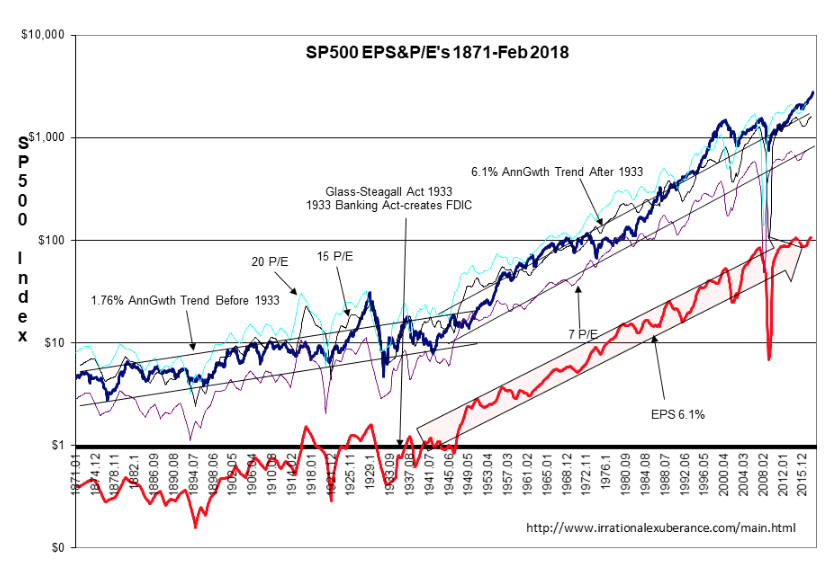

I have used a valuation band for the S&P 500 on Shiller’s data which trended higher with the trend of EPS, i.e., 6.1% annually since 1933 when FDIC placed bank speculation risk on speculators not on savers. 1933 is the beginning of the rise of Middle Class wealth.

Note that the S&P 500 is well above the long-term trend. This is due to low inflation, 1.7%, which has persisted in a down trend since 1982. Government spending has been less inflationary since we got past the Great Society impact of the 1970s and Great Inflation when Volcker raised rates to ~18% in 1982.

Low inflation prices EPS higher and we are seeing the lowest consistent inflation ever recorded.

To see more posts on any of the companies mentioned in this article, enter their stock ticker symbol in the search box.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer