Daily Markets Broadcast March 27, 2019

Wall Street edges higher as slowdown fears ease.

Soothing words from analysts suggesting the inversion in the US yield curve does not mean an instant recession helped risk appetite yesterday, allowing US indices to edge higher.

US30USD Daily Chart

Source: OANDA fxTrade

- The US30 index rose for a second straight day yesterday amid improving risk appetite.

- The index held above the 55-day moving average at 25,299, which has underscored prices since January 23.

- The US trade deficit is seen improving in January from December’s extreme, with estimates suggesting -$57.0 billion from -$59.8 billion.

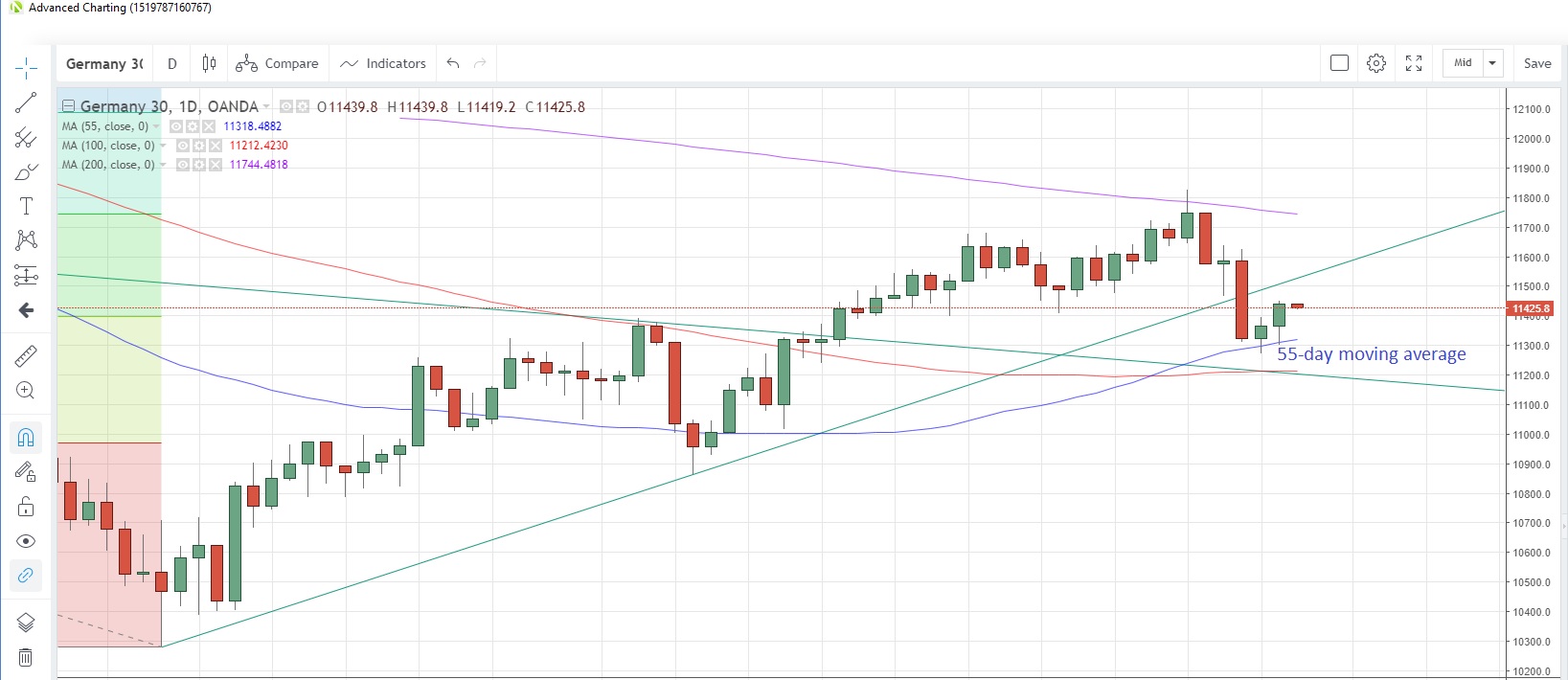

DE30EUR Daily Chart

Source: OANDA fxTrade

- The Germany30 index extended Monday’s rebound to a second day yesterday, helped by a pickup in risk appetite

- The 55-day moving average at 11,318 was again tested yesterday, and again it held on a closing basis. The moving average has supported prices on a closing basis since February 8

- Germany’s Gfk consumer confidence survey for April missed estimates, coming in at 10.4 rather than 10.8. There are no major data releases today, though we do have speeches from ECB’s Draghi, Praet, Lautenschlager, De Guindos and Mersch.

CN50USD Daily Chart

Source: OANDA fxTrade

- The China50 index snapped a two-day losing streak yesterday after rebounding off two-week lows.

- The rising 55-day moving average at 11,883 provides underlying support, as it has done since January 18.

- The US International Trade Commission is about to propose an import ban on iPhones made in China as they say it infringes a Qualcomm (NASDAQ:QCOM) patent.