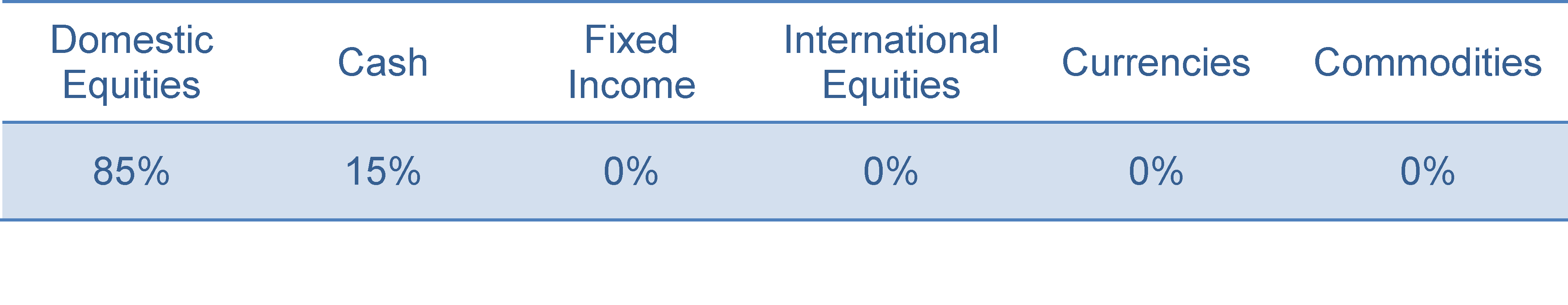

The Tactical Trend strategy seeks to identify favorable investment opportunities among six primary asset classes. Capital is rotated to the specific markets that the portfolio managers attempt to control risk by underweighting or eliminating exposure to markets that exhibit negative price trends and elevate risk. Relative strength and trend analysis are cornerstones to tactical allocation decisions.

US stocks continue to be the strongest asset class in Cumberland Advisors' relative strength matrix. As of December 2015, the broad indices are trading in a flat range, with the YTD performance (SPX +.05%) masking quite a bit of volatility. The Tactical Trend strategy is also in a flat return range YTD, as the indices and sectors had trouble putting together multiple-month trends throughout the year. As experienced investors and traders understand, some years are defined by playing defense and keeping capital safe in a choppy, sometimes treacherous environment. The strongest sectors in the strategy have been technology and consumer cyclicals. On the other hand, we have been disappointed with the recent trading action in the financial sector.

Fixed income and cash have been running a close second and third in asset class strength. At Cumberland Advisors, we currently err on the side of cash versus fixed income, as corporate and international debt has weakened. Longer-term T-bonds continue to trade decently, but we do not love the risk/reward set-up at 10-year UST 2.25% and 30-year UST 2.90%. For taxable fixed-income capital, we love the trading action in municipal bonds and continue to recommend them to clients. The spread versus AAA/AA-rated taxable bonds is a gift that should be taken advantage of at these levels.

Future Outlook: 2016

As a flexible allocation strategy, the Tactical Trend ETF can invest across six broad asset classes. The following is a current overview of our analysis as we enter the New Year.

Domestic Equities

Our primary concern continues to be the lack of breadth in the market. This can be seen in the strength of cap-weighted (N:SPY) versus equal-weighted (N:RSP). We run relative strength charts on these two securities to gauge market participation. Often times, we see short-term movement favoring one over the other. The current analysis is becoming worrisome, since SPY established a strong lead in 2015. This imbalance must correct itself heading into 2016, or we will have to reduce our US allocation, since the previous major market downdrafts (2001 and 2008) were preceded by similar action.

Fixed Income

Municipal bonds are the leaders in this space. Treasuries trade fairly dry and can be added on the long side, but be prepared to endure market volatility for a thimble full of coupon. We are not willing to make that tradeoff and therefore remain in cash versus fixed income. It should be noted that many of our Tactical Trend ETF clients own municipal exposure through Cumberland Advisors' separate-account Total Return Tax-Free Municipal Bond strategy. Our main concern in the fixed-income space remains contagion from junk-rated paper, primarily in the energy space. With plenty of this high-yield trapped in mutual funds, we are already seeing wide spreads and customer lock-ups in the space. Will this trend expand into 2016, or is it isolated to the cowboy funds that made big bets and are under distribution pressure? Should be interesting!

International Equities

This year began nice for this asset class. Unfortunately, international equities could not withstand the weakness in Asia and thus limped through summer and fall 2015. As the year comes to a close, we see strength in certain areas and continue to view Japan and areas of Europe as investable.

It is important to discuss the currency implications of owning foreign markets. The strong US dollar has made the question of hedging very important, particularly in our International ETF strategy. We are currently 50% hedged in Japan and euro equity holdings. This prudent decision has helped the strategy have a strong year versus its unhedged benchmark. We use trend and relative strength analysis to track the risk/reward in US dollar, yen and euro currencies and continue to monitor the action.

Currencies

The USD started 2015 with continued strength versus the yen and euro. After a pullback mid-year, we saw a spurt of USD strength to close the year. While we do not currently have currency exposure in the Tactical Trend ETF strategy, it is an asset class that gets reviewed constantly, as it affects many areas of the global markets. Traditionally, a strong USD has impacted commodities, specifically oil, negatively. If the USD weakens, that could be a contributing factor to commodity strength. It has not happened yet. As of December 2015, commodity indices are down 10% to 30%.

Commodities

As mentioned, we do not have commodity exposure at this time. We track the indices closely and have not received a buy signal as of yet. Unfortunately, extreme oversold readings have not evolved into buy signals, so we wait patiently. This asset class will be tradeable at some point in the future when most traders and investors have completely quit on it. Thus far, it has just shown short-term spikes off of oversold conditions. We need to see a higher low or two before becoming involved. Patience kept us out of this ugly rabbit hole in 2015. Let's see what 2016 has in store!