Investing.com’s stocks of the week

The US Department of Energy is predicting that crude inventory build is nearly over, that US production growth will fall sharply, and that WTI prices will be above $60 by the end of the year.

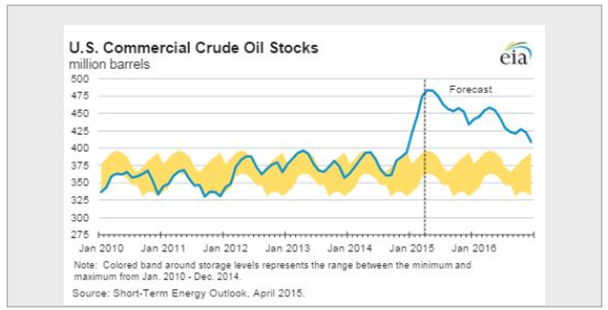

1. Inventories:

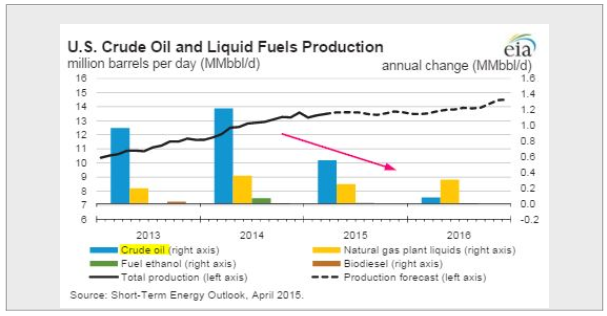

2. Production growth (YoY):

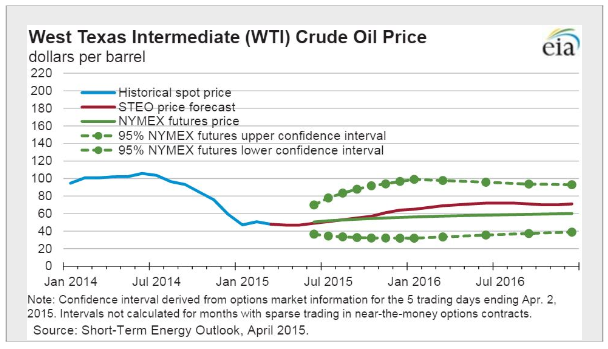

3. Prices (STEO = Short-Term Energy Outlook):

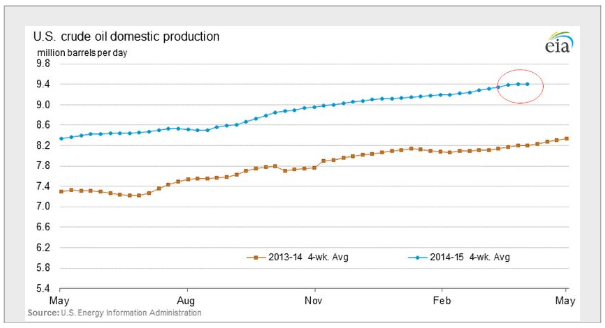

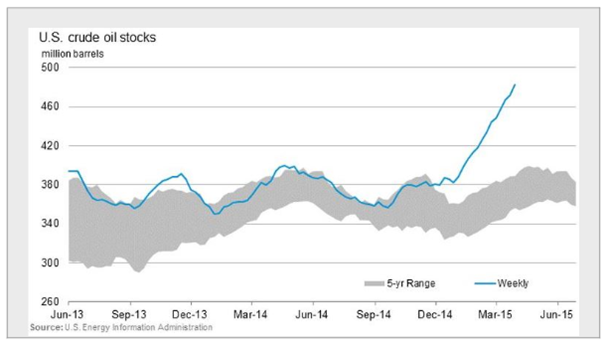

On Wednesday we got the latest inventory and production report for the week.

1. Production could indeed be slowing, although it's too early to tell:

2. But the inventory build shows no signs of moderating.

It's difficult to get excited about the current data in spite of the government's somewhat bullish assessment. That's why oil and gas exploration and production shares continue to lag the overall energy sector (via SPDR S&P Oil &Gas Exploration & Production ETF (NYSE:XOP) and SPDR Energy Select Sector Fund (ARCA:XLE)).

**********

Switching to China, we continue to see speculative activity in the nation's equity markets (via Shanghai Composite). Valuations and profitability have diverged.

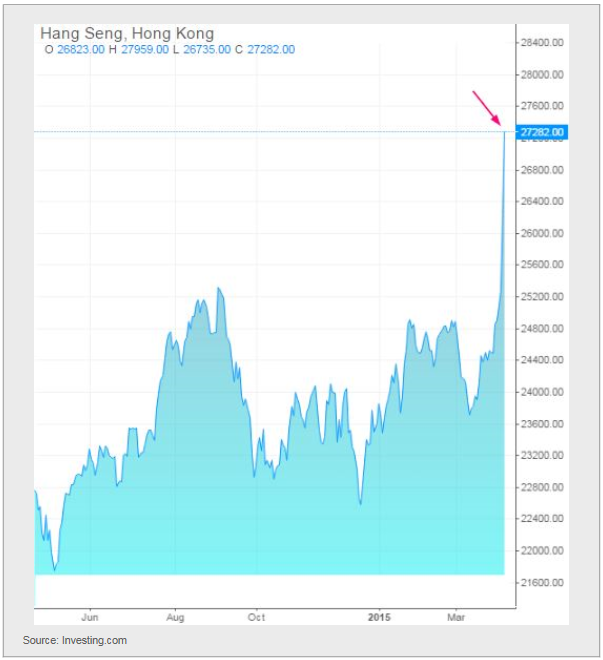

Moreover, China's stock-buying frenzy spilled over into Hong Kong. The Hang Seng index is up 4% on the day as I am writing this.

