Wall Street Buoyed By Trade Talk Progress

Wall Street was lifted by positive comments about pre-meeting trade discussions between U.S. and China. The talks officially start today. Japan’s Q4 GDP came in as expected, rebounding from Q3’s contraction.

US30USD Daily Chart

Source: OANDA fxTrade

- The US30 index hit the highest since December 4 yesterday before edging off into the close. Progress in the U.S.-China trade discussions, which officially start today in Beijing, supported the move up.

- The index has yet to test the 78.6% Fibonacci retracement of the October-December drop at 25,768. The 200-day moving average is at 25,038.

- U.S. retail sales are seen rising 0.2% m/m in December, the same pace as in November, according to recent surveys.

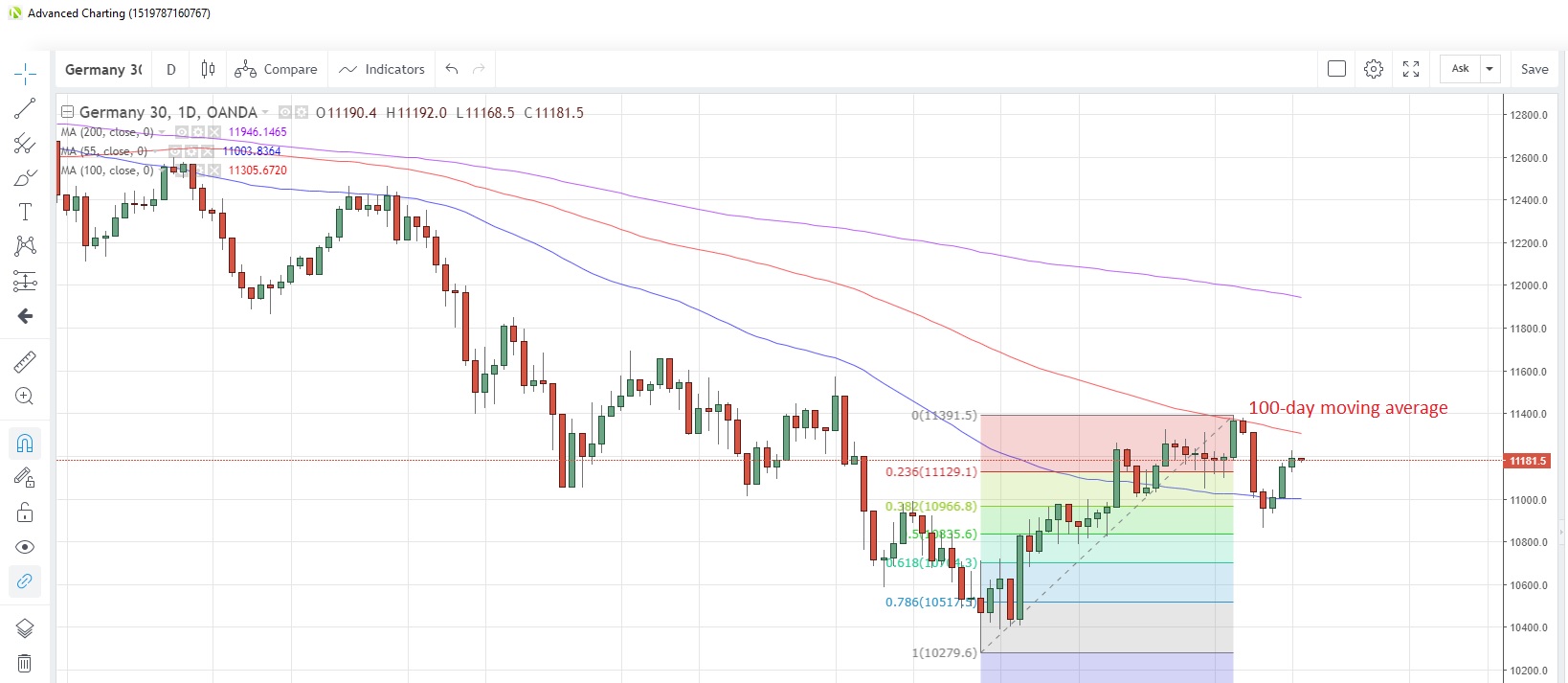

DE30EUR Daily Chart

Source: OANDA fxTrade

- The Germany30 index rose for a third day yesterday, taking its cue from sentiment on Wall Street.

- The index is edged closer toward the 100-day moving average at 11,305.

- Germany’s Q4 GDP growth is expected to slow to +0.7% y/y from +1.1% in Q3, the latest surveys show. A more marked slowdown would be negative for the index.

JP225USD Daily Chart

Source: OANDA fxTrade

- The Japan225 index hit the highest in almost two-month this morning, encouraged by the uptick in Japan’s GDP in Q4 and the positive close on Wall Street.

- The index is rising toward the 100-day moving average at 21,586, which has capped prices since December 4.

- The Japanese economy expanded 1.4% y/y in the fourth quarter of 2018, as expected, snapping the run of two-quarters of negative growth.