We begin with Brazil where manufacturing activity has collapsed as the nation's economic contraction deepened. Markit PMI hit the lowest level since the Great Recession.

Source: Markit

So why has the country's currency strengthened and the stock market jumped 4.5% on Tuesday?

Source: Investing.com

Source: Investing.com

The answer has to do with depressed valuations. For those with a good stomach for volatility, it's shopping time. In addition there may be a legislative move to encourage repatriation of assets back to Brazil.

Have we witnessed the worst of Brazil's economic contraction or is there more to come? From a contrarian perspective, the sentiment has been so bad that an upside surprise is quite possible.

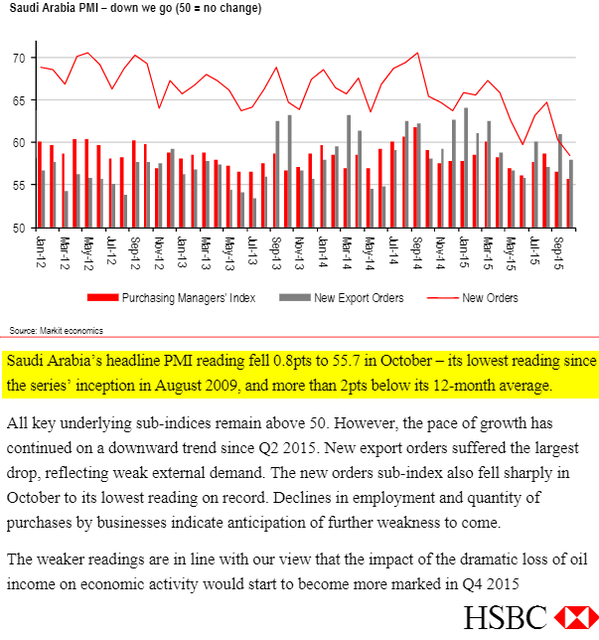

Continuing with emerging markets, Saudi Arabia's PMI index hit the lowest level since the series' inception. New orders and hiring took a hit as a result of the dramatic loss of oil revenue.

Zambia raised interest rates to 15.5% to fight a sudden spike in inflation. Some "frontier markets", last year's darling of the investment community, remain under pressure.

Source: Tradingeconomics.com, Bank of Zambia

Source: Tradingeconomics.com, Bank of Zambia

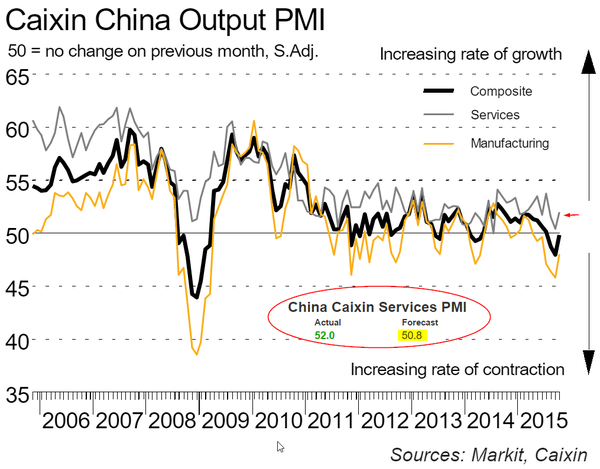

China's services PMI beat consensus as stimulus kicks in.

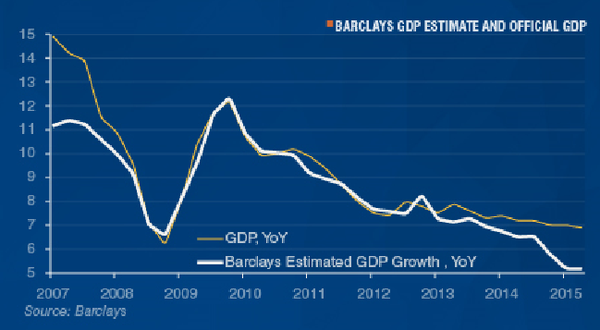

Debates continue about how fast China is growing (chart below) but it is clear that growth is not about to collapse.

Nevertheless, China and other emerging markets remain the primary risk for many investors. In fact it seems to overshadow any concerns associated with tighter monetary policy in the US.

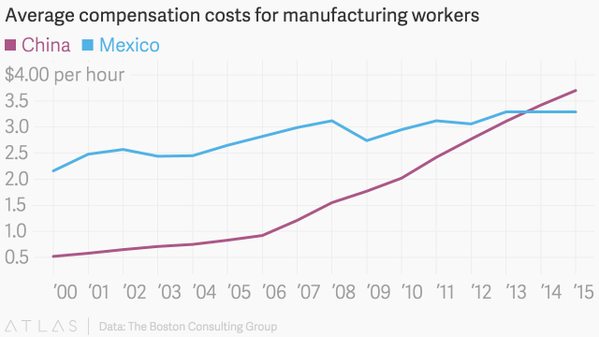

As I discussed a number of times, Mexico will be taking some market share from China. The recent peso devaluation, rising labour costs in China, and proximity to the US make Mexico attractive for manufacturing. This is why a further yuan devaluation seems likely in order for China to stay competitive. This is especially true given the latest government target to keep China growing at 6.5%.

The emerging markets rout has taken its toll on Standard Chartered bank (L:STAN), whose shares fell due to a large quarterly loss, job cuts, and planned capital raising. The EMG gravy train came to a screeching halt.

