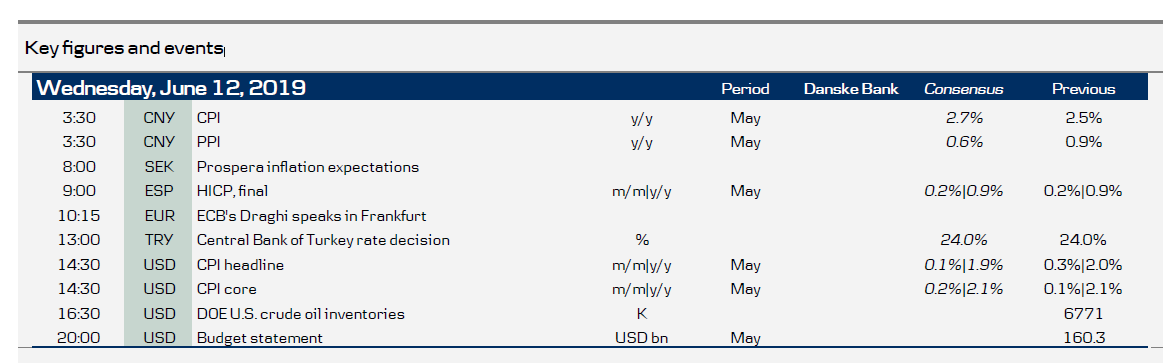

In Sweden, Prospera's inflation expectations survey is due out. We expect inflation expectations have fallen further, as actual inflation has come down, too. The Riksbank's Floden is also speaking this morning.

In the euro area, we have a lot of ECB speeches this morning, most notably ECB President Draghi at 10:15 CEST. If he or others want to correct last week's market reaction to the June ECB meeting there will be ample opportunities today.

In the US, we expect CPI core rose +0.2% m/m in May, implying an unchanged core inflation rate of 2.1% y/y, in line with expectations. Subdued underlying inflation pressure is one reason why we expect the Fed to ease monetary policy slightly in H2 19, see FOMC preview: Cutting like it is the 90s , 11 June.

In the UK, the House of Commons will vote on a proposal to give MPs control of parliamentary business on 25 June as a way to block the new prime minister, to simply let the UK crash out of the EU without a deal. It would require some Conservative rebels to vote with the opposition and it may fail this time, but shows the MPs will not let the prime minister take full control of the Brexit process, see full story .

This morning, we published our monthly euro area macro monitor, where we argue risks are increasing but our baseline persists, see Euro Area Macro Monitor , 12 June.

Selected market news

In an otherwise somewhat uneventful session, it was bit of deja vu for markets yesterday as a few Trump tweets and a Washington Post interview fuelled concerns over political pressure on the Fed and trade woes anew. The US President first tweeted that the US is put at a 'big disadvantage' as US rates are kept too high while others are devaluing their currencies, explicitly mentioning the EUR and CNY. Separately, Trump said that he is currently 'holding up' the deal between the US and China on trade, accusing China of reneging on previously agreed terms. The battle lines are now clearly drawn ahead of the G-20 meeting in Osaka on 28-29 June, but recent messages from central banks suggest Trump may get his way quite soon when it comes to policy rates and the USD.

Currency war - again? Europe does not have much ammunition to take part in that (cf ECB last week), but a good indicator of whether the Chinese authorities are directly using their currency in a trade deal context is USD/CNY. The cross rose above 6.93 early this week, closing in on the crucial 7.00 level, but has held firm around the 6.91 level after being guided lower by the People's Bank of China fixing on Tuesday morning. Separately, Chinese CPI growth rose to a 15M high at 2.7% y/y in May. Equities were mixed in the US session but predominantly lower in Asia, with the Hang Seng Index down 1.6% at the time of writing. Brent crude oil was stable just above the USD61/bbl level. US PPI data was broadly in line with expectations and the US 10Y Treasury yield declined just a tad to 2.13%. The USD remained on a weak footing; EUR/USD was steady around the 1.13 mark.

Fixed income markets

Today, we have both Spain and Italy in the market taking advantage of the recent drop in long-dated yields and strong periphery demand after the ECB announcement last week.

Spain is planning to sell up to EUR9bn in a long 10Y bond (Oct-29) according to Bloomberg. Given the lack of positive yielding 10Y bonds in the Euro zone, we would expect to see a very strong book. We saw a small 1bp concession in 10Y SPGB on the announcement.

Italy will also be in the market with a 20Y new BTP (Mar-2040). The higher yields in Italy should be able to attract investors, especially after the Sep-39 BTP jumped some 7bp after the announcement. That said, 20Y BTP yields are still more than 25bp below the 3.50 level that prevailed in mid-May.

Portugal will also tap the markets, in the 10Y and 15Y benchmark bonds. Despite 15Y PGB yields approaching 1% (currently 1.08%, down from 2.40% at the beginning of January) we would expect demand to be intact. We see room for further flattening of the PGB curve. We have several ECB speeches on the agenda, most notably Draghi at 10.15 CEST. If he feels that he has to correct the market pricing after the ECB meeting last week, this would be a good opportunity. Also, keep an eye on any comments on market-based inflation expectations after 5y5y EUR inflation dropped below 1.22%.

FX markets

In the Scandies, yesterday’s session delivered both a disappointing inflation print and a much better-than-expected Regional Network Survey. We think the latter is far more important for Norges Bank, as it showed accelerating mainland growth prospects despite weaker global growth impulses, higher employment, higher profitability, higher wage growth, higher investments, rising capacity utilisation and rising bottleneck problems. On the other hand, the inflation print was distorted by plane tickets, which means overall inflation has been roughly in line with NB’s projections since March. For markets, this confirms that Norges Bank will not only hike rates next week but also that the central bank will maintain its hiking bias. It remains our expectation that the NOK would move higher over the coming months, even if the currency has almost decoupled from relative rates lately, see FX Strategy – Why is the NOK so weak?

EUR/USD was temporarily roiled yesterday by a Trump tweet claiming the EUR (and other currencies) were too weak, hurting US competitiveness. We stress that EUR/USD is a matter for the ECB and Fed and that Trump has little leverage here; hence, Trump’s FX comments should be disregarded. Furthermore, if Trump slams the EU car industry with tariffs, we are likely to see an even lower EUR/USD. More importantly, EUR/USD has become more sensitive to US data given the uncertainty around Fed pricing. It means the outcome of today’s CPI release bears watching. On the margin, we think there is a possibility of a weaker figure, which could push EUR/USD higher on the day.

In yesterday’s FX Strategy - GBP: non-Brexit factors set to weigh on sterling, we lifted our EUR/GBP forecast from 0.86 to 0.90 and expect a higher trading range of 0.86 (in the event of renewed optimism on Brexit) to 0.91 (further weakening of data and worsening of sentiment on Brexit). In the coming months, (1) we are neutral to somewhat positive on politics but worry that (2) global appetite for credit-like risk will continue to worsen, (3) noticing that UK macro is now surprising on the downside and (4) that ECB passiveness is leading to broad EUR strength. In our view, factors 2-4 are likely to weigh on EUR/GBP.