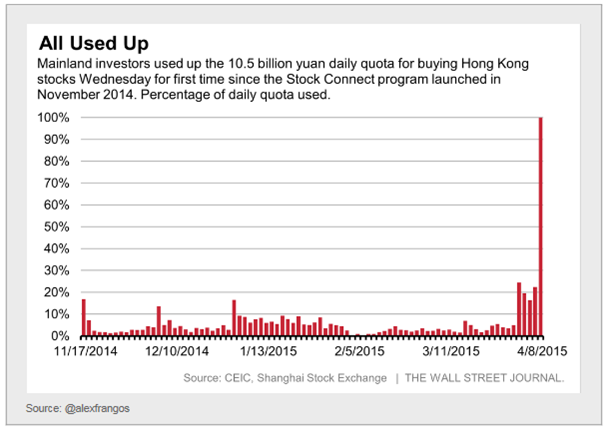

Mainland investors have used up the 10.5 billion yuan daily quota on HK share purchases. Let the good times roll.

**********

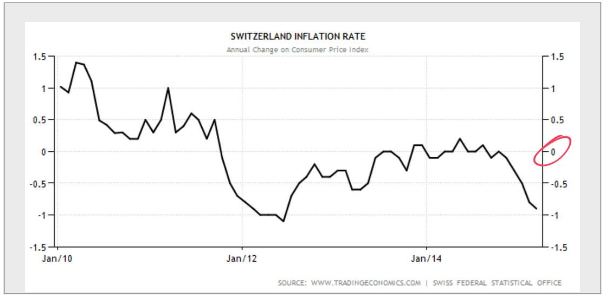

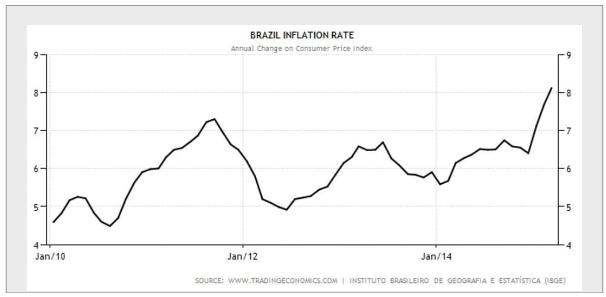

A couple of inflation reports came out today that drive home the impact of currency strength on domestic consumer prices.

1. Switzerland - recent currency strength (particularly relative to the euro) results in negative CPI.

2. Brazil - recent currency weakness (combined with the government hiking prices on transport, etc.) translates into rising inflation.

**********

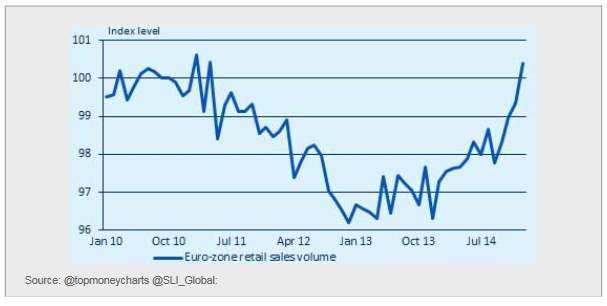

Now some developments in the Eurozone:

1. Consumer spending has strengthened dramatically.

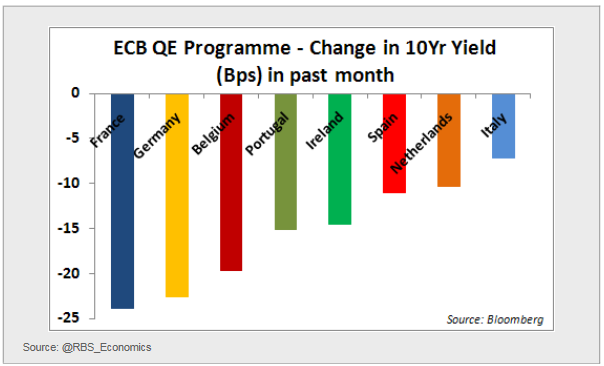

2. Yield compression continues as the German 10-Year yield hit a new low. It's going to be increasingly difficult for the Bundesbank to offset losses from negative yield by purchasing longer term bonds.

The spread between U.S. 10-Year Treasuries and Bunds hit a new high.

Here is how much the various nations' yields declined since the start of the European Central Bank's quantitative easing program:

Disclosure: Originally published at Saxo Bank TradingFloor.com