Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) is scheduled to report second-quarter fiscal 2017 numbers on Sep 5, after market close. We expect the company to beat expectations.

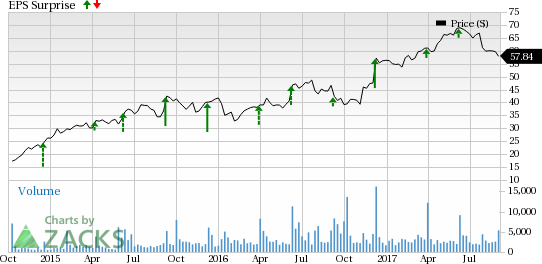

Last quarter, the company came up with a positive earnings surprise of 7.41%. In fact, the company has surpassed the Zacks Consensus Estimate in each of the 11 quarters it has reported so far and has an average positive earnings surprise of 30.5% for the trailing four quarters.

Why a Likely Positive Surprise?

Our proven model shows that Dave & Buster’s is likely to beat earnings because it has the perfect combination of the two key ingredients.

Zacks ESP: Dave & Buster’s has an Earnings ESP of +1.54% as the Most Accurate estimate is 55 cents while the Zacks Consensus Estimate is pegged at 54 cents. This is a meaningful indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Dave & Buster’s currently has a Zacks Rank #3 (Hold). Note that stocks with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating earnings estimates.

Conversely, Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

The combination of Dave & Buster’s favorable Zacks Rank and positive Earnings ESP makes us reasonably confident of an earnings beat.

Dave & Buster's Entertainment, Inc. Price and EPS Surprise

Factors at Play

Since its IPO in October 2014, Dave & Buster's has been performing well on the back of the unique customizable experience it offers across four platforms, “Eat, Drink, Play and Watch”. Launching new games, expansion of units, menu innovation and effective marketing strategies are expected to boost the company’s top line in the to-be-reported quarter as well. Further, Dave & Buster’s focus on enhancing guest experience through digital enhancements also bodes well for the top line.

In addition to food and beverage items, the company’s amusement and other segment – that accounts for more than 50% of its revenues – is expected to drive results in the quarter. In fact, increased dependence on gaming should aid in cushioning the company from the adversities plaguing the restaurant space of late. Also, focus on amusement should drive Dave & Buster’s earnings, given it is a higher-margin business.

However, rising labor costs, pre-opening costs of outlets given the company’s unit expansion plans and expenses incurred to execute sales initiatives might dent the quarter’s profits. Additionally, a choppy sales environment in the U.S. restaurant space is likely to limit revenue growth in the to-be-reported quarter.

Stocks to Consider

Dave & Buster’s is not the only company looking up this earnings season. Here are some other companies to consider as our model shows they also have the right combination of elements to post an earnings beat this quarter:

Zumiez Inc. (NASDAQ:ZUMZ) has an Earnings ESP of +16.67% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

RH (NYSE:RH) has an Earnings ESP of +4.26% and a Zacks Rank #3.

Malibu Boats, Inc. (NASDAQ:MBUU) has an Earnings ESP of +2.5% and a Zacks Rank #3.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Malibu Boats, Inc. (MBUU): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Dave & Buster's Entertainment, Inc. (PLAY): Free Stock Analysis Report

Restoration Hardware Holdings Inc. (RH): Free Stock Analysis Report

Original post

Zacks Investment Research