Market Movers Today

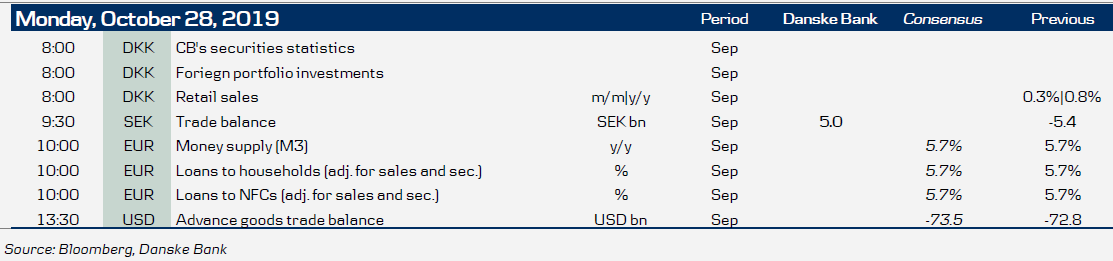

- We have a slow start to a very important week today. Today we get euro area monetary aggregates and loan data and Swedish trade balance is also released . After years of negative prints, the trend is once again positive, surely helped by the weak SEK. Our forecast is for a SEK5bn surplus, but this should not be a market mover.

- Focus this week will be on the Brexit deadline on Thursday (although we expect another extension) and FOMC meeting on Wednesday (where we expect a cut). We also have Bank of Japan policy meeting where markets price around some 50% probability of a rate cut.

- On Friday, we expect a weak US job report , with an increase of just 50,000. Preliminary Q3 GDP data for both the euro area and the US are due out.

- In China, both Caixin and official PMI manufacturing for October, which diverged in September, are due for release.

Selected Market News

Asian stock markets opened the Fed week climbing to three-month highs on extended risk on sentiment. The S&P 500 Index saw its all-time high last Friday, while Europe traded in green as well. Ten-year US Treasury yields climbed to a five-week high. Markets are likely to enter a standby mode ahead of the Fed's rate decision on Wednesday amid ongoing developments in the China-US trade negotiations and the corporate earnings season. According to Reuters, more than 80% of American companies have exceeded Wall Street expectations so far this earnings season despite concerns about the trade war.

China announced that the text of the first phase of a trade agreement with the US is 'basically completed' and agricultural standards have been successfully discussed. Last Friday, the American counterpart also released positive comments on the pact, which is aimed to be signed by Presidents Donald Trump and Xi Jinping in Chile in November.

The EU is proposing to extend the Brexit deadline to 31 January. Bloomberg reported it saw a draft ahead of today's meeting in Brussels. According to the plan, the UK could leave the EU earlier if both sides ratify the divorce deal in time. The recommendation comes as British Premier Boris Johnson looks set to lose his bid for a snap poll on 12 December that parliament will consider today.

Argentine markets will be in focus today with probably excessive volatility after opposition candidate Alberto Fernandez won in Sunday's presidential election, while business-friendly candidate Mauricio Macri surrendered. Argentina's central bank tightened further capital controls ahead of the vote, cutting the maximum amount of USD Argentines can buy. Last Friday Argentine's bonds were already in free fall.

Scandi

The trade balance, a second-tier release, is due for release in Sweden today. After years of negative prints, the trend is once again positive, surely helped by the weak SEK. Our forecast is for a SEK5bn surplus, but this should not be a market mover.

Fixed Income Markets

Contrary to our expectations, S&P did not move Italy back to ‘neutral outlook’ from ‘negative outlook’ last Friday despite lower political risks and lower funding rates.

However, noteworthy the factors that can trigger an actual downgrade are if debt-to-GDP ‘significantly’ exceeds S&P’s forecasts or if policy changes ‘permanently’ weaken Italy's potential growth. In other words, a downgrade does not seem imminent. Hence, we are comfortable with our long 10Y BTP versus 10Y Bund recommendation and the new recommendation from this week’s Government Bonds Weekly, where we recommend 30Y BTP versus swaps. We have also moved the target for our 10Y Spain versus 10Y France recommendation from 35bp to 25bp, see Government Bonds Weekly: We recommend buying 30Y BTP vs swaps, 25 October. We also take a closer look at tiering that begins on 30 October and the QE programme, where trading starts the same day. Finally, we look at the low free float in Bunds.

We once again have a relatively light supply calendar ahead of us and we only expect a total supply of EUR11bn. The underlying cash flow remains positive with redemption and coupons of EUR32.7bn coming to the market, mainly from Spain (EUR27.4bn) and Italy (EUR5bn). It leaves rooms for syndicated deals. Finally, index extensions can be supportive for Ireland, France and Italy, see FI Research - November EGB-index extensions - Austria and Belgium subtract, 24 October.

FX Markets

The first key event for EUR/USD this week is Wednesday’s FOMC meeting. We look for a market reaction in EUR/USD similar to the one of the September meeting, i.e. for EUR/USD to drop as the Fed once again fails to pre-commit to additional rate cuts – the potential is probably in the area of 50 pips. However, the market was a bit more aggressively priced at that point, so the reaction should be less pronounced. See more in FOMC preview: Divided Fed is likely to cut again without pre-commitment, 25 October. For Scandi FX it is a relatively thin data calendar to look forward to. That in turn means both SEK and NOK are likely to find the tone from global risk appetite not least derived from the US calendar. As the Riksbank has seemingly ignored the Swedish downturn, domestic macro has likely lost some importance for the time being. Instead, the SEK might be more sensitive to global sentiment from hereon and with the Brexit endgame and Fed this week, we are likely in for some volatility in both SEK and NOK.

On DKK, we have looked into the market implications of the large inflow of saved vacation money to Lønmodtagernes Dyrtidsfond next year. This would be a force of continued upward pressure on EUR/DKK and likely a trigger of FX intervention selling of EUR/DKK by Danmarks Nationalbank (DN). See more in DKK Edge: Beware the wall of vacation money, 25 October.

Key Figures And Events