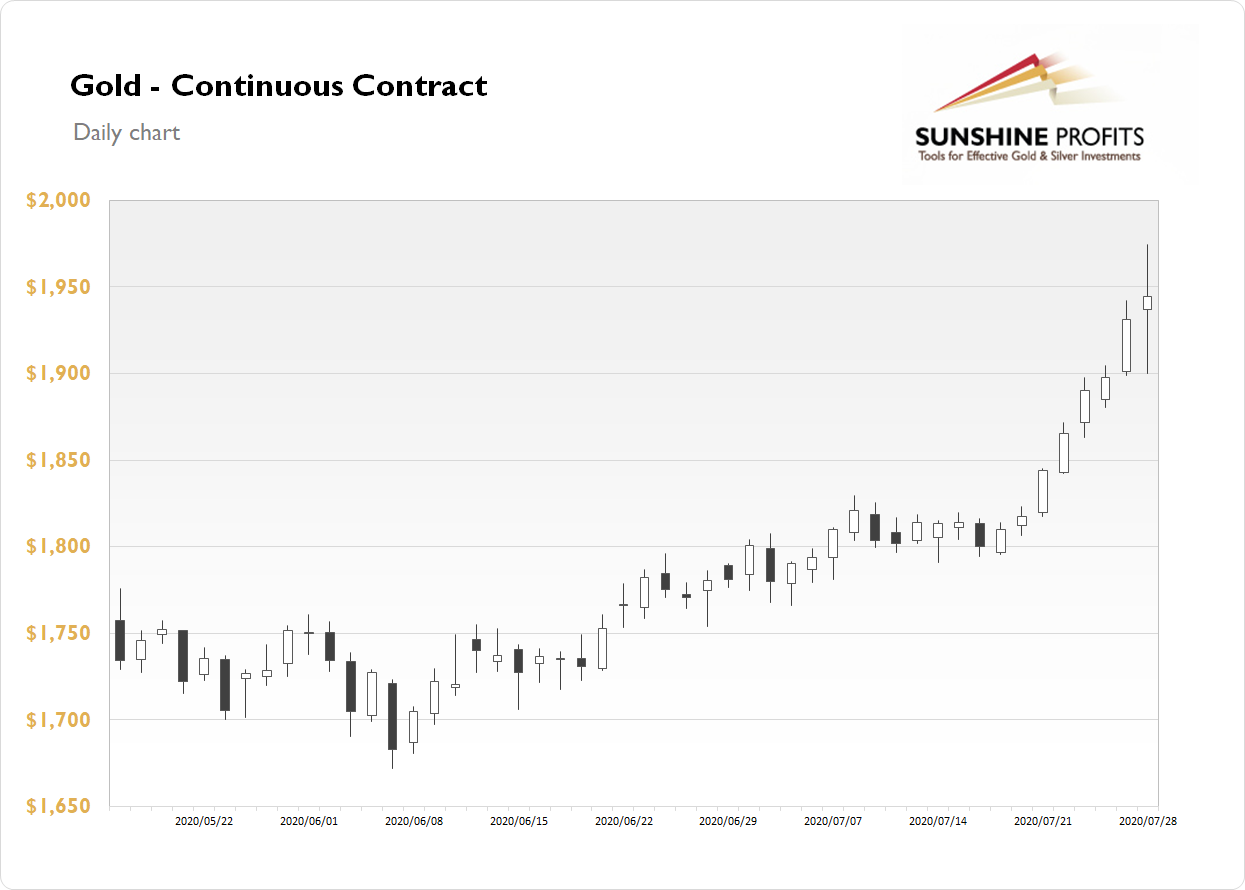

On Tuesday the Gold Futures contract reached another new record high of $1,974.70, as it accelerated the advance following recent breakout above the short-term trading range and $1,800 level. However, the yellow metal closed $30 below the daily high yesterday, as it gained 0.7%. Gold reached the highest in history following U.S. dollar sell-off, among other factors.

Gold is 0.30% higher this morning following short-term consolidation following record-breaking advance. What about the other precious metals? Silver lost 0.82% on Tuesday and today it is 0.45% higher. Platinum gained 2.03% and today it is 0.845% lower. Palladium lost 0.18% on Tuesday and today it's 1.8% lower. So precious metals are mixed this morning.

Yesterday's U.S. CB Consumer Confidence release has been slightly worse than expected at 92.6. Today we will get the Pending Home Sales number at 10:00 a.m. and then the important FOMC Statement release at 2:00 p.m.

On Thursday we will get the U.S. Advance GDP number, among others. The GDP is expected to decline by a stunning 35.0% q/q!

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Wednesday, July 29

- 8:30 a.m. U.S. - Goods Trade Balance, Preliminary Wholesale Inventories m/m

- 10:00 a.m. U.S. - Pending Home Sales m/m

- 2:00 p.m. U.S. - FOMC Statement, Federal Funds Rate

- 2:30 p.m. U.S. - FOMC Press Conference

Thursday, July 30

- 4:00 a.m. Eurozone - German Preliminary GDP q/q, ECB Economic Bulletin

- 5:00 a.m. Eurozone - Unemployment Rate

- 8:30 a.m. U.S. - Advance GDP q/q, Advance GDP Price Index q/q, Unemployment Claims

- 9:00 p.m. China - Manufacturing PMI, Non-Manufacturing PMI

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.