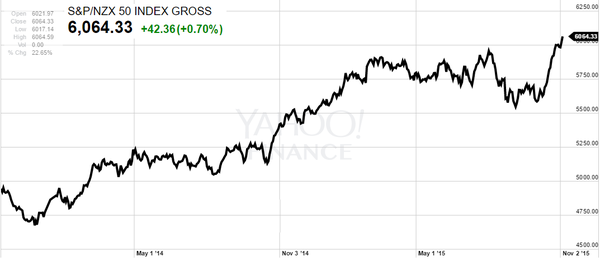

The New Zealand stock market hit a record on Tuesday following a global rally across the region. The "risk-on" sentiment is back.

Back in the United States, manufacturing orders remain soft -- although the weakness was largely expected. Manufacturers and their clients have been working down inventories that had piled up recently.

Source: Reuters

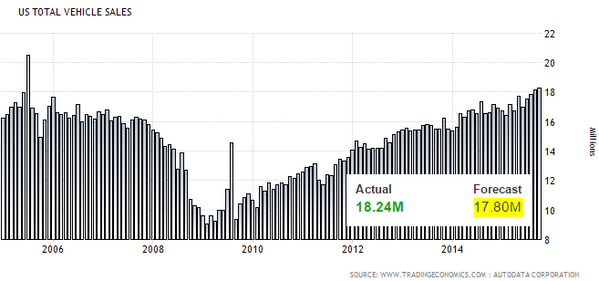

One area of manufacturing in the US that remains strong is autos. It seems that domestic demand has not been impacted - for now. US total vehicle sales exceeded consensus.

Source: Tradingeconomics.com, Autodata Corporation

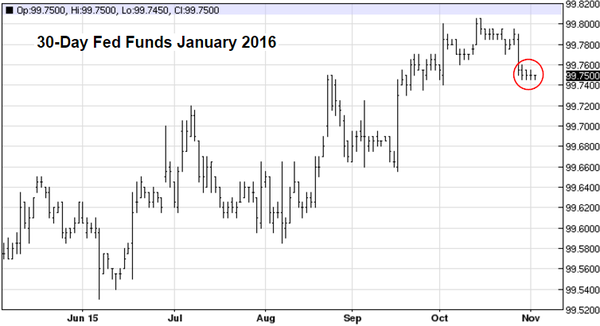

The market-implied probability of a December liftoff remains at around 50%.

Source: FRB

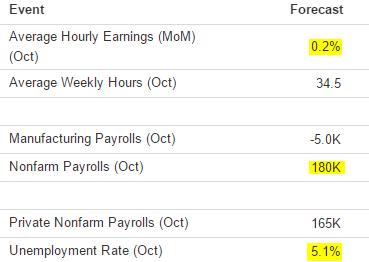

Much will ride on the October payrolls report this Friday. In particular, watch for the change in average hourly earnings as an indication of "tightness" in labor markets.

Source: Investing.com

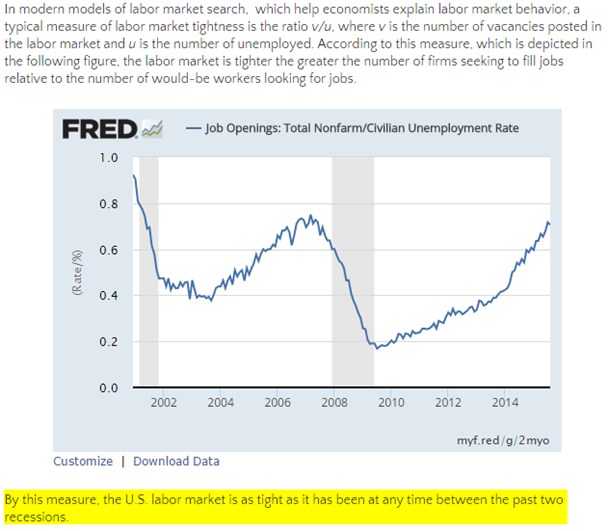

Some may remember me discussing (numerous times) the skills mismatch in the United States. Now some researchers from the Fed are using this concept to argue that the labour market is in fact tighter than the data may suggest.

Source: Federal Reserve Bank of St. Louis

Will this be used to justify a rate hike in December? Unfortunately while the labour market for skilled workers has indeed been tight, the slack remains for the unskilled labor pool. The research above seems to suggest that many of those "unemployable" workers will simply leave the workforce. Perhaps.

Turning to Food for Thought:

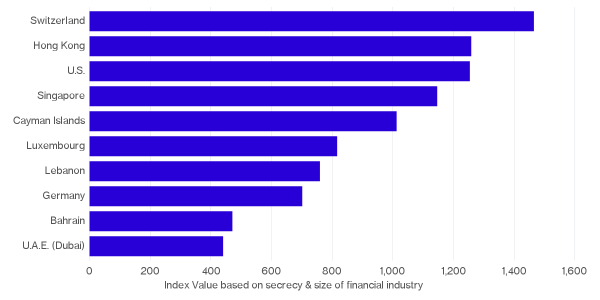

According to Bloomberg, the US refusal "to comply with information-sharing standards created by the Organization for Economic Cooperation and Development" placed the nation fairly high on the financial secrecy "blacklist."

Disclosure: Originally published at Saxo Bank TradingFloor.com