Market Summary

Friday was an important day for the global investors as both Federal Reserve Chair Janet Yellen and European Central Bank President Mario Draghi gave speeches. While the markets were expecting clues about the future of their respective economies, they refrained from talking about monetary policies. Yellen’s silence caused the US Dollar to lose strength across the markets, while Draghi’s warning about rising protectionism being a danger to global markets initially helped Euro. However, the regional currency finished the week mixed against its major counterparts.

In Asia, markets finished mostly higher as weakening U.S. dollar helped lift equities. Chinese investors were especially active ahead of this week’s PMI data and the China A50 Index added 2.1%. Japan’s Nikkei gained on the back of exporter shares, but the Australian S&P/ASX200 was flat as losses from banks offset gains from miners.

European markets were choppy on Friday as investors awaited Yellen’s speech. When Yellen didn’t hint anything about the monetary policy, the European bourses dropped and finished the day lower. With ECB President Draghi’s speech was at 20:00 (GMT), there was also some caution among investors.

U.S. markets were mixed at the close Friday as North American investors were able to react to Draghi’s speech. While nine of the eleven S&P500 sectors finished in the black, technology and healthcare losses led NASDAQ to a decline. Still, it closed the week 0.8% higher, the first weekly gain in five weeks.

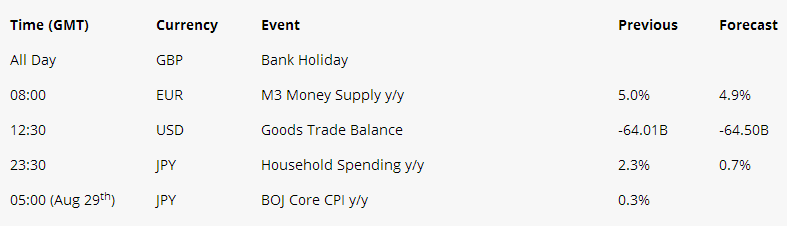

Today’s Expectations

EUR/USD

The pair moved higher on Friday in response to Jackson Hole news, where central bankers refused to discuss monetary policy. The pair gained more than 100 pips, closing above 1.1900 for the first time since January 2015. Euro-Dollar began its rally following Yellen’s speech and made a final push following the speech of Mario Draghi as both avoided any mention of monetary policy.

Metals

Precious metals rallied in response to a drop in the USD Index to a three week low. Yellen’s refrainment from sharing information on monetary policy caused the U.S. dollar to fall and help Gold to briefly test the $1,300 level day.