The DAX index has posted slight gains in the Thursday session. The index is up 0.49%, and is currently at 12,732.50 points. On the release front, German Industrial Production bounced back in April with a strong gain of 0.8%, which beat the forecast of 0.6%. There was more good news from Eurozone Revised GDP, which improved to 0.6%, edging above the estimate of 0.5%. Today’s highlight is the ECB rate meeting, with policymakers expected to maintain the benchmark rate at a flat 0.00%.

The market gaze is focused on the ECB, which holds it monthly rate meeting later in the day. The benchmark rate has been pegged at 0.00% since March 2016, and no change is expected. As well, policymakers are unlikely to make any changes to the quantitative easing program, which ends in December. However, stock markets could react if there are any surprises in the rate statement or from Mario Draghi, who will hold a follow-up press conference.

On Wednesday, the euro briefly lost ground on reports that the ECB was planning to downgrade its inflation forecast to 1.5% annually for 2017, 2018 and 2019. In a March forecast, the bank predicted inflation at 1.7%, 1.6% and 1.7%, respectively. The forecast of weaker inflation is being attributed to lower energy prices. Earlier in the year, inflation reached the ECB’s target of 2.0%, but this didn’t last long, and the May figure of 1.4% was well of this goal.

Mario Draghi has preached caution and patience, and will reluctant to tighten policy without stronger inflation levels. Still, with the euro-area economy showing improved growth in 2017, the markets would like to see the ECB at least acknowledge that the economic picture has brightened, and will be looking for a more hawkish tone from the central bank, such as a removal of the bias towards easing. If there are some nuances in the rate statement or Draghi’s comments that point to a more hawkish stance, the French stock market could move higher.

It’s being labeled the “Political Superbowl”.

In Washington, the hottest ticket in town is the Senate Intelligence Committee hearing of former FBI director James Comey. On Wednesday, the committee released a written statement from Comey which discussed his meeting with President Trump. There are accusations that Trump asked Comey to close an investigation into Trump’s alleged ties with Moscow, and the committee will grill Comey on this key issue.

The media is in a feeding frenzy ahead of Comey’s testimony, but it is would be a stunning development if Comey’s testimony proves to be the “smoking gun” that leads to charges of obstruction of justice against President Trump. At the same time, Comey could complicate matters for a beleaguered Trump administration, and any dramatic revelations could shake up the markets. Investors are growing more skeptical that Trump, who seems to be spending most of his time in damage control mode, will be able to deliver on key campaign planks, such as tax reform.

Economic Calendar

Thursday (June 8)

- 2:00 German Industrial Production. Estimate 0.6%. Actual 0.8%

- 5:00 Eurozone Revised GDP. Estimate 0.5%. Actual 0.6%

- 7:45 ECB Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

Friday (June 9)

- 2:00 German Trade Balance. Estimate 20.3B

*All release times are EDT

*Key events are in bold

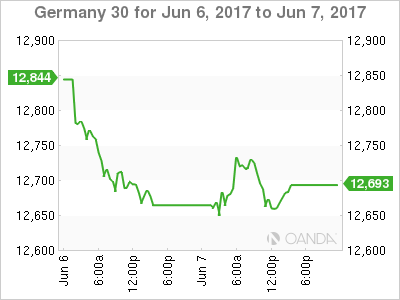

DAX, Thursday, June 8 at 7:35 EDT

Open: 12,688.50 High: 12,740.45 Low: 12,684.70 Close: 12,732.50