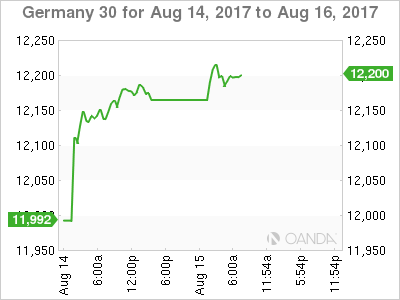

The DAX index has posted gains in the Tuesday session, continuing the upward movement seen on Monday. The DAX is trading at 12,200.80, up 0.29% on the day. On the release front, there is only one euro zone indicator on the schedule. German Preliminary GDP in the second quarter edged lower to 0.6%, missing the forecast of 0.7%. On Wednesday, the euro zone releases Flash GDP.

Tensions in the Korean peninsula last week weighed on global stock markets, and the DAX declined 2.4%. Washington and Pyongyang exchanged sharp warnings, with North Korea threatening to attack Guam, which hosts a major US military base. Tensions between North Korea and the US remain high, but the prevalent sentiment in the markets is that a diplomatic solution will be found to end the crisis. The stock markets are excellent barometers of geopolitical tensions, and the gains we are seeing this week are a direct result of the lowering of tensions. Still, Donald Trump and Kim Jon-un are unpredictable leaders, and a move by either side could easily ratchet up hostilities and send stock markets lower.

The robust German economy continues to perform well in 2017, as German GDP expanded 0.6% in the second quarter. Consumer spending, a key driver of economic growth, continues to propel economic growth, and Germany has now posted 12 straight quarters of growth. Higher wages and increased government spending has also boosted the economy. The export sector remains strong, despite the stronger euro, as global demand for German products, especially cars, remains firm. Positive economic conditions in Germany have translated into a stronger euro zone economy, which has experienced higher growth and lower unemployment.

The ECB has long insisted that it would not begin to wind up its quantitative easing (QE) before inflation moves higher, but at the July meeting, the bank appeared to change directions. In July, the ECB said it would hold discussions on the q scheme in “the autumn”, and analysts are split as to whether that means September or October. Either way, this means that the markets expect to hear an announcement regarding QE, and such a statement could have a significant impact on the euro. The ECB tapered QE earlier in 2017, from EUR 80 billion to 60 billion/mth, and there are calls to reduce this to 40 EUR billion/mth. The ECB is scheduled to terminate the asset purchases program in December, and could start tapering in early 2018. The bloc’s economy is forecast to expand a healthy 2.0% this year, and the eurozone outperformed both the US and the UK in the first half of 2017. The sore point remains inflation, which is stuck at low levels, despite the ECB’s ultra-accommodative monetary policy. Another factor which policymakers must deal with is the ECB’s bloated balance sheet, which stands at more than EUR 2 trillion.

Economic Calendar

Tuesday (August 15)

- 2:00 German Preliminary GDP. Estimate 0.7%. Actual 0.6%

Wednesday (August 16)

- 5:00 Eurozone Flash GDP. Estimate 0.6%

*All release times are EDT

*Key events are in bold

DAX, Tuesday, August 15 at 7:00 EDT

Open: 12,207.50 High: 12,236.50 Low: 12,180.25 Close: 12,200.80