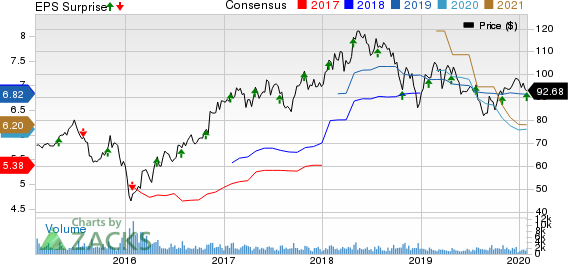

Cullen/Frost Bankers, Inc. (NYSE:CFR) delivered fourth-quarter 2019 positive earnings surprise of 1.3%. Earnings per share of $1.60 surpassed the Zacks Consensus Estimate of $1.58. However, the bottom line compared unfavorably with the prior-year quarter figure of $1.82 per share.

Results reflected top-line strength and higher loan and deposit balances. However, elevated expenses and provisions, along with contracting margins, were major drags.

The company reported net income available to common shareholders of $101.7 million, down 13.3% from the prior-year quarter.

In 2019, earnings of $6.84 per share were down nearly 1% from the prior year’s figure, but outpaced the consensus estimate by 2 cents. Net income declined 2.5% to $435.5 million.

Revenues Rise, Expenses Escalate

The company’s total revenues were $370.3 million in the fourth quarter, up 2.6% from the prior-year quarter. The revenue figure topped the Zacks Consensus Estimate of $364.6 million.

In 2019, total revenues were $1.5 billion, up 4.3%. Also, the top line matched the consensus estimate.

Net interest income on a taxable-equivalent basis moved marginally upward year over year to $275 million. Additionally, net interest margin contracted 10 basis points (bps) to 3.62%.

Non-interest income totaled $95.3 million, up 9.3% from the year-ago quarter. This increase was due to rise in all the components except interchange and debit card transaction fees, and other charges, commissions and fees.

Non-interest expenses of $220.8 million jumped 10.6% year over year. Increase in almost all the cost components led to elevated expenses in the reported quarter.

Strong Balance Sheet

As of Dec 31, 2019, total loans were $14.8 billion, marginally up from the prior quarter. Total deposits amounted to $27.6 billion, up 2.1% sequentially.

Credit Quality: A Mixed Bag

As of Dec 31, 2019, provision for loan losses increased significantly on a year-over-year basis to $8.4 million. Non-performing assets were $109.5 million, up 46.2%. Also, net charge-offs, annualized as a percentage of average loans, expanded 8 bps year over year to 0.34%. However, allowance for loan losses, as a percentage of total loans, was 0.90%, down 4 bps.

Profitability and Capital Ratios

As of Dec 31, 2019, Tier 1 risk-based capital ratio was 12.99% compared with 12.94% recorded at the end of the prior-year quarter. Furthermore, total risk-based capital ratio was 14.57%, down from 14.64% as of Dec 31, 2018. Leverage ratio moved up to 9.28% from 9.06% as of Dec 31, 2018.

Return on average assets and return on average common equity were 1.21% and 10.74%, respectively, compared with 1.48% and 14.85% in the prior-year quarter.

Our Viewpoint

Cullen/Frost remains well positioned for revenue growth, given the steady improvement in loan and deposit balances as well as efforts to improve fee income. Also, a strong balance sheet is likely to aid the company’s performance going forward. However, rising provisions and expenses are major concerns. Moreover, low interest rates might keep margins under pressure.

Zacks Rank

Currently, Cullen/Frost has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

UMB Financial (NASDAQ:UMBF) reported fourth-quarter 2019 net operating earnings of $1.36 per share, which surpassed the Zacks Consensus Estimate of $1.16. The bottom line also compared favorably with the prior-year quarter’s earnings of 56 cents per share.

New York Community Bancorp, Inc. (NYSE:NYCB) reported fourth-quarter 2019 earnings per share of 20 cents, in line with the Zacks Consensus Estimate. The figure compared favorably with the prior-year quarter figure of 19 cents.

Bank of Hawaii Corporation (NYSE:BOH) delivered fourth-quarter 2019 positive earnings surprise of 6.6%. Earnings per share of $1.45 surpassed the Zacks Consensus Estimate of $1.36. Further, the bottom line improved 11.5% from the prior-year quarter.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

UMB Financial Corporation (UMBF): Free Stock Analysis Report

Cullen/Frost Bankers, Inc. (CFR): Free Stock Analysis Report

Bank of Hawaii Corporation (BOH): Free Stock Analysis Report

New York Community Bancorp, Inc. (NYCB): Free Stock Analysis Report

Original post

Zacks Investment Research