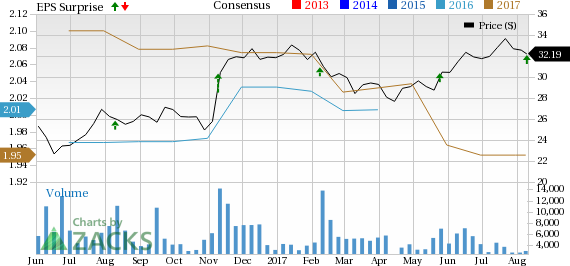

CSRA Inc. (NYSE:CSRA) reported adjusted earnings of 48 cents per share in first-quarter fiscal 2018, surpassing the Zacks Consensus Estimate by 3 cents but flat on a year-over-year basis.

Revenues of $1.23 billion decreased 2% from the year-ago quarter and lagged the Zacks Consensus Estimate. Segment wise, Defense and Intelligence (42.7% of revenues) decreased 7.6% to $525 million. However, Civil (57.3% of revenues) increased 2.6% to $704 million.

CSRA is benefiting from its domain expertise and strong partnership base that includes the likes of ServiceNow (NYSE:NOW) , Microsoft (NASDAQ:MSFT) and Red Hat among others. The small tuck-in acquisition of NES is also expected to boost the company’s ability to win new contracts re-compete them, going forward.

CSRA stated that its new business win rate has been 39% over the trailing 12 months. Re-compete win rate over the last year was 80%.

Notably, CSRA’s stock has returned 1.1% year to date, substantially underperforming the 19.4% gain of the industry it belongs to.

Greenway Expected in Aug/Sep, IMPACT Delayed

With respect to the Greenway and the IMPACT contract, CSRA noted that its prime bid, known as GES, continues to track for late August or early September. According to management, there are three parts of the Greenway contract – Regional Infrastructure Support contracts (RIS I), followed by the GES and lastly RIS II (end of calendar year or beyond that).

CSRA stated that its pre-award protest against flouting of the process by the Transportation Security Administration (TSA) has been successful. TSA has now indicated that it plans to reopen discussions and seek another round of proposal submissions to address the concerns that the company raised.

Program Wins Drive Bookings

Bookings totaled $1.6 billion in the reported quarter, representing a book-to-bill ratio of 1.3 times. Moreover, 56% of bookings in the quarter were for new business, while the win rate on new business was well above management’s target of 25%.

During the quarter, the U.S. Department of Defense’s (DoD) Defense Information Systems Agency (DISA) has granted CSRA a single-award, indefinite-delivery/indefinite-quantity contract with a $498 million ceiling over eight years. CSRA will provide DoD with a robust and resilient private cloud infrastructure.

CSRA has secured an Information Technology Infrastructure Program (ITIP) bridge contract under TSA, with a series of options totaling $153 million over one year.

Moreover, the Department of Homeland Security (DHS) awarded the company a 21-month, $152 million follow on contract to design, develop, maintain and deploy cyber security technologies to detect and deter sophisticated cyber adversaries.

Additionally, the company was also awarded United States Marine Corps’ (USMC) Technology Services Organization (TSO) IT support contract. The five-year contract is worth $143 million.

CSRA’s backlog of signed business orders was $15.6 billion, of which $2.5 billion was funded at the end of the quarter.

EBITDA margin Improves in Q1

Adjusted EBITDA was $204 million up 5% from the year-ago quarter. EBITDA margin of 16.6% expanded 100 basis points (bps) from the year-ago quarter. Management noted that the EBITDA margin was above the company’s fiscal year target.

Contract mix, as a percentage of total revenue, was favorable. Management noted that 45% was on fixed price contracts, 21% on time and material contracts and 34% on cost plus contracts.

Selling, general and administrative expenses (SG&A), as percentage of revenues, remained flat at 4% on a year-over-year basis.

Segment operating margin expanded 180 bps on a year-over-year basis to 12.6%. Defense and Intelligence segment operating margin expanded 350 bps, while Civil segment operating margin expanded a massive 40 bps in the reported quarter.

Cash, Share Buyback, Dividend

Cash & cash equivalents as of Jun 30 was $126 million, up $68 million from the previous quarter.

During the quarter, CSRA returned $31 million to shareholders, including $17 million in dividends and $14 million in share repurchases.

Visibility Improves

Management believes that revenue visibility has improved since the end of the fourth-quarter fiscal 2017. CSRA expects the year-over-year revenue comparison will turn positive in the second or third quarter of fiscal 2017.

Moreover, management reiterated fiscal 2018 guidance based on positive government spending. CSRA believes that the passing of the Modernizing Government Technology Act, which establishes a government-wide technology modernization fund worth $500 million indicates a favorable spending environment.

Revenues are still expected to be in the range of $5.000–$5.200 billion, while adjusted EBITDA is anticipated to be in the range of $770–$800 million.

At the mid-point of the top-line guided range, management expects that about 91% of revenues will come from existing business, which is up from previous expectation of 85%. Of the remaining 9%, more than 5% will come from re-competes, with the remainder from new business.

Earnings are still anticipated to be in the range of $1.88–$2.00 per share. Free cash flow is anticipated to be in the range of $330–$380 million.

Zacks Rank & Key Picks

CSRA carries a Zacks Rank #3 (Hold). Luxoft Holding (NYSE:LXFT) with a Zacks Rank #1 (Strong Buy) is a better-ranked stock in the same industry. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Luxoft is currently pegged at 20%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

ServiceNow, Inc. (NOW): Free Stock Analysis Report

CSRA Inc. (CSRA): Free Stock Analysis Report

Luxoft Holding, Inc. (LXFT): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post