Daily Markets Broadcast July 1, 2019

Stocks firmer on tariff truce

An agreement to get US-China trade negotiations back on track has given equity indices a boost at the start of a new month. A public holiday in Hong Kong could keep liquidity and volumes low in the Asian session. The OPEC meeting starts today, with Saudi Arabia and Russia already agreeing on production cuts.

US30USD Daily Chart

Source: OANDA fxTrade

- The US30 index pushed higher in early trading this morning after the weekend G-20 summit.

- The index is attempting to retest last month’s high at 26.913 and the October high of 26,940.

- The ISM manufacturing PMI is seen slipping to 51.0 in June from 52.1 the previous month. That would be the weakest reading since August 2016.

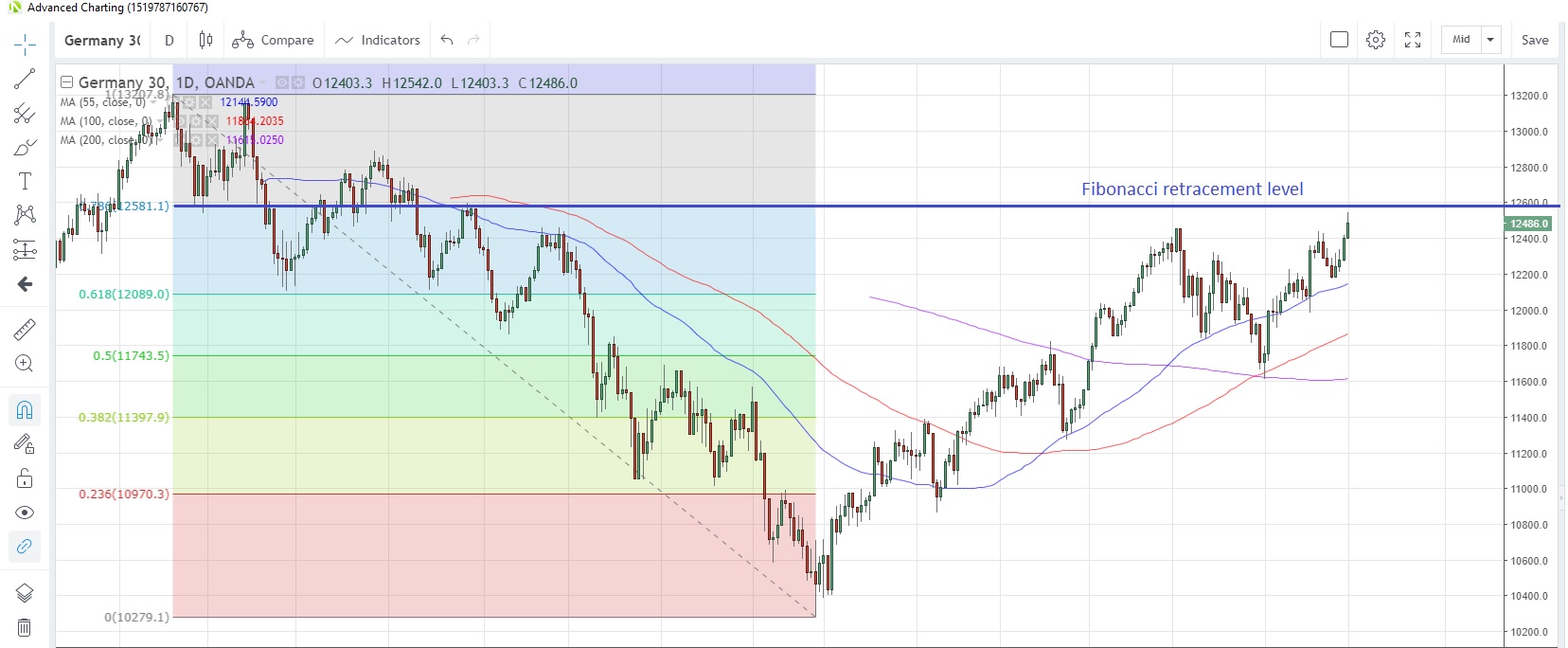

DE30EUR Daily Chart

Source: OANDA fxTrade

- The Germany30 has powered ahead to the highest since August last year in early trading this morning after the weekend trade truce agreement.

- The 78.6% Fibonacci retracement of the May-December drop last year at 12,581 is being tested, while the August 2018 high is at 12,599.

- Germany’s unemployment rate is seen unchanged at 5% in June, the latest surveys suggest. There are speeches from ECB’s De Guindos and Lane today.

CN50USD Daily Chart

Source: OANDA fxTrade

- The China50 index is expected to advance at the open this morning following the announcement of a trade truce and an intention to get back to the negotiating table.

- The index may test the 78.6% Fibonacci retracement of the decline from April 19 to May 9 at 13,824.

- China’s manufacturing PMI missed estimates in June, coming in at 49.4, the same as May. Today sees the release of the Caixin manufacturing PMI which is expected to slide to 50.0 from 50.2 in May.