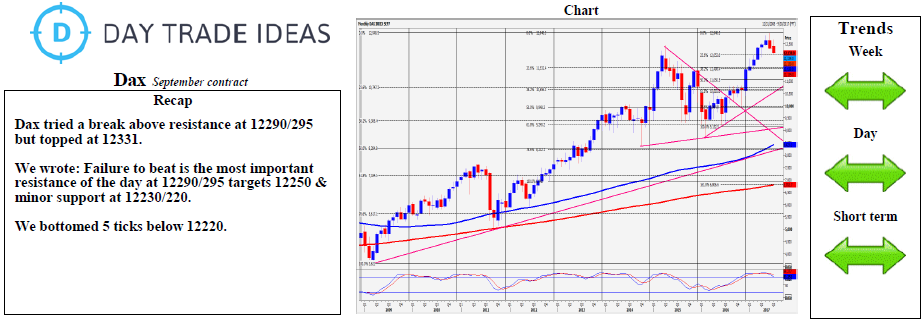

Dax holding minor support at 12220/230 re-targets the main challenge for bulls at 12290/295. A break above 12340 is a short term buy signal targeting 12375/380 & perhaps as far as strong resistance at 12410/420 for some profit taking on longs.

First support at 12230/220 held but further losses target 12180/185 & 12150/145 before the 12088/085 low. Strong support at 12060/050 is probably the best chance of a low for the correction as well we know...& held last week. Try longs on the approach again with stops below 12000. A break below 12000 however is another sell signal targeting 11975 & 11945/940 this week.