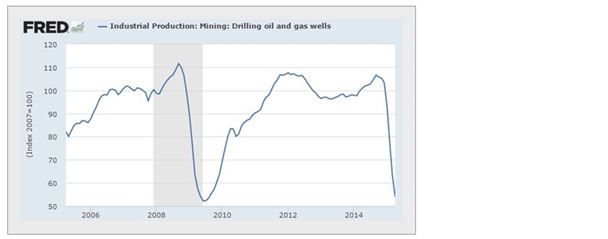

Let's start with US energy markets where oil and gas drilling activity has collapsed.

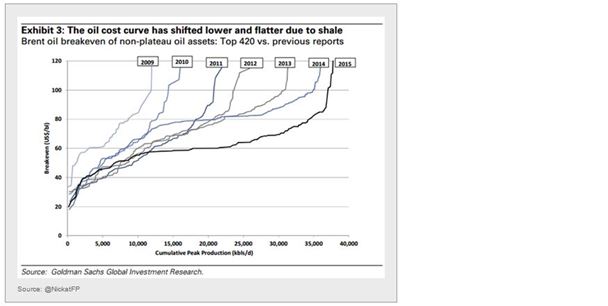

While this decline in drilling is a bullish sign for crude oil, it's important to note that the oil cost curve continues to shift lower, with capacity extending further out. That's why it is difficult to see how WTI can be sustained materially above $60/barrel where significant capacity can be quickly brought back online.

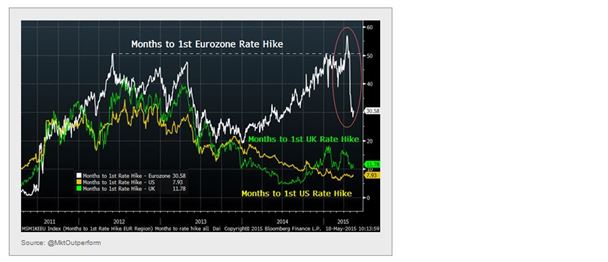

Switching to the Eurozone, we see a dramatic shift in timing expectations for the first European Central Bank hike. We went from 57 months until the first expected hike to just over 30 months in a matter of days.

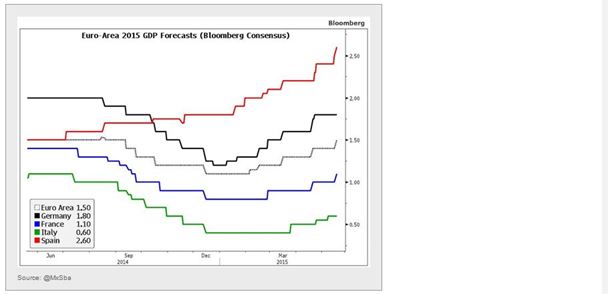

This shift is driven by the recent selloff in sovereign bonds, in part due to improved expectations for Eurozone growth.

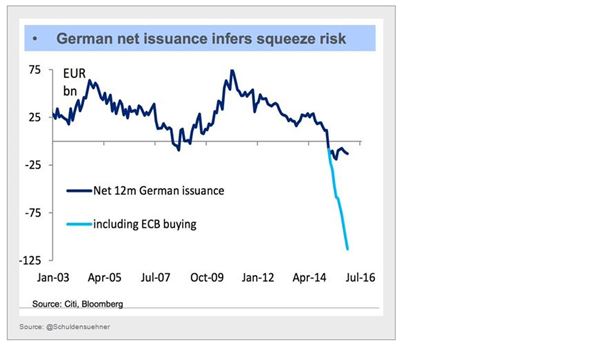

However, many analysts point out that this correction is likely overdone, as the lack of paper – particularly German government bonds – will push yields lower.

This yield compression will likely be helped by the ongoing uncertainty around Greece, where a compromise with the creditors remains elusive. Greek bond yields are beginning to rise again.

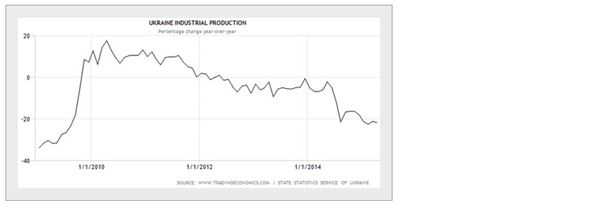

Ukrainian industrial production is declining by more than 20% on a year-over-year basis.

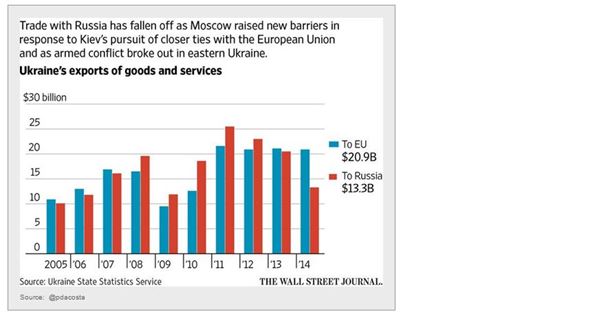

Part of the issue is the nation's declining exports to Russia, while trade with EU remains flat. Those lost sales, especially for industrial products and aircraft, will be impossible to replace.

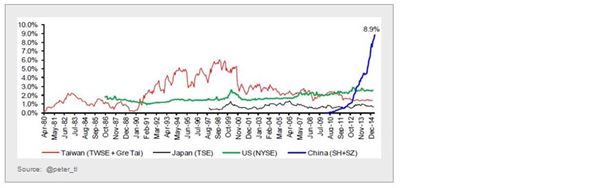

Margin leverage in China's equity markets continues to rise. Macquarie pointed out recently that, "this could already be the highest level of margins versus free float in market history." Meanwhile, the Shanghai Composite is back above 4,400 – up 2.7% this morning.

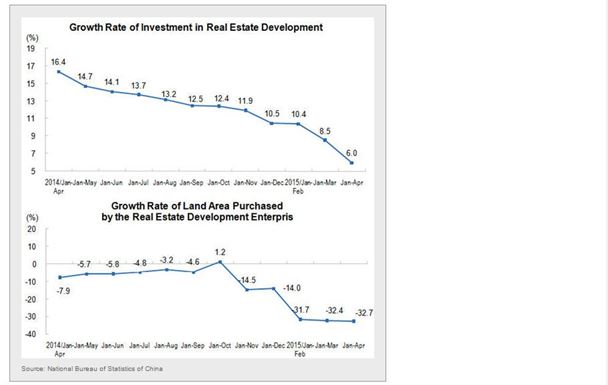

In spite of somewhat firmer real estate prices in China, the volume of land purchases and property development growth continue to decline. This does not look great for the shares of nation's developers.

Now some food for thought...

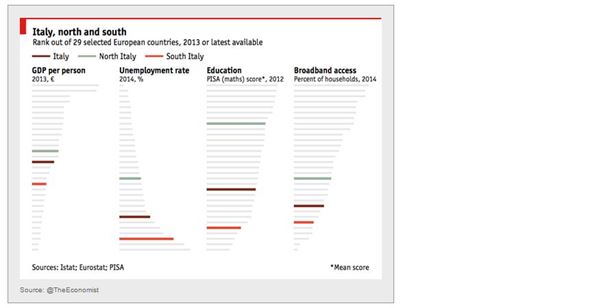

Italy's economic gap between the nation's north and south is striking.

Disclosure: Originally published at Saxo Bank TradingFloor.com