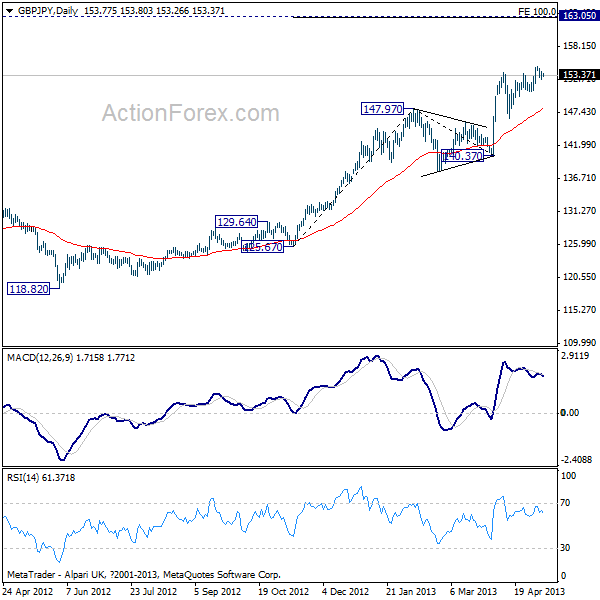

GBP/JPY Daily Outlook

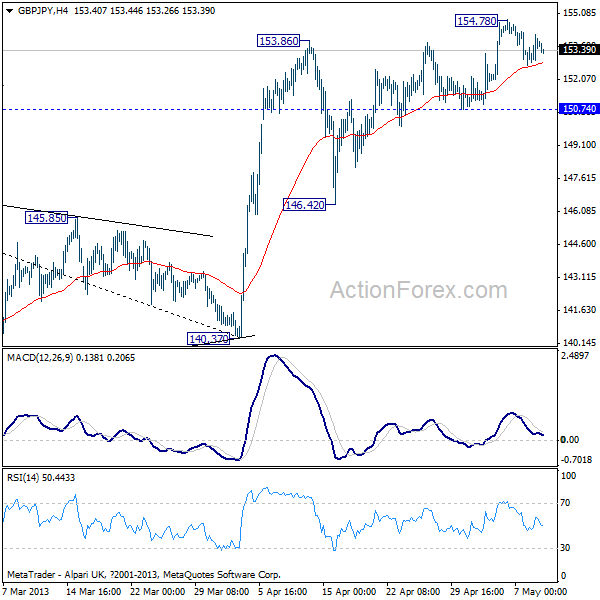

Daily Pivots: (S1) 152.98; (P) 153.54; (R1) 154.37;

Intraday bias in GBP/JPY stays neutral for the moment. As long as 150.74 holds, further rally is still expected. Above 154.78 will extend the larger up trend to 100% projection of 125.67 to 147.97 from 140.37 at 162.67.

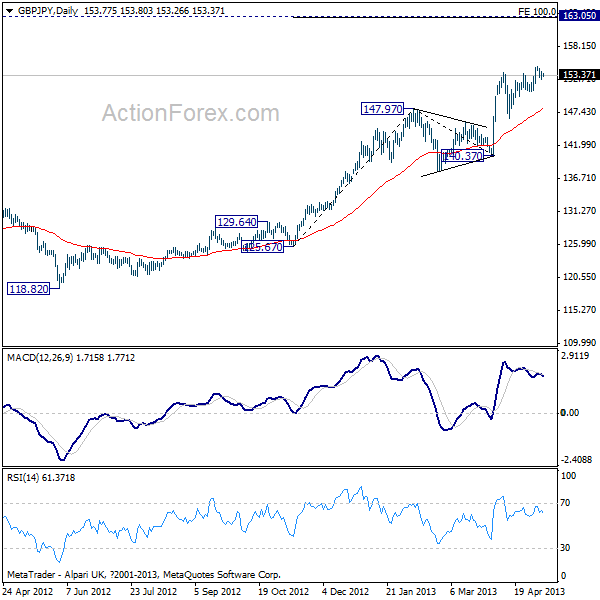

Medium term fall from 163.05 has already completed at 116.83. It's a bit early to conclude reversal of the long term down trend from 251.09 (2007 high). A rise from 116.83 should at least be a move at the same degree as fall from 163.05. Medium term rise is now expected back at 163.05. We'll stay bullish as long as 140.37 support holds.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

