The DAX index has posted small gains in the Thursday session. Currently, the DAX is trading at 12,656.25 points. On the release front, German and the Eurozone Manufacturing PMIs both indicated expansion. German Manufacturing PMI improved to 59.4, a shade under the estimate of 59.5. The Eurozone report rose to 57.0, matching the forecast. The US will release ISM Manufacturing PMI. Employment data is in the spotlight for the remainder of the week. Thursday’s releases include ADP Nonfarm Payrolls and unemployment claims. On Friday, the US releases Nonfarm Employment Change, which is expected to drop to 186 thousand.

A solid and reliable German economy has been the backbone of an improved eurozone economy in 2017, but recent consumer spending data is raising concerns that the largest economy in the euro-area is slowing down. In April, retail sales declined 0.2%, compared to a forecast of +0.4%. This marked the third decline in 2017, and if there is further contraction in the second quarter, the eurozone economy could be in trouble. Although the German labor market remains strong, this has not translated into higher inflation, which declined 0.2% in May, after a flat reading of 0.0% in April.

The US labor market remains very strong, boasting an unemployment rate of just 4.4%. Despite healthy employment numbers, the US economy was unable to avert a slowdown in the first quarter of 2017, and it’s questionable if we’ll see improvement in the second quarter. Still, a rate hike from the Federal Reserve at the June 14 meeting remains very likely, with the odds of a 0.25% hike priced in at 89%. As for the second half of 2017, the likelihood of rate move is significantly lower. The odds for a September rate stand at just 26%, with the markets skeptical as to whether the Fed will make further moves this year if inflation remains below the Fed target. Political concerns are a serious worry, as the Trump administration is embroiled in scandals, with several congressional investigations probing into Trump’s alleged connections with Russian politicians. A weakened White House raises doubts if Trump will be able to keep his election promises to lower taxes and cut government spending.

Economic Calendar

Thursday (June 1)

- 3:55 German Final Manufacturing PMI. Estimate 59.4. Actual 59.5

- 4:00 Eurozone Final Manufacturing PMI. Estimate 57.0. Actual 57.0

Friday (June 2)

- 8:30 US Nonfarm Employment Change. Estimate 186K

*All release times are EDT

*Key events are in bold

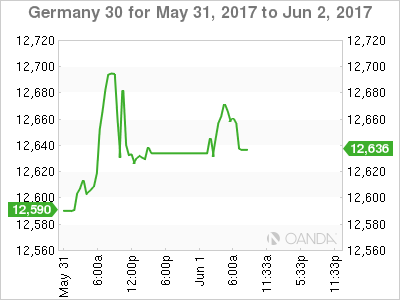

DAX, Wednesday, June 1 at 6:45 EDT

Open: 12,627.50 High: 12,677.00 Low: 12,622.00 Close: 12,656.25