The DAX is almost unchanged in the Thursday session. Currently, the index is trading at 13,422.50, down 0.06% on the day. On the release front, GfK Consumer Climate rose to 11.0, above the estimate of 10.8 points. As well, Ifo Business Climate improved to 117.6, beating the estimate of 117.1 points. Later in the day, the ECB will issue a monetary policy statement and is expected to maintain rates at a flat 0.00%. On Friday, the US releases Advance GDP for the fourth quarter of 2016, with an estimate of 3.0%.

With the German economy firing on all cylinders, there was no surprise that business and confidence levels rose in January. Consumer confidence improved to 11.0, pointing to an optimistic consumer early in 2018. Business confidence also moved higher, as Ifo Business Climate improved to 117.6, up from 117.1 in the previous release. The German Office of Statistics recently released preliminary data for GDP, and the reading of 2.2% for 2017 improved on the 2016 figure of 1.9%.

With the eurozone economy in rebound mode, there is increasing talk of the ECB shifting to a normative monetary policy, after years of massive stimulus. Still, we’re unlikely to see any dramatics at the first policy meeting of 2018, as the ECB is likely to retain its pledge to continue buying bonds under its asset-purchase program (QE). The ECB has trimmed QE from EUR 60 billion to 3o billion/mth, and ECB policymakers have hinted that the Bank could wind up QE in September, and this has pushed the euro higher in recent weeks. ECB President Mario Draghi will speak after the statement, and any hints that QE will not be extended could send the euro to higher ground. However, Draghi may prefer to keep a low profile until the March policy meeting, when policymakers will have had a chance to review updated economic forecasts.

The US Senate confirmed Jerome Powell as the next head of the powerful Federal Reserve on Tuesday. The vote of 84-13 was a cakewalk, reflecting strong bipartisan support for Powell. The new chair is expected to continue Janet Powell’s monetary stance, which was marked by small, incremental rate hikes during a period of economic expansion. The Fed has started to trim its massive balance sheet, another vote of confidence in the strength of the economy. At the same time, Fed policymakers are divided over how to approach inflation, which remains below the Fed target of 2.0%, despite a strong economy and a red-hot labor market. Another unknown is how the recent tax reform legislation will impact the US economy, and investors will be looking at the Fed as one source for guidance.

Economic Calendar

Thursday (January 25)

- 2:00 German GfK Consumer Climate. Estimate 10.8. Actual 11.0

- 4:00 German Ifo Business Climate. Estimate 117.1. Actual 117.6

- 7:45 ECB Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

Friday (January 26)

- 8:30 US Advance GDP. Estimate 3.0%

*All release times are GMT

*Key events are in bold

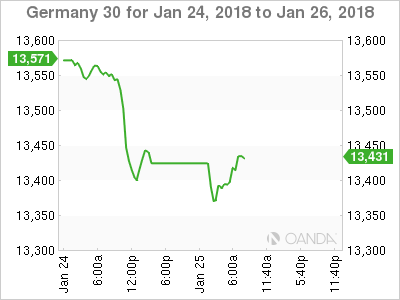

DAX, Thursday, January 25 at 6:40 EDT

Open: 13,370.50 High: 13,428.50 Low: 13,351.50 Close: 13,422.50