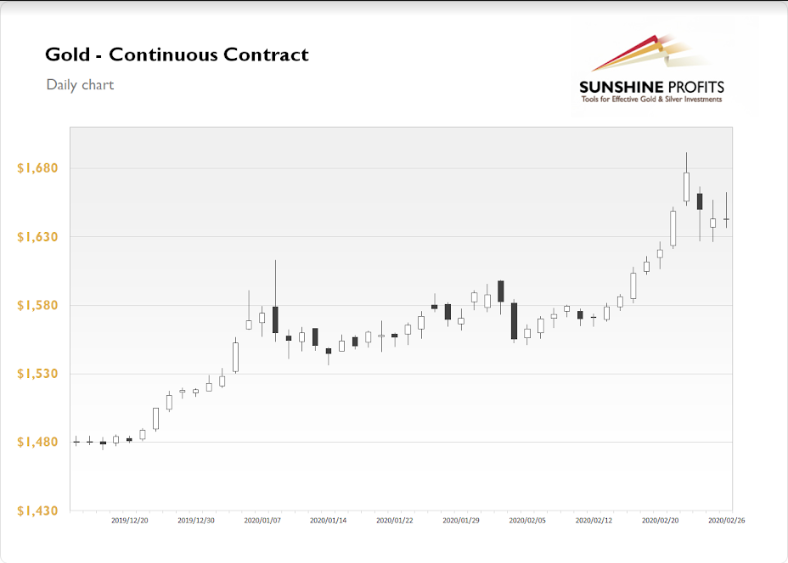

The Gold Futures contract lost 0.04% on Thursday, as it continued to fluctuate after retracing most of Friday’s-Monday’s rally. The daily trading range remained relatively big yesterday, as it reached over 25 dollars. It shows how high short-term volatility is. Investors were buying the safe-haven asset amid corona virus outbreak, economic slowdown fears recently. But gold has retraced a big chunk of that rally after bouncing off $1,700 mark.

Gold is 1.3% lower this morning despite stock market’s sell-off and the mentioned corona virus fears. What about the other precious metals? Silver lost 1.00% on Thursday. Today silver is 4.0% lower after breaking below January lows. Platinum lost 1.02% on Thursday, and right now it is trading 3.3% lower. The metal broke below $900. Palladium was the only gainer again, as it advanced by 1.68% yesterday. However, it is 3.9% lower this morning.

The financial markets went risk-off since last Friday, as corona virus fears came back again. Yesterday’s Durable Goods Orders release was mixed, the Preliminary GDP was in line with expectations and Pending Home Sales number was better than expected. However, stocks accelerated their sell-off and the S&P 500 index lost a stunning 4.42%.

Today we will have the Personal Spending and Personal Income numbers release at 8:30 a.m. Then at 9:45 a.m. the Chicago PMI will be released. There will also be Michigan Consumer Sentiment number release at 10:00 a.m. So a lot of news releases ahead of us this morning. However, economic data releases seem less important than the mentioned virus scare recently.