Investing.com’s stocks of the week

The markets came to a realisation on Wednesday that the Greece-Eurozone deal is far from being finalised. Deal fatigue is setting in, and the euroarea leadership may be faced with political pressures at home if the negotiations drag on for too much longer.

For now, it's about trying to make the Greek budget numbers work under various new revenue assumptions – a difficult task indeed.

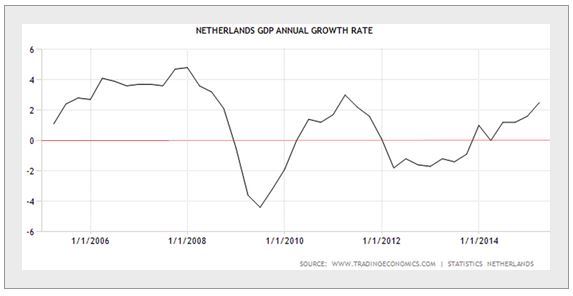

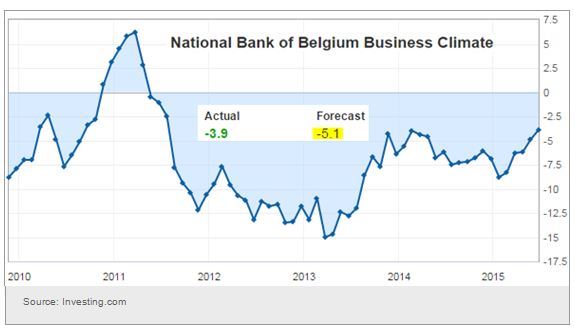

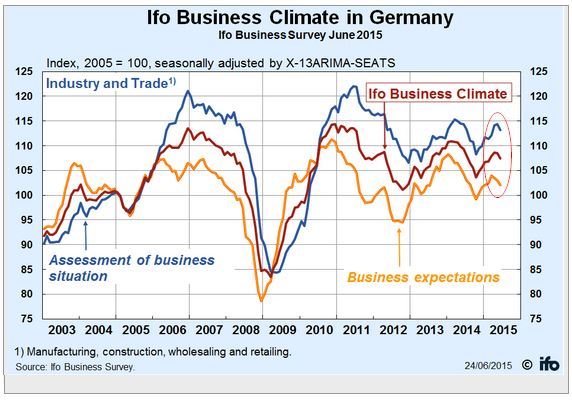

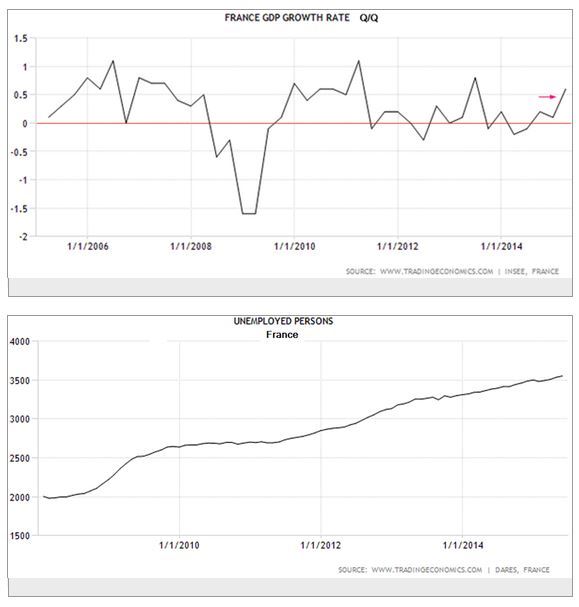

The rest of the Eurozone continues to show signs of economic improvements – which once again should give the negotiators some comfort that the area's economy can absorb the shock, should the "unthinkable" happen.

1. The Netherlands GDP growth has firmed up.

2. Belgian business confidence improved more than expected.

3. There is some nervousness among German businesses around Greece, but sentiment remains relatively strong.

France has returned to growth, but the ranks of the unemployed continue to swell. The Eurozone still has a long way to go to ease its labour market problems.

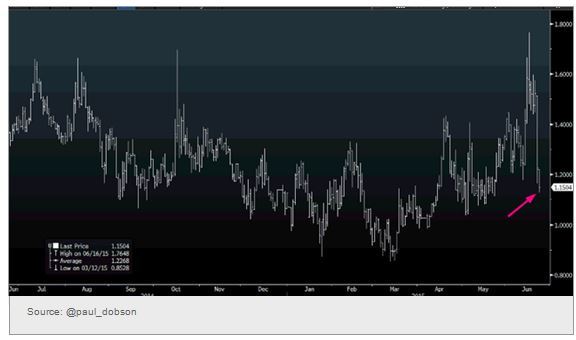

Markets are pricing in very little Eurozone 'contagion' risk as Spain-Germany 10-year spread falls back almost as quickly as it rose.

