Daily Markets Broadcast 2019-02-15

Wall Street waiting for trade talk developments

With little sign, or news, or progress in the U.S.-China trade negotiations, it was left to weak economic data to lead the way lower for Wall Street. Weak data also pressured German shares while Chinese counters were capped by the trade talks.

US30USD Daily Chart

Source: OANDA fxTrade

- The US30 index closed lower after U.S. retail sales plummeted 1.2% m/m in December, the weakest monthly performance since 2009. White House economic adviser Kudlow said there may be “glitches” in the data due to the government shutdown.

- The index touched the highest since December 4 before closing lower. The 200-day moving average is at 25,042

- U.S. industrial production expansion is expected to slow to just 0.1% m/m in January, surveys suggest. That would equal the lows since May last year. Capacity utilization is seen steady at 78.7%.

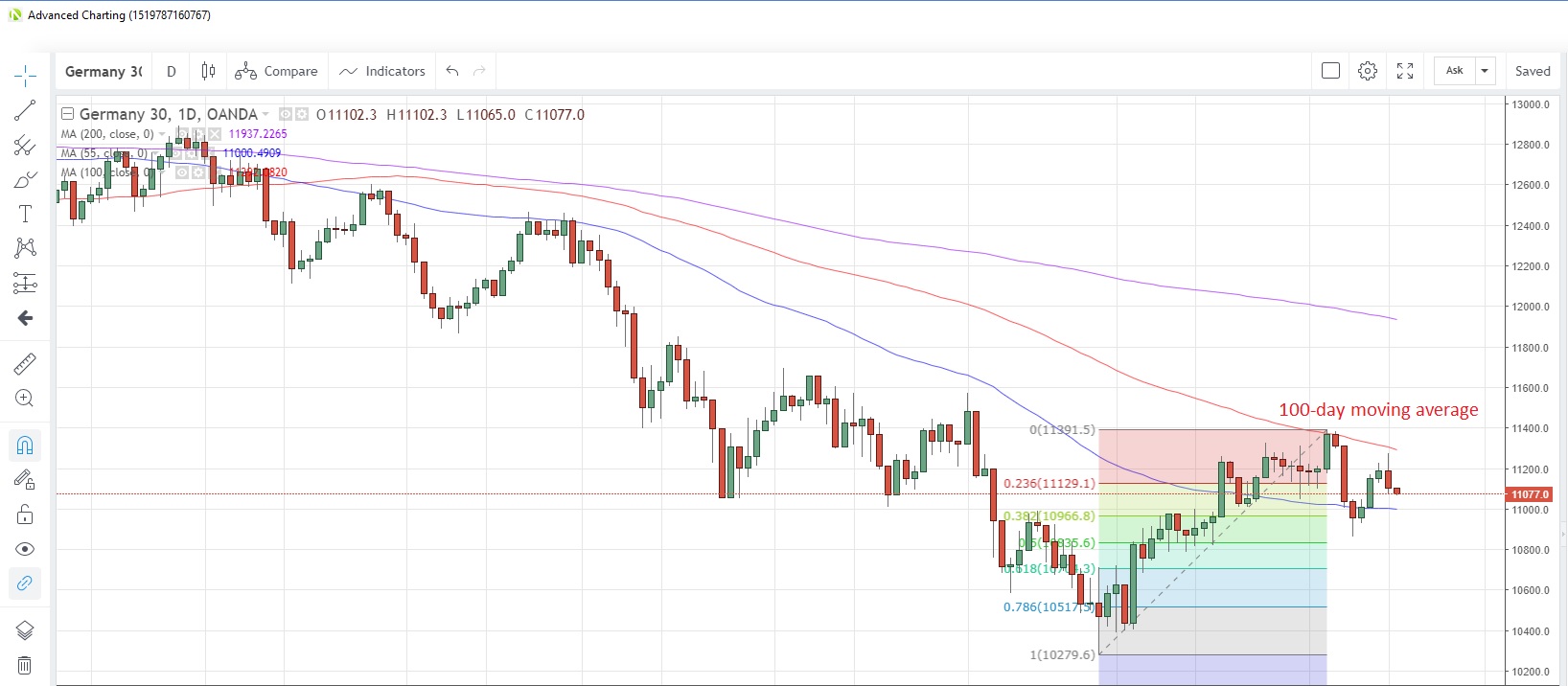

DE30EUR Daily Chart

Source: OANDA fxTrade

- The Germany30 index snapped a three-day winning streak as German GDP growth slowed in Q4, but narrowly avoided a technical recession

- The 100-day moving average resistance at 11,292 remains intact, for now. Support may be found at the 55-day moving average at 11,000

- Germany’s economy stood still in Q4, with zero growth on a quarter-by-quarter basis. ECB’s Coeure is due to speak today.

CN50USD Daily Chart

Source: OANDA fxTrade

- China shares retreated from 4-1/2 month highs yesterday amid a lack of progress in the trade negotiations with the U.S.

- The index snapped a three-day winning streak yesterday as the index’s rally stalled near the previous high on September 28 at 11,931. That could prove to be a significant resistance point. The nearest support level could be the 200-day moving average at 11,405

- China’s trade surplus with the U.S. narrowed to $27.3b in January from $29.9b in December, according to data released yesterday. A convenient release as the U.S.-China trade negotiations were underway.