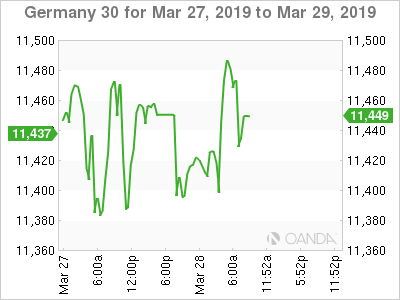

The DAX index is showing little movement on Thursday. In the North American session, the DAX is trading at 11,440, up 0.19%. In economic news, German releases Preliminary CPI, while the U.S. publishes Final GDP. On Friday, Germany releases retail sales.

The economic slowdown in Germany and the eurozone shows no signs of letting up anytime soon. The global trade war has dampened the demand for German and eurozone exports, and the manufacturing sectors have also been hurt. On Wednesday, ECB President Mario Draghi sounded pessimistic in his remarks about the economy. Draghi acknowledged that the economic slowdown which started in the second half of 2018 had extended into 2019. Draghi blamed uncertainty in the global economy, adding that “risks to the outlook remained tilted to the downside”. With weak conditions in the eurozone and Germany, the ECB is expected to remain dovish in its stance and keep a freeze on interest rates until 2020.

Trade tensions have also weighed on inflation levels, and eurozone inflation remains well below the ECB target of 2.0%. German CPI rebounded in February, with a gain of 0.5%, its strongest gain in a year. Will we see an improvement in the March release? The estimate stands at 0.6%.

Economic Calendar

Thursday (March 28)

- All Day – German Preliminary CPI. Estimate 0.6%

- 5:00 Eurozone M3 Money Supply. Estimate 3.9%. Actual 4.3%

- 5:00 Eurozone Private Loans. Estimate 3.3%. Actual 3.3%

- 8:30 US Final GDP. Estimate 2.4%

Friday (March 29)

- 3:00 German Retail Sales. Estimate -1.0%

- 4:55 German Unemployment Change. Estimate -10K

*All release times are DST

*Key events are in bold

DAX, Thursday, March 28 at 8:25 EST

Previous Close: 11,419 Open: 11,404 Low: 11,398 High: 11,494 Close: 11,440