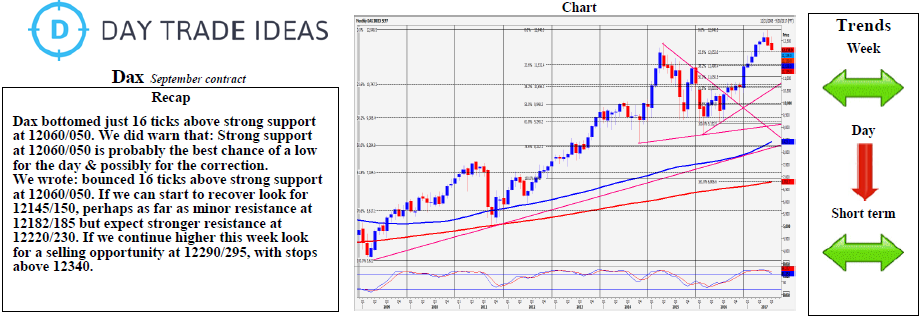

DAX bounced 16 ticks above our expected low for the correction at 12060/050. Initially we paused at minor resistance at 12182/185 then shot higher through stronger resistance at 12220/230 for a selling opportunity at the upper target of 12290/295. We topped exactly here. Obviously this is the most important resistance of the day. Shorts need stops above 12325. A break higher however targets 12340, 12375/380 and perhaps as far as strong resistance at 12405/415.

Failure to beat strong resistance at 12290/295 targets first support at 12230/220. Failure here targets only minor support at 12185 and 12150/145. Strong support at 12060/050 is probably the best chance of a low for the day and possibly for the correction. Try longs with stops below 12000. A break below 12000 however is another sell signal targeting 11975 and 11945/940 this week.