Market movers today

After better-than-expected Chinese and euro area data triggered a sell-off in global bond markets on Friday, markets will pay close attention to a range of sentiment indicators released on both sides of the Atlantic later this week.

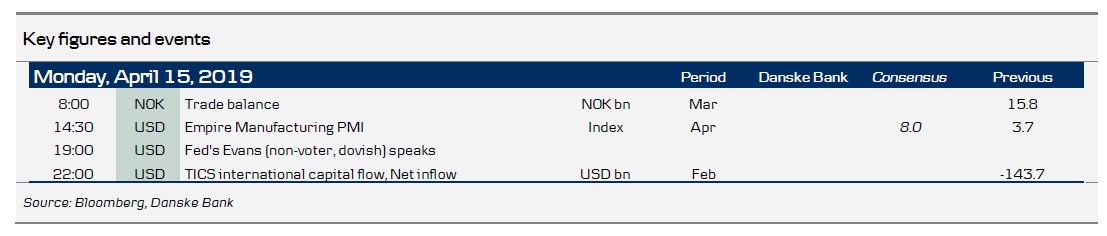

But today we start the week in a somewhat quiet fashion , with the US Empire Manufacturing index the only data release of interest. The US manufacturing sector has not been immune to the global slowdown and we will look to see whether the April figure points to any trend reversal.

On the political front, EU ministers are expected to vote today on approving the negotiating mandate for the Commission to start trade talks with the US . With cracks in the EU's united front not only showing with regard to the Brexit strategy, focus will be on whether France openly opposes the start of the negotiations.

Selected market news

Equities in Asia saw a brisk opening, following good earnings news from the US, where the S&P 500 index climbed over the 2,900 level for the first time since early October 2018. Positive export and bank loan data from China last week and optimism on the oncoming China-US deal are also supporting the risk-on sentiment. On Saturday, US Treasury Secretary Steven Mnuchin declared a China-US trade agreement would go "way beyond" previous efforts to open China's markets to US companies hoping that the two countries were "close to the final round" of negotiations.

Reuters wrote that US negotiators have tempered demands that China curb industrial subsidies as a condition for a trade deal after strong resistance from Beijing. In the push to secure a deal in the next month or so, US negotiators have become resigned to securing less than they would like on curbing those subsidies and are focused instead on other areas where they consider demands are more achievable.

On Monday, the US starts trade talks with Japan. Mnuchin wants a currency clause to stop manipulation of the JPY to support exports.

US President Donald Trump criticised the Fed, tweeting that if the Fed had done its job properly the stock market 'would have been up 5,000 to 10,000 additional points, and GDP would have been well over 4% instead of 3% with almost no inflation', blaming quantitative tightening. ECB chief Mario Draghi said he was worried about central bank independence, especially in "the most important jurisdiction in the world", thus criticising Trump. Central bank independence was a key part of IMF meetings in Washington over the weekend.

Fixed income markets

We saw a pronounced fixed income sell-off on Friday after Chinese loan data and European industrial production data gave renewed optimism that China and even the Euro zone look better. Together with profit-taking on ‘low for longer’ trades, it pushed 10Y Bund yields to 5bp and 10Y US Treasury yields rose to 2.56%.

During the weekend, the discussion regarding tiering in the Euro zone continued. Both Chief Economist Praet and Bundesbank President Weidmann said that they welcome the review of negative deposit rates, but both stopped short of outright recommending a tiered rate system. Weidman underlined that he would not necessarily overestimate the effect tiering could have on lending, referring to the size of interest payments on deposits [EUR 7-8bn] relative to other bank income. The comments could extend the negative fixed income sentiment today, as the market might continue pricing out any probability of a new rate cut. However, we strongly doubt we are in for a prolonged fixed income sell-off given the still weak inflation and growth data from the Euro zone.

This week, attentions turns to the positive cash flow coming to the market over the next five weeks, as a total of EUR122.3bn (France alone with EUR43bn) is coming to the market in coupons and redemptions. In the coming week, there will be a modest positive net cash flow of EUR7.1bn.

The Netherlands will tap in the 10Y benchmark bond (EUR1-2 bn) tomorrow. It will be the last tap before the DSTA on 21 May issues a new 20Y green bond. France will also be in the market on Thursday, introducing a new 6Y OAT (Mar-25) and with taps in the May-23 and Feb-22 nominals. In the linker space, the 3y, 10y and 20Y linkers will be tapped. For more see Government Bonds Weekly, 12 April. There, we also reiterate why we still see a positive carry environment in the EGB market.

FX markets

Friday’s price action in FX markets was a blueprint on how different currencies respond to positive news out of China. The better trade data led commodity currencies, e.g. AUD, NZD, CAD to rally. The NOK also strengthened, together with the EUR, while the JPY was the big loser on Friday, highlighted by USD/JPY testing the 112 level. In this respect, Wednesday’s batch of Chinese data could prove interesting. i.e. another dose of positive news could extend Friday’s move, while a disappointment could reverse the move. As we also stressed last week in Global Research - What a US-China trade deal brings to the market, 8 April, we expect Friday’s development in FX markets to be repeated once we see further progress towards a US-China trade deal.