Investing.com’s stocks of the week

We begin with the market reaction to the downing of a Russian fighter jet by Turkey as tensions escalated on Tuesday.

The lira fell and Turkish bond yields rose (first chart below shows the dollar rising vs. the lira).

Source: Investing.com

Source: Investing.com

The Turkish stock market (via BIST 100) sold off sharply.

Source: Investing.com

Crude oil rallied 3% while US gasoline futures shot up 6%.

Source: Investing.com

Many speculative accounts have been short energy and the increased geopolitical risks forced some short-covering. However, given the supply overhang, it will take significantly more uncertainty to create a longer-lasting rally.

Ironically, the Russian ruble rallied on the back of stronger energy prices.

Gold prices rose but surprisingly platinum continued to fall. Given all the negative sentiment, this may be an opportunity for commodities to begin stabilising as hot money covers short positions.

Source: barchart

Turning to Germany, here are the latest economic reports:

Turning to Germany, here are the latest economic reports:

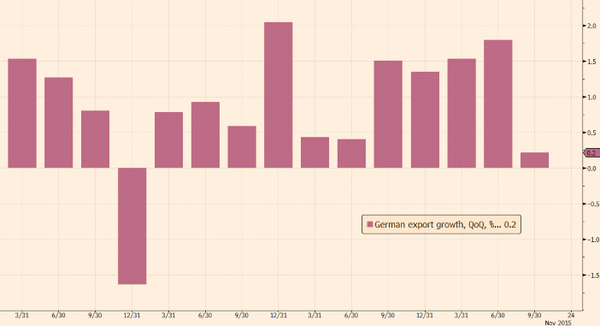

Export growth slowed sharply creating a drag on the GDP, which was not entirely unexpected.

Source: @fastFT

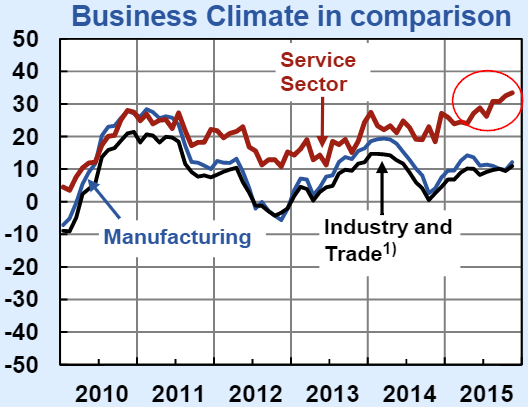

Notwithstanding this weakness in exports and in spite of the Paris tragedy, German business sentiment (Ifo) improved more than expected.

Source: @HolgerSandte

Moreover, German services sector sentiment hit the highest level on record.

Source: Ifo

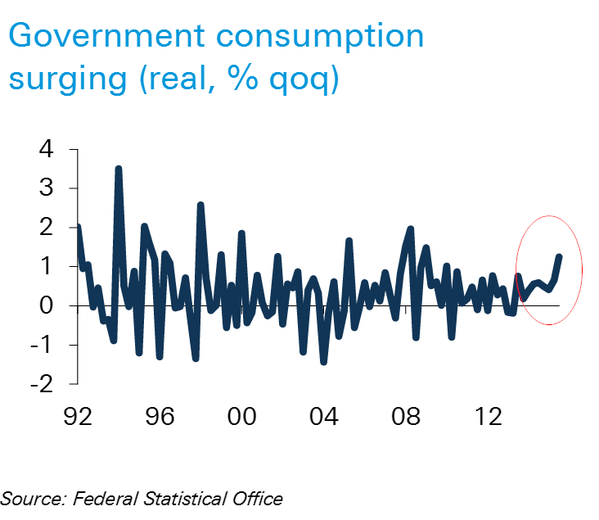

Another tailwind for growth is the government consumption which is growing at the highest rate since Q1 2009 -- in part as a result of the new spending related to refugees. Fiscal stimulus in Germany -- who would have thought?

Source: Deutsche Bank (DE:DBKGn)  Now on to China where the data continues to show slowing industrial and construction activity. For instance, cement prices are still declining.

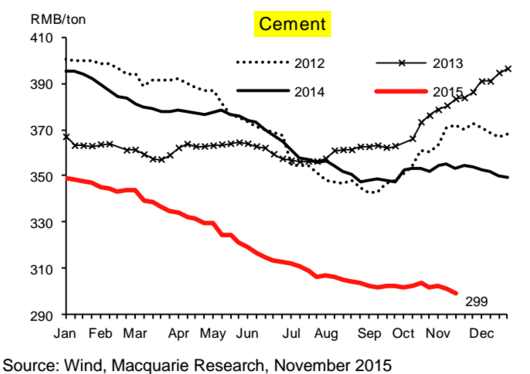

Now on to China where the data continues to show slowing industrial and construction activity. For instance, cement prices are still declining.

