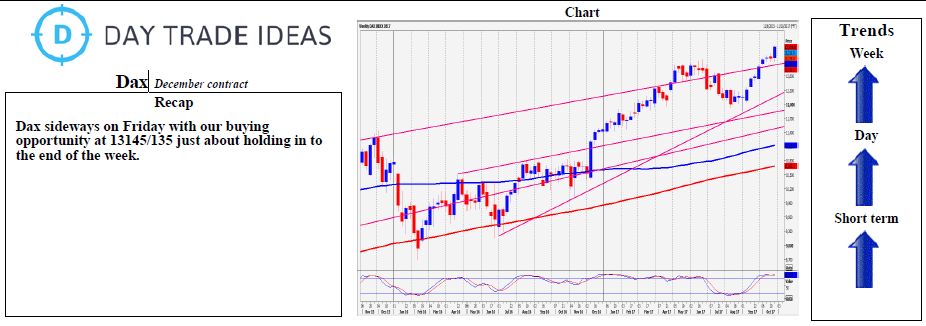

DAX just holding our buying opportunity at 13145/135. We over ran by 30/33 ticks on Thursday and Friday. Bulls need to beat 13210/220 at the start of this week to regain some control targeting the main challenge for bulls today at 13285/295. If you want to try shorts this is the place – with stops above 13340. A break higher however targets 13385/395 and 13420/430.

A buying opportunity at 13145/135 but stop below 13100. A break lower sees 13135/145 act as resistance to enter shorts, targeting 13030/020 then a buying opportunity at 12900/890.