comments. Draghi presented an optimistic view of the euro-area, saying that the recovery was broad and shrugged off weak inflation levels. Draghi said that the ECB’s stimulus program was needed for now, but would be gradually withdrawn once inflation moved higher.

Draghi’s comments did not appear to be a major change from previous statements, as the ECB has said time and time again that the bank has no plans to remove stimulus until inflation levels in the eurozone are closer to the ECB’s target of 2 percent. However, the markets clearly think otherwise, as Draghi’s comments have raised speculation that the ECB is planning to tighten policy. After the euro jumped, the ECB beat a hasty retreat, as sources said that the markets had “misinterpreted” Draghi’s remarks. This impeded the euro’s rally, but only briefly.

The ECB has consistently said that it would not reduce stimulus until inflation moves closer to the ECB’s target of 2%, but the message the markets appear to have heard is that the long war on inflation has been won, so it’s only a matter of time before the ECB wraps up its monetary stimulus. If investors remain convinced that the ECB’s easy money policy is on its way out, European stock markets could lose ground.

The German economy continues to perform well, as the labor market is strong, exports are up and consumer demand is solid. Still, Germany has not been immune to low inflation levels, which have hampered economies in Europe, Japan and North America (the UK is one notable exception). German CPI, the primary gauge of consumer inflation, has not posted a gain since March, and the estimate for the June report stands at a flat 0.0%. The strong economy and the ECB’s loose monetary policy, inflation remains stubbornly low.

One key factor in this is falling oil prices, which have also pushed energy stocks lower, and this has weighed on the DAX as well. Some analysts have projected that the ECB will not raise interest rates before 2019, as the eurozone economy is simply not strong enough to withstand higher interest rates in the near future.

It’s report card day for the US economy, with the release of Final GDP for the first quarter later on Thursday. The economy is expected to grow 1.2%, but there are worrying signs that the GDP might miss this target. Recent US economic data has been softer than expected, notably construction and manufacturing reports. US durable goods releases were weak in May. Core Durable Goods broke a streak of two straight declines, but the weak gain of 0.1% missed expectations. Durable Goods declined 1.1%, its sharpest decline since June 2016.

The slowdown in orders of business equipment could weigh on second quarter growth. Last week, it was the turn of construction numbers to disappoint, as Housing Starts and Building Permits both missed expectations. Consumer spending has also been softer than expected, and if Final GDP falls short of the modest estimate of 1.2%, investor sentiment could sour and send the stock markets lower.

Economic Calendar

Thursday (June 29)

- 2:00 GfK German Consumer Climate. Estimate 10.4. Actual 10.6

- All Day – German Preliminary CPI. Estimate 0.0%

- 8:30 US Final GDP. Estimate 1.2%

Upcoming Key Events

Friday (June 30)

- 2:00 German Retail Sales. Estimate 0.3%

- 3:55 German Unemployment Change. Estimate -10K

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.2%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 1.0%

*All release times are EDT

*Key events are in bold

DAX, Thursday, June 29 at 7:00 EDT

Open: 12,589.50 High: 12,538.00 Low: 12,625.50 Close: 12,605.50