Since the beginning of 2018, investors have encountered a stock market that is more volatile, yet at a level of volatility that is more normal. The below chart shows the return pattern for the S&P 500 Index since 1/2/2018 and the steep decline that began at the end of last September has been followed by a sharp recovery in 2019.

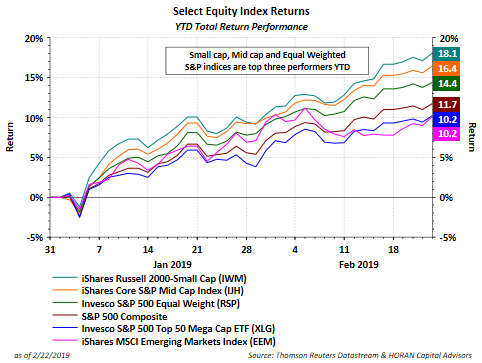

Leading the recovery has been small cap stocks that are up 18.1% year to date versus 11.7% for the S&P 500 Index. Additionally, a positive development with the market's advance in 2019 has been the broad-based nature of the move higher. In terms of performance, and following small-cap stocks, mid-cap is up 16.4% and the equal weight S&P 500 Index (RSP) is up 14.4%. All three of these indexes are outperforming the S&P 500 Index. In other words, the market's move higher is not centered on just a handful of stocks.

The outperformance of small-cap stocks over large-cap stocks is also seen in the below chart. The return over the total time period from the beginning of 2018 to the market close on 2/22/2019, small-cap stock returns continue to trail large caps as the relative performance line remains below the horizontal dotted line. The relative strength chart in the lower frame of the chart shows small-cap performance relative to large-cap is overbought.

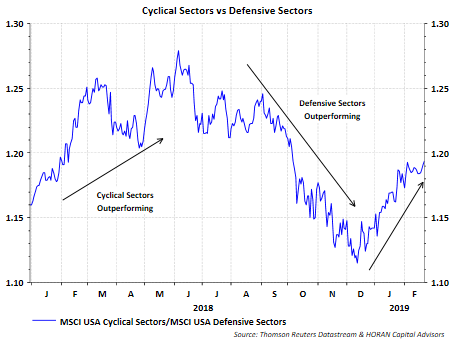

And lastly, the MSCI USA Cyclical Sectors Index has been outperforming the MSCI Defensive Sectors Index since mid-December. An improvement in the cyclical sectors may be an indication the market is anticipating strengthening economic activity in the coming quarters. Although the trade and tariff issues continue to be unresolved, recent headlines indicate progress is being made. Eliminating this uncertainty could at least reduce this market headwind. As a note of caution though, the market seems to react strongly to either favorable or unfavorable trade headlines. When an ultimate agreement is reached, it could be a situation where a short term reaction is more of a 'sell the news' type of outcome.

With small cap stock outperformance overbought relative to large-cap and with a potential resolution on trade near term, maybe large caps return to their outperforming ways. Improvement on the trade front may favor large multinational firms.