The DAX is almost unchanged in the Friday session. Currently, the index is trading at 13,293.50, down 0.04% on the day. On the release front, there are no major eurozone events. Investors will be keeping a close eye on US Advance GDP, which is expected to post a strong gain of 3.0%.

There were no surprises on Thursday, as the ECB maintained interest rates at a flat 0.00%. ECB President Mario Draghi was dovish in his follow-up remarks. Draghi said that interest rates would not rise until well after the ECB’s asset-purchase program (QE) was over. The QE program will not end until September at the earliest, so Draghi essentially ruled out any rate hikes before early 2019. Draghi added that the ECB was prepared to increase QE in “size or duration”, a reminder to the markets that it is premature to expect normalization anytime soon. A new headache for Draghi is the streaking euro, which has hit 3-year highs against the US dollar. Will this have a negative impact on the stock markets? Investors are worried that a stronger euro could hurt exports and company earnings. EUR/USD has jumped 3.6% in January, as the dollar continues to struggle.

The German economy is firing on all cylinders, and confidence levels improved in January. Consumer confidence improved to 11.0, pointing to an optimistic consumer early in 2018. Business confidence also moved higher, as Ifo Business Climate improved to 117.6, up from 117.1 in the previous release. The German Office of Statistics recently released preliminary data for GDP and the reading of 2.2% for 2017 improved on the 2016 figure of 1.9%.

It’s a busy time for the Federal Reserve, which will set the benchmark rate on January 31 and bid adieu to Janet Yellen, who will be replace by Jerome Powell in February. Earlier in the week, the Senate confirmed Jerome Powell in a decisive vote of 84-13, reflecting strong bipartisan support for Powell. The new chair is expected to continue Yellen’s monetary stance, which was marked by small, incremental rate hikes during a period of economic expansion. The Fed has started to trim its massive balance sheet, another vote of confidence in the strength of the economy. At the same time, Fed policymakers are divided over how to approach inflation, which remains below the Fed target of 2 percent, despite a strong economy and a red-hot labor market. The markets will be watching to see how Powell & Co. respond to President Trump’s tax reform legislation, which is sure to have a significant impact on the US economy.

Economic Calendar

Friday (January 26)

- 4:00 Eurozone M3 Money Supply. Estimate 4.9%. Actual 4.6%

- 4:00 Eurozone Private Loans. Estimate 2.9%. Actual 2.8%

- 8:30 US Advance GDP. Estimate 3.0%

*All release times are GMT

*Key events are in bold

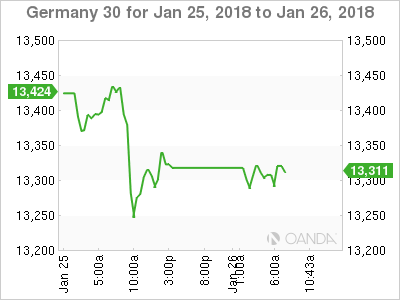

DAX, Friday, January 26 at 6:45 EDT

Open: 13,294.50 High: 13,339.50 Low: 13,267.00 Close: 13,293.50