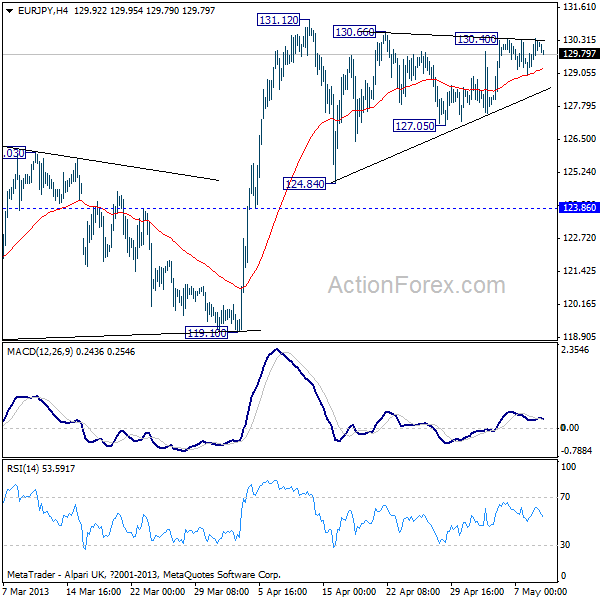

EUR/JPY Daily Outlook

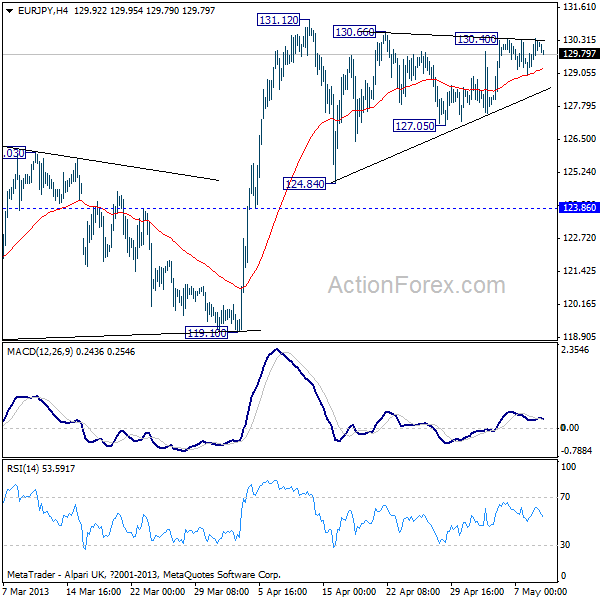

Daily Pivots: (S1) 129.32; (P) 129.86; (R1) 130.76;

Intraday bias in EUR/JPY stays neutral as consolidation from 131.12 could extend. Below 127.05 will bring deeper decline, but in that case downside should be contained by 123.86 support and bring rebound. An upside breakout is expected, and a break of 131.12 will confirm resumption of larger up trend and should target 132.03 long term fibo level first.

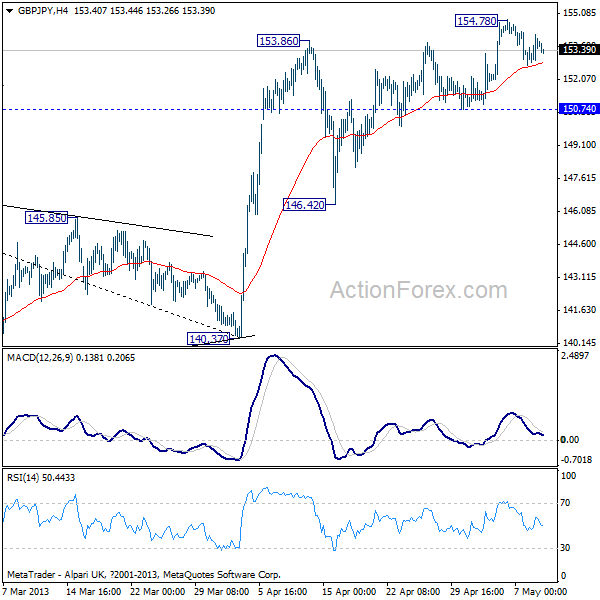

Whole down trend from 169.96 (2008 high) has already completed at 94.11, on bullish convergence condition in weekly MACD. Rise isn't finished yet, and is expected to continue to 50% retracement of 169.96 to 94.11 at 132.03 next. Such a rise would likely extend to 139.21 resistance and above. Break of 119.10 support is needed to be the first sign of medium term topping. Outlook will stay bullish otherwise.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

Daily Pivots: (S1) 152.98; (P) 153.54; (R1) 154.37;

Intraday bias in GBP/JPY stays neutral for the moment. As long as 150.74 holds, further rally is still expected. Above 154.78 will extend the larger up trend to 100% projection of 125.67 to 147.97 from 140.37 at 162.67.

Medium term fall from 163.05 has already completed at 116.83. It's a bit early to conclude reversal of the long term down trend from 251.09 (2007 high). A rise from 116.83 should at least be a move at the same degree as fall from 163.05. Medium term rise is now expected back at 163.05. We'll stay bullish as long as 140.37 support holds.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" /> GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />EUR/JPY Daily Outlook

Daily Pivots: (S1) 129.32; (P) 129.86; (R1) 130.76;

Intraday bias in EUR/JPY stays neutral as consolidation from 131.12 could extend. Below 127.05 will bring deeper decline, but in that case downside should be contained by 123.86 support and bring rebound. An upside breakout is expected, and a break of 131.12 will confirm resumption of larger up trend and should target 132.03 long term fibo level first.

Whole down trend from 169.96 (2008 high) has already completed at 94.11, on bullish convergence condition in weekly MACD. Rise isn't finished yet, and is expected to continue to 50% retracement of 169.96 to 94.11 at 132.03 next. Such a rise would likely extend to 139.21 resistance and above. Break of 119.10 support is needed to be the first sign of medium term topping. Outlook will stay bullish otherwise.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" /> EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI