- Bad news from the Eurozone: Industrial production in Germany and Spain low

- Oil and gas production in increase meant UK industrial production bet forecast

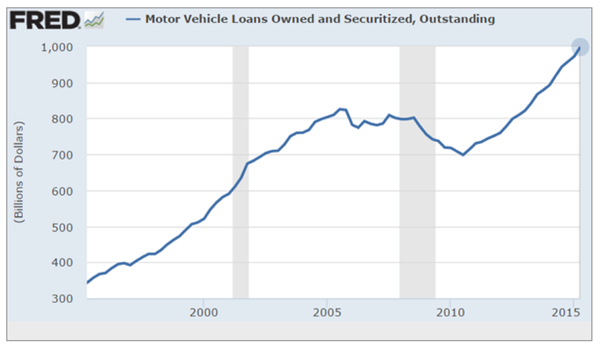

- Auto debt growth has been quite impressive

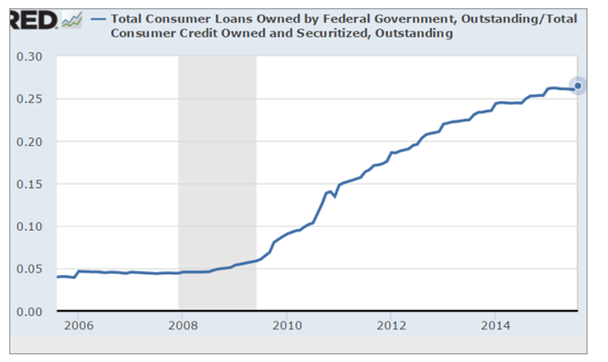

- US federal government now owns over 26% of consumer debt - via student debt

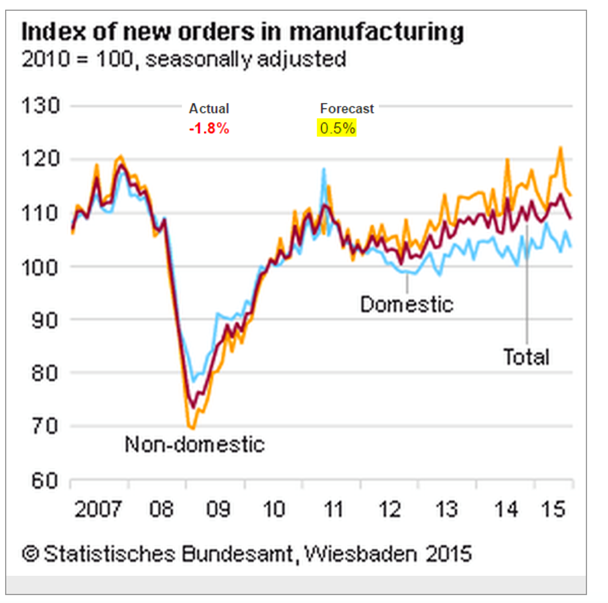

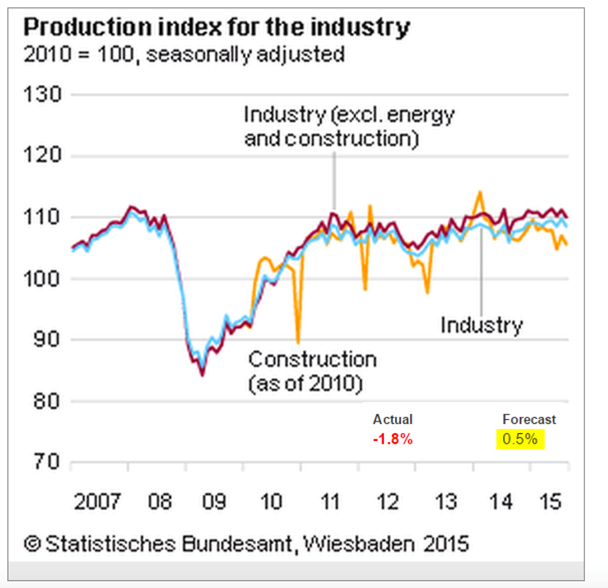

We start with the Eurozone, where we see German factory orders and industrial production decline. Economists were forecasting an increase for both. A portion of the weakness in industrial production was driven by weaker energy prices, but that's not the only reason.

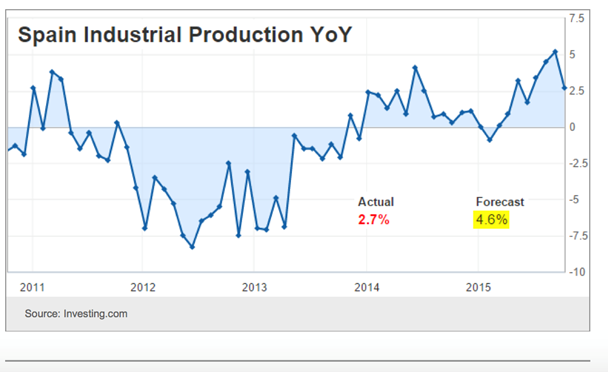

Moreover, Spain's industrial production also missed consensus. Are we seeing loss of momentum in the Eurozone?

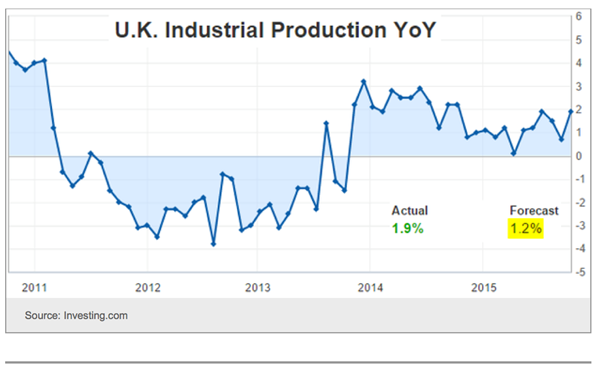

On the other hand, the UK's industrial production surprised to the upside. Interestingly, this was driven by a 26% year-over-year increase in oil and gas output - which is unlikely to be sustainable.

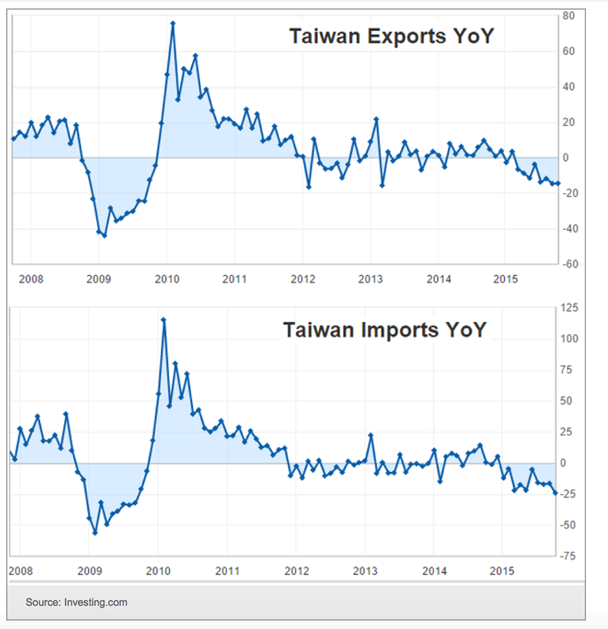

Turning to emerging markets we see Taiwan's trade under pressure, with September shipments falling sharply. Here are the imports and exports (YoY).

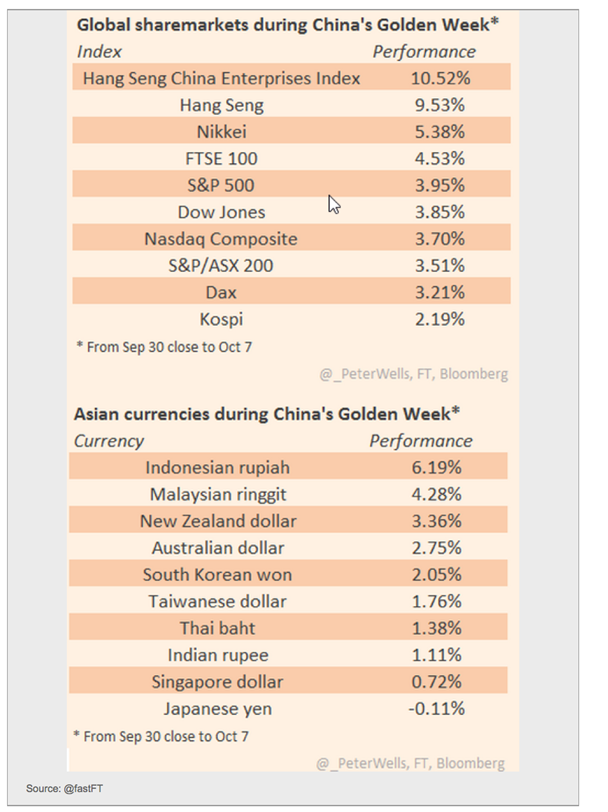

Malaysia's FX reserves have declined to multi-year lows recently. The reserves are likely to stabilize for now, as the ringgit jumps the most in 17 years on stronger oil and a positive trade surplus report. The expectations of a delayed rate hike in the US are also helping.

As a whole, EM currencies are showing signs of stabilization. An earlier than expected Fed hike, however, could derail this.

With China's markets shut for several days prior to today (Golden Week), the global "risk-on" markets have done quite well. Much of this rally is related to the Fed rather than China, but it's an interesting coincidence nevertheless.

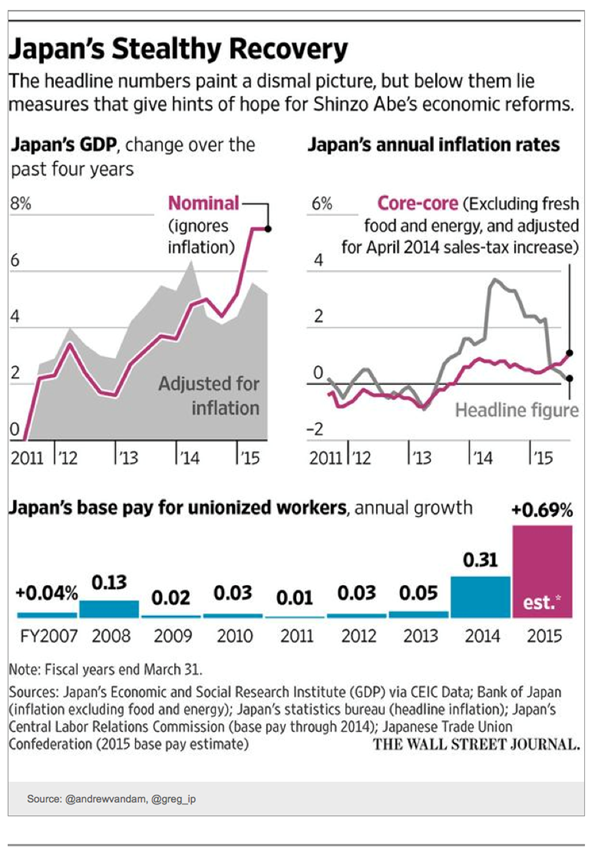

The Journal published an interesting story on Japan's growth, suggesting that the economic picture may not be as ugly as it appears. Nominal GDP growth has been strong, inflation adjusted for food and energy is improving, and union workers' wages increased at the fastest pace in years.

In the US, lets take a look at some trends in consumer credit.

1. Auto debt growth has been quite impressive.

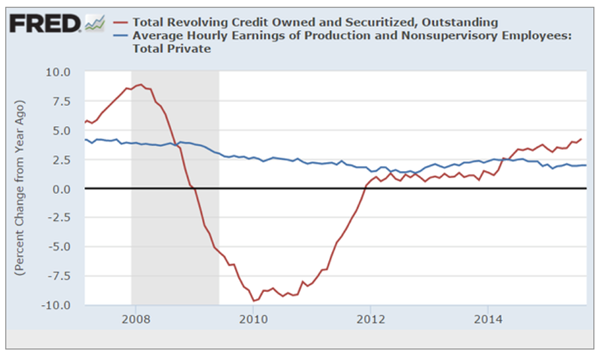

2. On a year-over-year basis, US revolving credit growth (mostly credit cards) has accelerated. Consumers seem to be increasingly comfortable taking out more credit card debt in spite of the weak wage growth (or maybe because of it).

3. US federal government now directly owns over 26% of consumer debt outstanding - via student debt. Of course, it also guarantees a large amount of pre-2008 student debt.

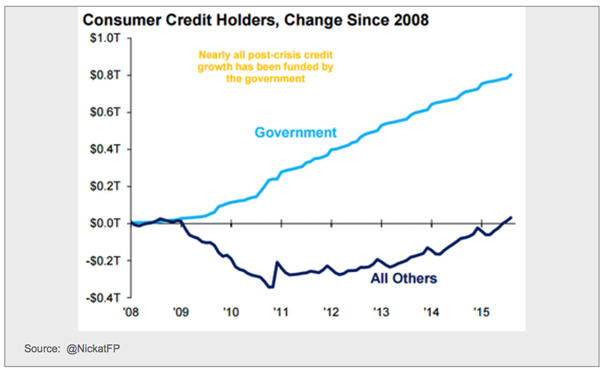

By the way, here is consumer credit growth excluding the federal government.

4. The MBA Purchase Index (indicator of mortgage volume for house purchase) jumped to the highest level since 09. Much of this was due to a regulatory change, but mortgage rates below 4% also helped.

Turning to Food for Thought, we have 3 items this morning:

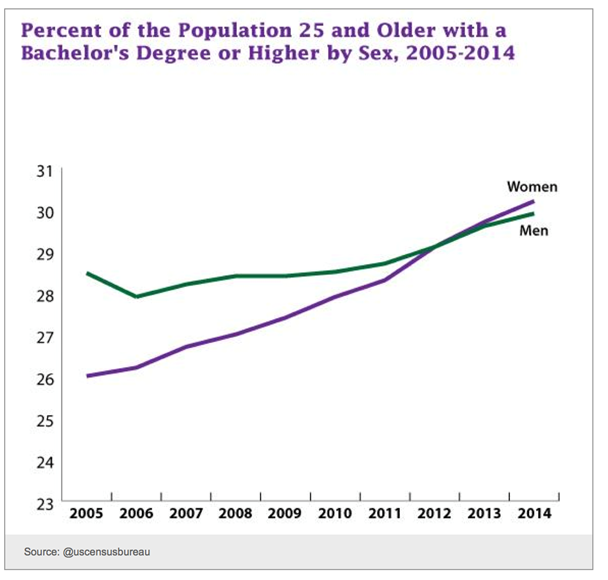

1. According to the U.S. Census Bureau, "for the first time, women are more likely to have a bachelor’s degree than men."

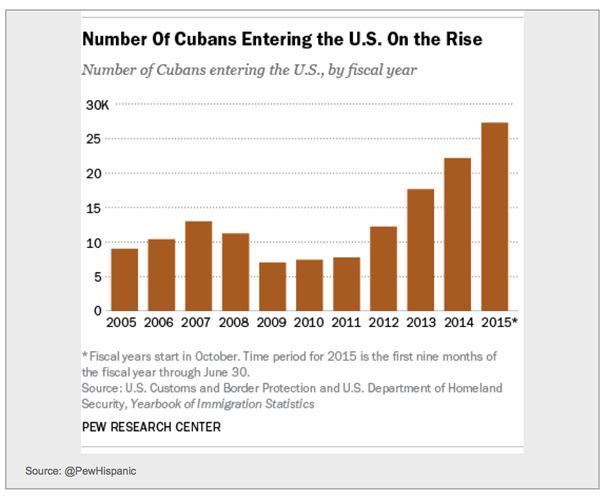

2. According to Pew Research, the "number of Cubans who have entered the U.S. has spiked since President Obama announced renewal of ties."

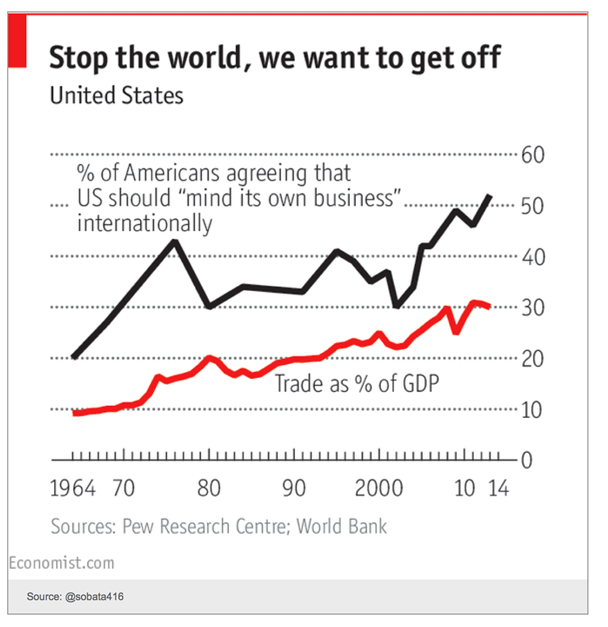

3. The majority of Americans now believe that the US should "mind its own business" internationally.

Disclosure: Originally published at Saxo Bank TradingFloor.com