ASIA ROUNDUP:

- AUD/USD retraced following poor data from building approvals, down -3.5% from last month. ANZ job adverts came in positive at 2.2%, compared with 1.4% last month, and a 3rd consecutive positive release.

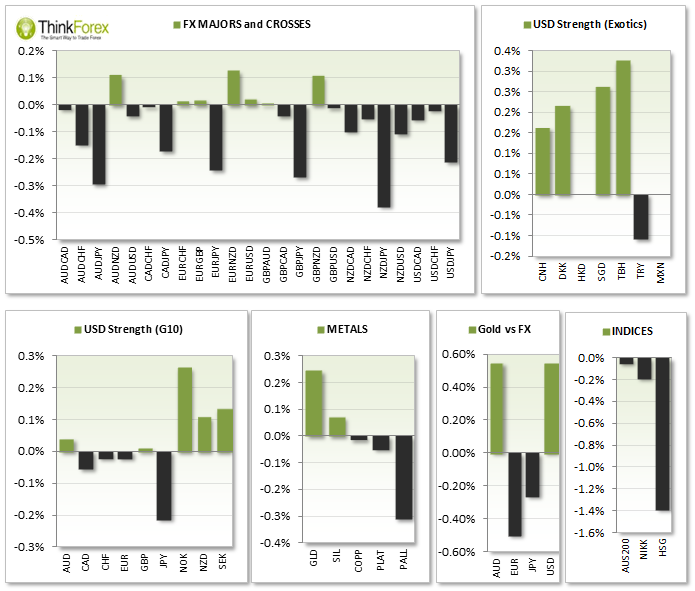

- Yen crosses saw the most action following today's PMI data from China, which confirmed the Flash PMI of 48.3 last week was optimistic and the markets didn't like it. GBP/JPY now trades back within the neckline it broke above last week, whilst AUD/JPY broke through 94.50 support and see a 5-week low. NZD/JPY broke an intraday bullish trendline but found interim support at 88.20. Resistance sits at 88.40. USD/JPY looks vulnerable following Friday’s whipsaw to 103 and prompt reversal all the way back to the weekly open, producing a Gravestone Doji reversal pattern. Early Asia trading has seen continued weakness to trade beneath last week’s lows and targeting 101.50.

- Weak China Data also saw Asia stocks weakness with Hang Seng down -1.6% and Nikkei 225 at a 3-day low. AUS200, whilst also down, holds above Friday's low and above the bullish trendline from Jan '14 swing low.

- GBP Bank Holiday

- US Non-Manufacturing PMI is forecast at a 6-month high so any shortfall here should keep USD within it's bearish intraday trends. It would take a significant positive number above 56 to have any lasting impact for the remainder of the session, so the bias is for USD shorts.

TECHNICAL ANALYSIS:

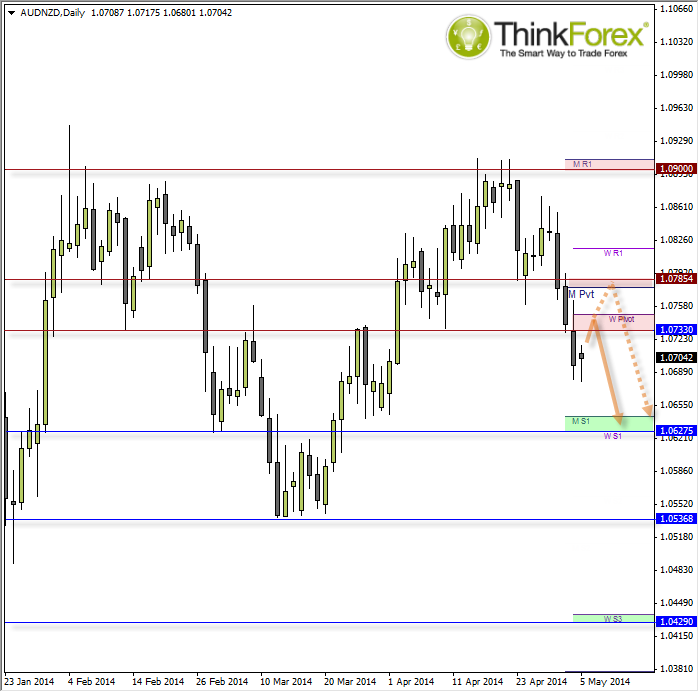

AUD/NZD: Seeking bearish setups below 1.0730

The daily timeframe has produced a lower-low and lower-high and now hover beneath 10730 resistance and weekly Pivot. The strategy is to seek a pullback towards the resistance zone and trade any sell-signals beneath this level for a run down to 1.06280.

Whilst there is potential for a deeper pullback towards 1.0785 I would ideally like to see bearish momentum increase at the lower resistance level for a cleaner entry short.

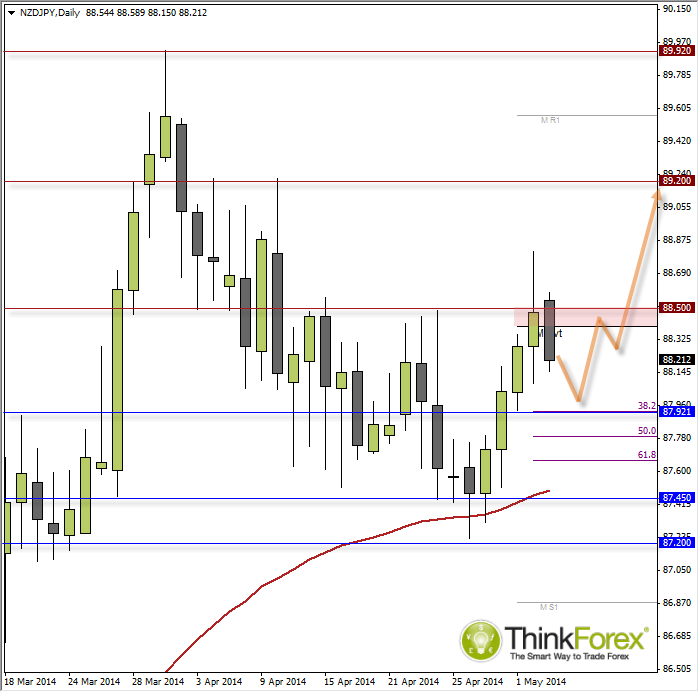

NZD/JPY: Seeking buy signals above 87.90-80.00

View Friday's post for larger view analysis.

Friday's close produced a volatile Spinning Top Doji to see today's price hold beneath 88.50 but remain within Friday's range. If we remains within Friday’s range at market close then this provides a little confidence we may see bullish momentum begin to build throughout the week.

Ideally we will witness a sift retracement towards 88 and bullish patterns to appear on D1, H4 or below.

The fact that last week's high has produced a new 'higher-high' the strategy now is to pinpoint the 'higher-low' and jump on board the larger bullish trend highlighted in Friday's analysis.