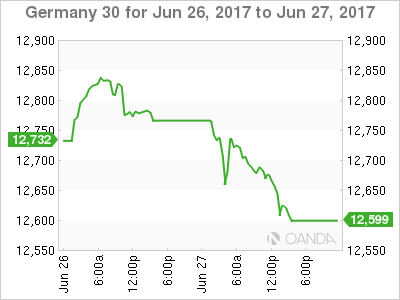

The DAX index has lost ground in the Tuesday session. Currently, the index is at 12,679.50, down 0.72%. On the release front, there are no German or eurozone releases. Earlier in the day, ECB President Mario Draghi addressed the ECB Forum on Central Banking. On Wednesday, Draghi will again address the forum, and Germany will release Import Prices.

The markets were listening closely as ECB President Mario Draghi addressed the ECB Forum on Tuesday, and although the euro responded positively, Draghi’s message to the markets was essentially “more of the same”. Draghi acknowledged that economic indicators were showing a broadening recovery in the eurozone, but pointed to inflation as the barrier to tightening policy. Draghi defended the bank’s loose accommodative policy, saying that it had pushed inflation higher, but stimulus was needed until inflation becomes “durable and self-sustaining”. Germany is not happy with the ECB’s current monetary policy, as it feels that tighter policy is more appropriate for the strong German economy. For his part, Draghi has no intentions of altering current policy until inflation moves closer to the ECB’s target of 2 percent, and he has been consistent in this message.

It was a busy weekend in Italy, as the Italian government announced that would bail out two ailing banks, Banca Popolare di Vicenza and Veneto Banca. This deal will cost the Italian taxpayer 5.2 billion euros, and the government provided additional guarantees of 12 billion euros. Italy has already agreed to bail out another Italian bank, Monte dei Pashci di Siena, for up to 6.6 billion euros. The Italian government has set aside 20 billion euros to bail out struggling banks, and potentially may have used up the entire amount for these bailouts, depending on how the actual size of the bailouts. European stock markets reacted positively to the move, and Deustche Bank and Commerzbank both started the week with gains. The bailouts remove a major headache for European regulators and should strengthen the fragile Italian banking sector, which has at times been in crisis mode, threatening the stability of the eurozone financial sector.

EUR Climbs as Draghi Praises Strengthening Recovery

Economic Calendar

Tuesday (June 27)

- 4:00 ECB President Mario Draghi Speaks

Wednesday (June 28)

- 2:00 German Import Prices. Estimate -0.6%

- 4:00 Eurozone M3 Money Supply. Estimate 5.0%

- 4:00 Eurozone Private Loans. Estimate 2.5%

- 9:30 ECB President Mario Draghi Speaks

*All release times are EDT

*Key events are in bold

DAX, Tuesday, June 27 at 9:25 EDT

Open: 12,738.00 High: 12,756.50 Low: 12,644.00 Close: 12,679.50