One of the bigger concerns in the world of exchange-traded fund is the overall growth of the industry over the last decade. As these vehicles swell in popularity, so too does the number of funds that are launched every year and the amount of money that investors entrust to this diversified vehicle.

Some market watchers fear that ETFs themselves are becoming inherently risky for two reasons:

- There has been a tremendous tide of inflows switching from actively managed mutual funds to passively-indexed ETFs over the last decade. Many liken this to a “bubble” phenomenon that will eventually peak and contract, thereby hurting the crowd that has come to trust these funds.

- The second fear is that the hundreds of relatively new, small, and untested ETFs will ultimately fail in the course of a major market stress test. Think in terms of a flash crash or some other wildly unforeseen event.

Over the weekend, I stumbled upon a discussion on social media by several top ETF experts and market researchers on the structural merits of ETFs. To help dispel fears of these risks, Tom Psarofagis, a Chartered Market Technician,

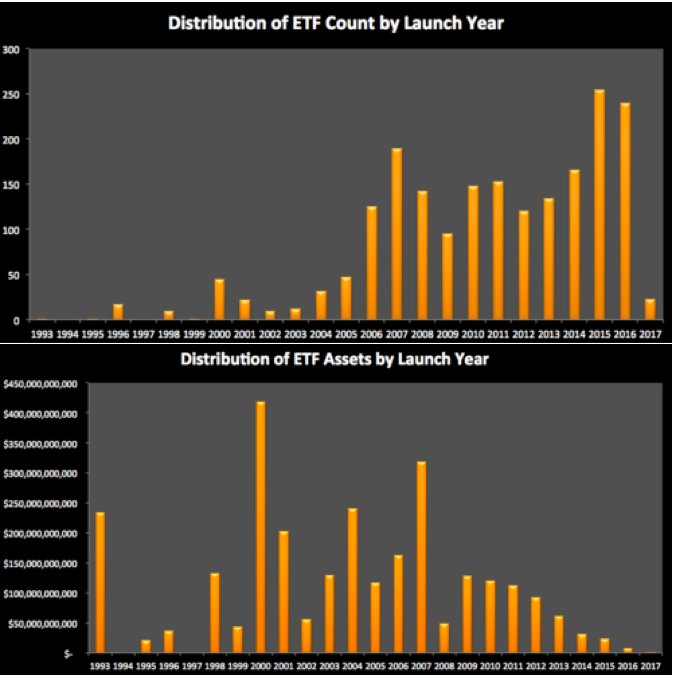

At the top, this chart graphically demonstrates the number of funds that have been launched every year since the SPDR S&P 500 ETF (NYSE:SPY) debuted in 1993. At the bottom, it shows the current distribution of ETF assets by launch year.

This data is fantastic for two reasons. It clearly demonstrates the tremendous growth in the number of funds that have been launched in just the last 10 years as opposed to the decade prior. It also starkly depicts the importance that investors place on funds with an established history. I like to refer to these funds as “battle-tested” in the sense that they were around during the great financial crisis of 2008-2009 and have also ridden through many transient periods of volatility ever since.

The statistics confirm that an overwhelming majority of ETF assets are allocated to strategies with at least 10 years of track record. SPY is still the largest overall ETF with more than $240 billion in total assets and is also the most heavily traded in terms of net dollars daily.

The class of 2000 is certainly a standout crowd that is filled with many of the first factor and sector-specific funds from the Blackrock/iShares brand. The $120 billion iShares Core S&P 500 (AX:IVV) was launched that year. Along with the iShares Russell 2000 (NYSE:IWM), iShares Russell 1000 Value (NYSE:IWD) and several other large flagship funds.

Vanguard first arrived on the scene in 2001 with the venerable Vanguard Total Stock Market (NYSE:VTI), which has $80 billion under management. A slew of additional popular ETFs on the Vanguard platform followed in 2004 and onward.

The gross size of the top issuers in the ETF market is an advantage in terms of attracting assets, as is the “first mover” lead in any investment segment. These firms have successfully engaged investors by gradually lowering costs and offering education on the benefits of these transparent vehicles versus traditional stock picking or high-priced mutual fund alternatives.

It’s highly unlikely that a market crash or some other exogenous event will precipitate a permanent exodus from the ETF marketplace. These funds have already proven themselves to be reliable platforms for exposure to stocks, bonds or commodities even during periods of turmoil.

Ultimately, the greatest threat to newer ETFs is generating enough of a performance story or value proposition to lure away money from the stalwart indexes. There is also a greater risk of price dislocations for those smaller funds that don’t get an active share of daily trading volume. This is one dynamic that investors must be keen to before executing a buy or sell using a simple market order, particularly with large transactions.

The Bottom Line

The expansion and maturation of the ETF marketplace continues to instill confidence in the structure of these funds. In my opinion, higher adoption rates will only lead to lower costs, better trading spreads, and successful outcomes for all participants. This should be similar to the confidence that mutual funds have enjoyed for nearly a century now.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.