Source: Macquarie

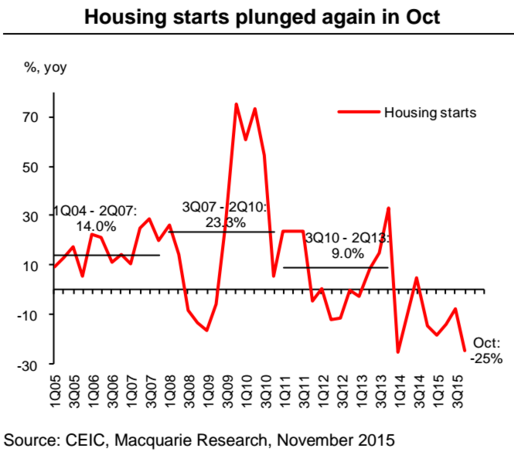

China housing starts slow.

Source: Macquarie

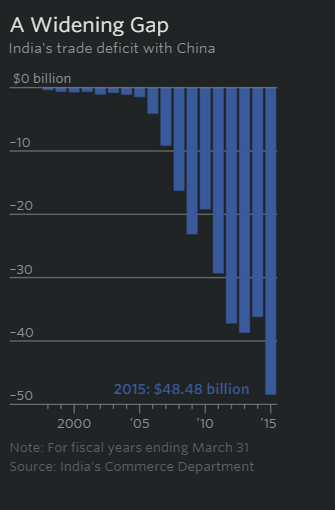

Separately, India's trade deficit with China has been increasing significantly. India's rapidly growing middle class is buying more stuff from China.

Source: @pdacosta, WSJ  Investors have been pulling out of EM debt funds as US rates (and rate expectations) increased. Is this a contrarian investment opportunity?

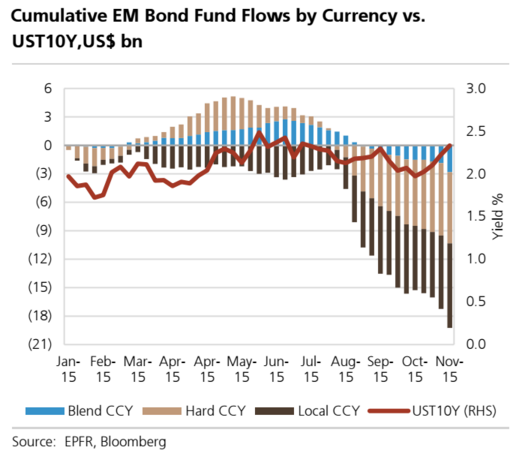

Investors have been pulling out of EM debt funds as US rates (and rate expectations) increased. Is this a contrarian investment opportunity?

Source: UBS

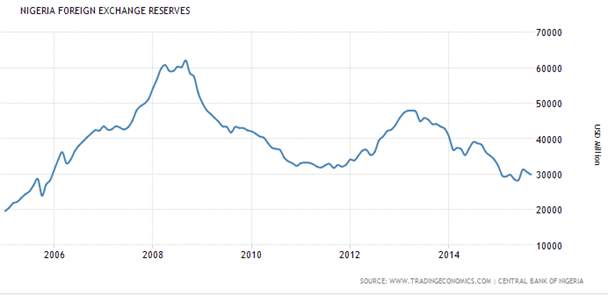

As a number of African nations tighten interest rates, Nigeria's central bank chose to cut rates instead.

As a number of African nations tighten interest rates, Nigeria's central bank chose to cut rates instead.

Source: Tradingeconomics.com, Central Bank of Nigeria

Will this create further pressure on the dollar peg? The nation's FX reserves have declined substantially over the past few years.

Source: Tradingeconomics.com, Central Bank of Nigeria

N:BHP and N:VALE are going to pay heavily for the mining disaster in Brazil.

N:BHP and N:VALE are going to pay heavily for the mining disaster in Brazil.

The Guardian said: A huge brown plume of mud and mining waste spread out along the coast of the Brazilian state of Espírito Santo on Monday, a little over two weeks after the collapse of a dam at an iron ore mine. According to projections from Brazil’s environment ministry, the tide is expected to spread along 5.5-mile (9km) stretch of the coastline, threatening the Comboios nature reserve, one of the only regular nesting sites for the endangered leatherback turtle.

BHP shares were up on Tuesday, but here is the 5-year chart.

