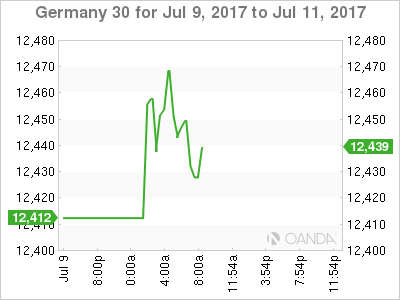

The DAX index has edged higher in the Monday session, as the index is up 0.32% on the day. Currently, the DAX is at 12,437.00. On the release front, Germany’s trade surplus widened to EUR 20.3 billion, matching the forecast. The Eurozone Sentix Investor Confidence edged up to 28.4, above the estimate of 28.1.

The new trading week has started with positive data. Germany’s trade surplus climbed to EUR 20.3 billion in May, which was the second highest surplus this year. A boom in exports continues to lead to a favorable trade balance, and the manufacturing sector has also benefited from stronger global demand for German products. The German economy has also received a boost from strong domestic demand, and the labor market remains tight. The IMF has upgraded its forecast for the German growth to 1.8 percent in 2017, up from its estimate of 1.6 percent in April.

With the euro-area continuing to record stronger growth, the ECB is tiptoeing towards a tighter policy, as underscored by the ECB’s June minutes. Policymakers discussed removing its “easing bias” at the June meeting, but ultimately decided not to make a move, since stronger economic conditions had not resulted in higher inflation. At the same time, minutes were cautious in tone, noting that “it was necessary to avoid signals that could trigger a premature tightening of financial conditions”.

ECB chief economist Peter Praet reiterated the bank’s stance at a conference in Paris last week. Praet noted that eurozone economic growth is accelerating, but said that the ECB still needs to provide a “steady hand” in order to spur stubbornly low inflation levels.

The ECB holds its next policy meeting on July 20. In June, the bank removed an easing bias towards lowering interest rates. However, policymakers may now be wary about sending more signals of tightening policy, so as to avoid another run on the euro, as was the case after Draghi’s comments at the ECB forum. The ECB doesn’t want the rate statement to shake up markets, so we could see an innocuous statement, to the effect that the economy is headed in the right direction, but QE will remain in place until inflation levels move higher.

Economic Calendar

Monday (July 10)

- 2:00 German Trade Balance. Estimate 20.3B. Actual 20.3B

- 4:30 Eurozone Sentix Investor Confidence. Estimate 28.1. Actual 28.3

*All release times are EDT

*Key events are in bold

DAX, Monday, July 10 at 7:55 EDT

Open: 12,455.50 High: 12,421.50 Low: 12,483.50 Close: 12,437.00