ASIA ROUNDUP:

- Nikkei stocks reached their highest level since Jan 23rd

- Japan Finance Ministry Names Tatsuo Yamasaki as Top Financial Diplomat

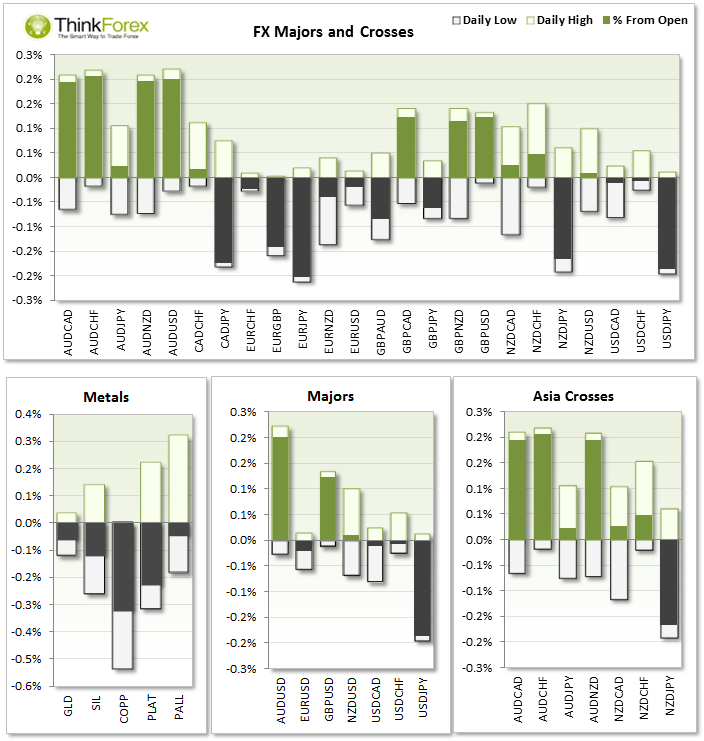

- Relatively subdued across FX and Commodity markets following last night's action from NFP, which saw narrow ranges as investors booked profit and await today's European session, which may be quiet due to lack of news.

- With US celebrating Independence Day we can expect thinner volumes due to less activity from the US banks. However European session will be business as usual, so European crosses may be the markets to monitor tonight for tradable opportunities.

- German Factory orders is a volatile data set, and whilst forecast at -0.8% it tends to range between +/- 4%. With Germany being the largest economy within the Eurozone it is closely monitored by ECB.

TECHNICAL ANALYSIS:

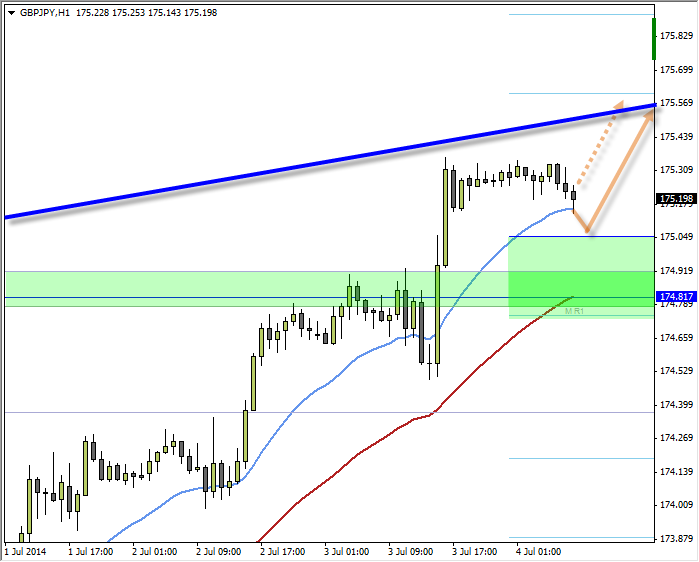

GBP/JPY: One 'last hurrah' before the weekend?

Please view today's analysis for a larger view of GBP/JPY. Price currently trades above the monthly pivot with plenty of room for a retracement before an assault to Daily S1.

However as Europe is just about to open (followed by London in just over 1 hr) we may see a quick spike down towards/past the Daily Pivot before the trend resumes. Therefor you may want to consider a buy-limit order, which could be easily cancelled if it travels north without us, to catch such spikes

We have good levels of support between 1.748-175 so I personally would only consider long positions above this level.