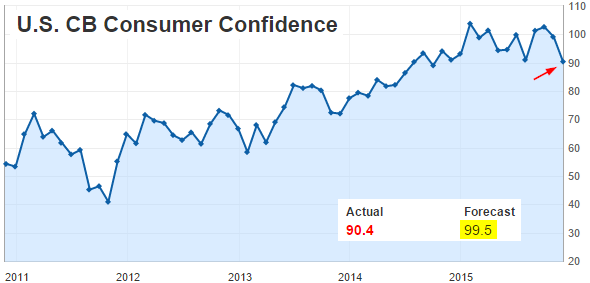

Source: Google  Back in the United States the Conference Board consumer confidence unexpectedly dropped to the lowest level of the year on job concerns. Even with improving labor market indicators Americans remain jittery about job security.

Back in the United States the Conference Board consumer confidence unexpectedly dropped to the lowest level of the year on job concerns. Even with improving labor market indicators Americans remain jittery about job security.

Source: Investing.com

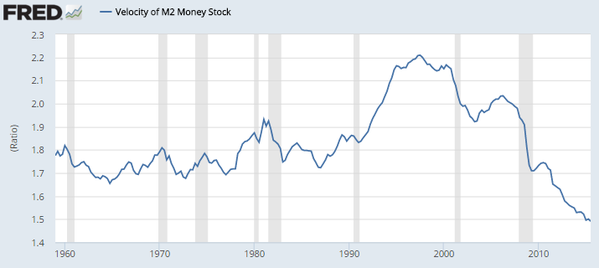

In spite of the upward revision in the Q3 GDP, velocity of money remains at lowest level in recent history. Credit expansion has generated a great deal of cash in the system but all this liquidity is not resulting in stronger GDP growth.

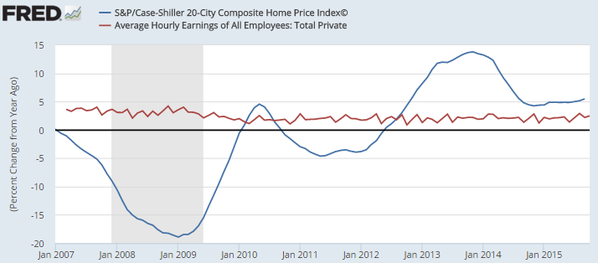

Home prices in the US continue to rise, with increases now accelerating. How is this possible when wage growth has been fairly tepid?

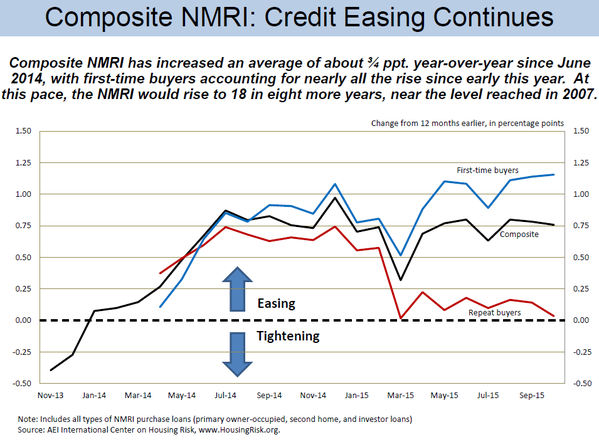

A big part of the reason is the easing of credit conditions.

Source: HousingRisk.org, h/t Ira

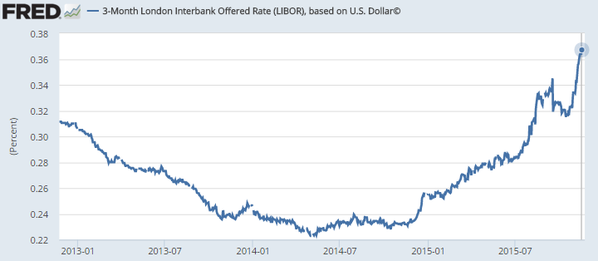

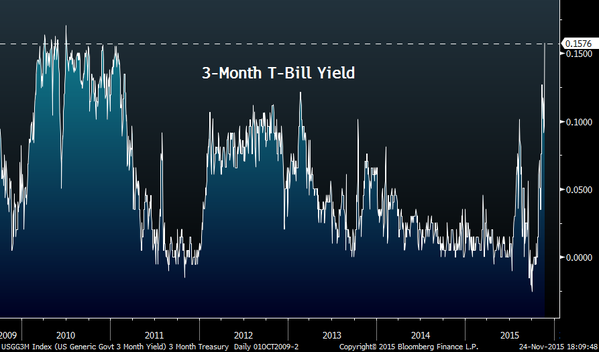

In fixed income, we see money market rates rising sharply as the December rate hike is being priced in. The 3-month LIBOR and treasury bill rates are shown below.