Turning to Asia, here are the latest developments:

The Nikkei 225 index is at levels we haven't seen since the late '90s.

China's equity markets turn higher, but remain highly volatile. There doesn't seem to be a shortage of factory workers willing to part with their savings.

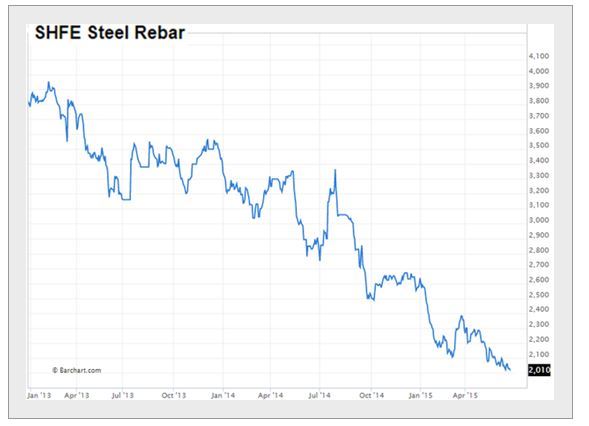

Below is a chart of steel rebar futures (nearest contract) on the Shanghai Futures Exchange. What does it say about China's construction demand?

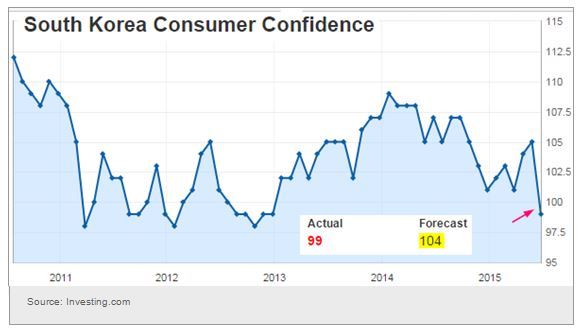

The MERS outbreak spreads, taking its toll on South Korea's consumer sentiment. It's hard to get excited about going shopping when you see trucks spraying disinfectant in the streets.

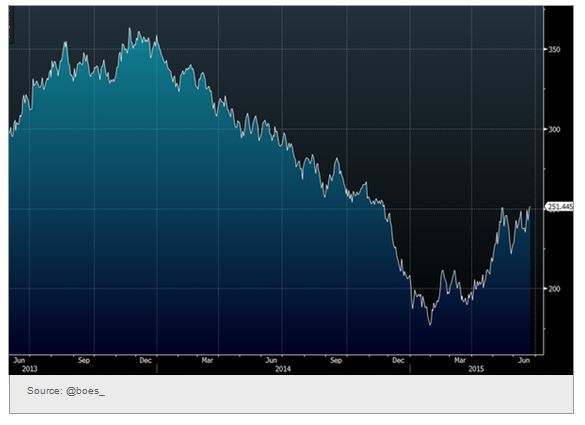

Back in the US, we see the yield curve continue to steepen. The 30-year - 2-year spread is back at November levels.

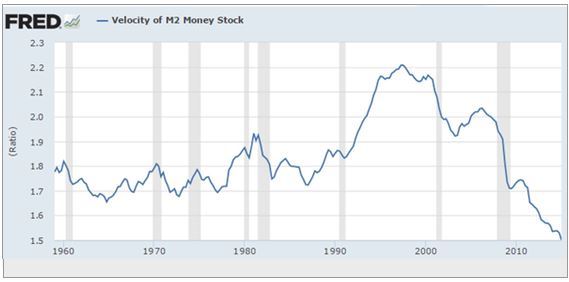

The latest revision of the Q1 GDP was better than expected. One economic trend that was updated with the GDP is the velocity of money. The combination of strong credit creation and a disinflationary environment has resulted in this sharp decline.

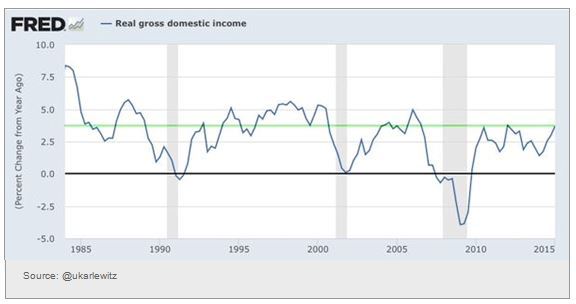

By the way, the gross domestic income (GDI), which is another way to measure economic activity, has been fairly strong lately.