Source: @MktOutperform

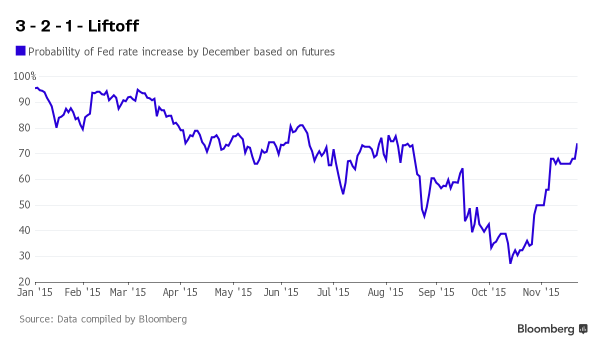

The futures-implied probability of December liftoff is now at 74%. The markets seem to be ready.

Source: @business

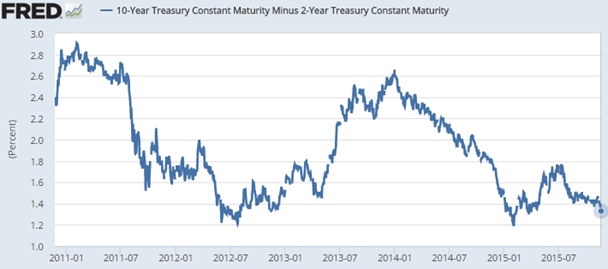

Moreover, the treasury curve continues to flatten as the market prices in longer-term growth and inflation rates are materially below historical averages.

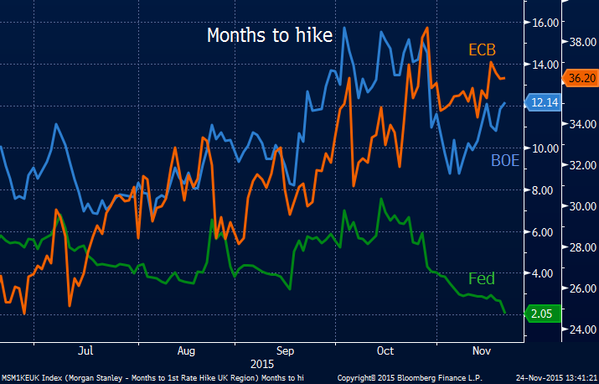

Note that the Fed is alone in this tightening endeavor as the monetary policy diverges from other major central banks.

Source: @auaurelija  Finally, let's take a look at some trends in the equity markets. The outperformance of S&P 500 vs. European equities (STOXX Europe 600) has been dramatic. Is it sustainable?

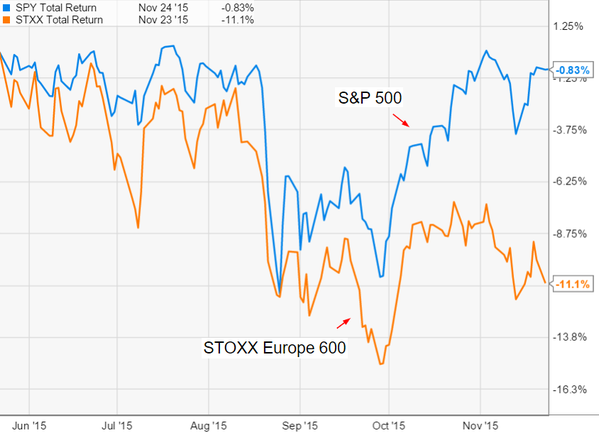

Finally, let's take a look at some trends in the equity markets. The outperformance of S&P 500 vs. European equities (STOXX Europe 600) has been dramatic. Is it sustainable?

Source: Ycharts.com

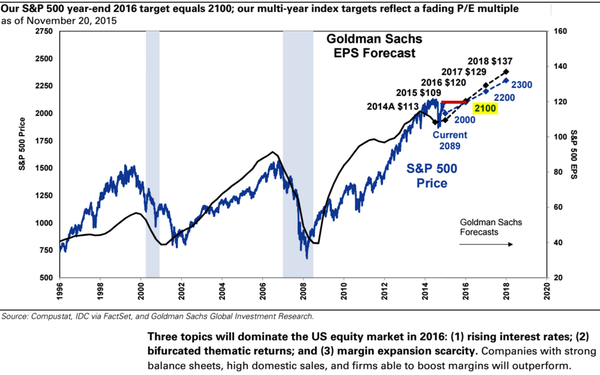

Goldman is predicting another flat year in 2016 for the S&P 500.

Source: Goldman Sachs (N:GS)

Disclosure: Originally published at Saxo Bank TradingFloor.com