Economists across the board are beginning to come to a consensus that the US needs more immigration in order to continue growing. Advanced economies with smart immigration policies (for example Canada) will over time have a tremendous advantage. Yet others will become more like Japan.

Here are the latest trends in the energy markets:

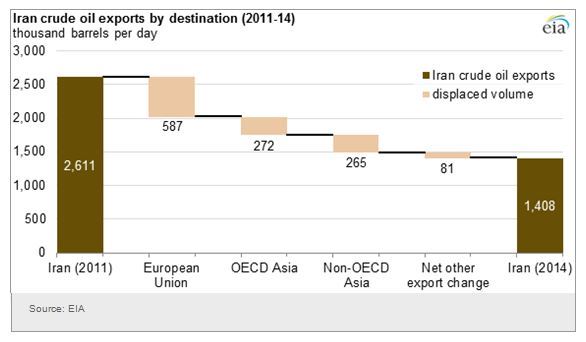

1. Sanctions really crippled Iran's crude oil export (and to some extend production) capability. Here is the breakdown of export reductions.

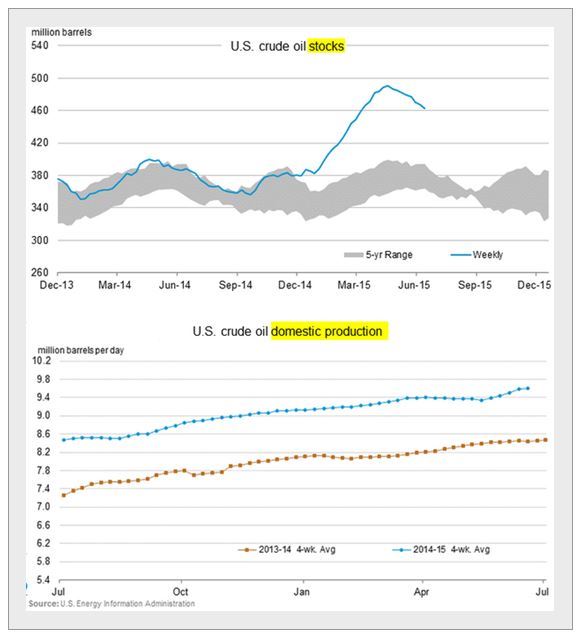

Below is what's going on with US crude oil in storage and crude production.

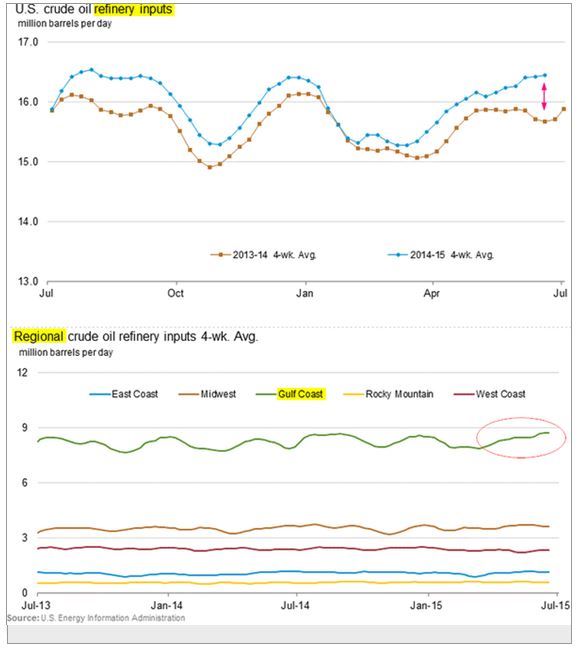

The key reason behind strong crude oil inventory declines is the demand from refineries. US refinery input is at record levels (16.1 mm b/d). Most of the increases are at the Gulf Coast refineries.

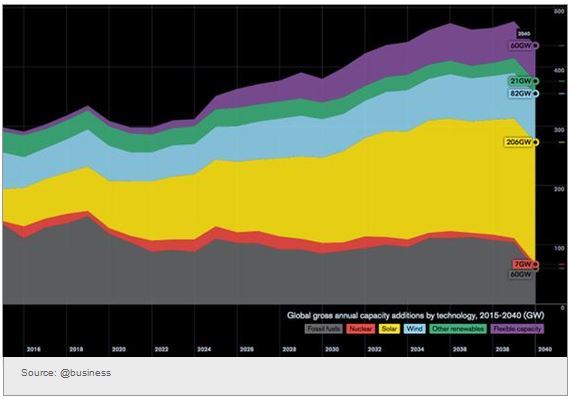

Finally, some food for thought. Global growth in energy production capacity by type through 2040 (yellow is solar, gray is fossil fuels).

Disclosure: Originally published at Saxo Bank TradingFloor.com