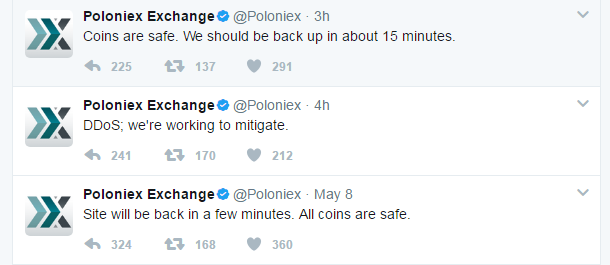

Another major attack on an even bigger exchange. This morning, one of the largest cryptocurrency exchange websites was hit with a DDoS attack. Here's their twitter feed...

Though there was some volatility in the cryptocurrency markets the overall effect did seem to be minimal. Though, many questions arise.

Who is waging a war against the cryptocurrencies? Most big hackers are of the mind that fiat is corrupt and crypto is the future of money. Why then would they try to take these sites down?

Or perhaps, the motivation is financial. They know that the technology will easily survive these type of short term shocks and are well aware of the long-term potential of the blockchain infrastructure. It seems to me is that they're just trying to scare off some of the tourists so that they can get in at a lower price.

Today's Highlights

Please note: All data, figures & graphs are valid as of May 9th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

After clearing the French election hurdle and seeing the USA put out a strong jobs number, everything seems to be going well. Theresa May is performing swimmingly in the polls and there are no major risk events on the horizon.

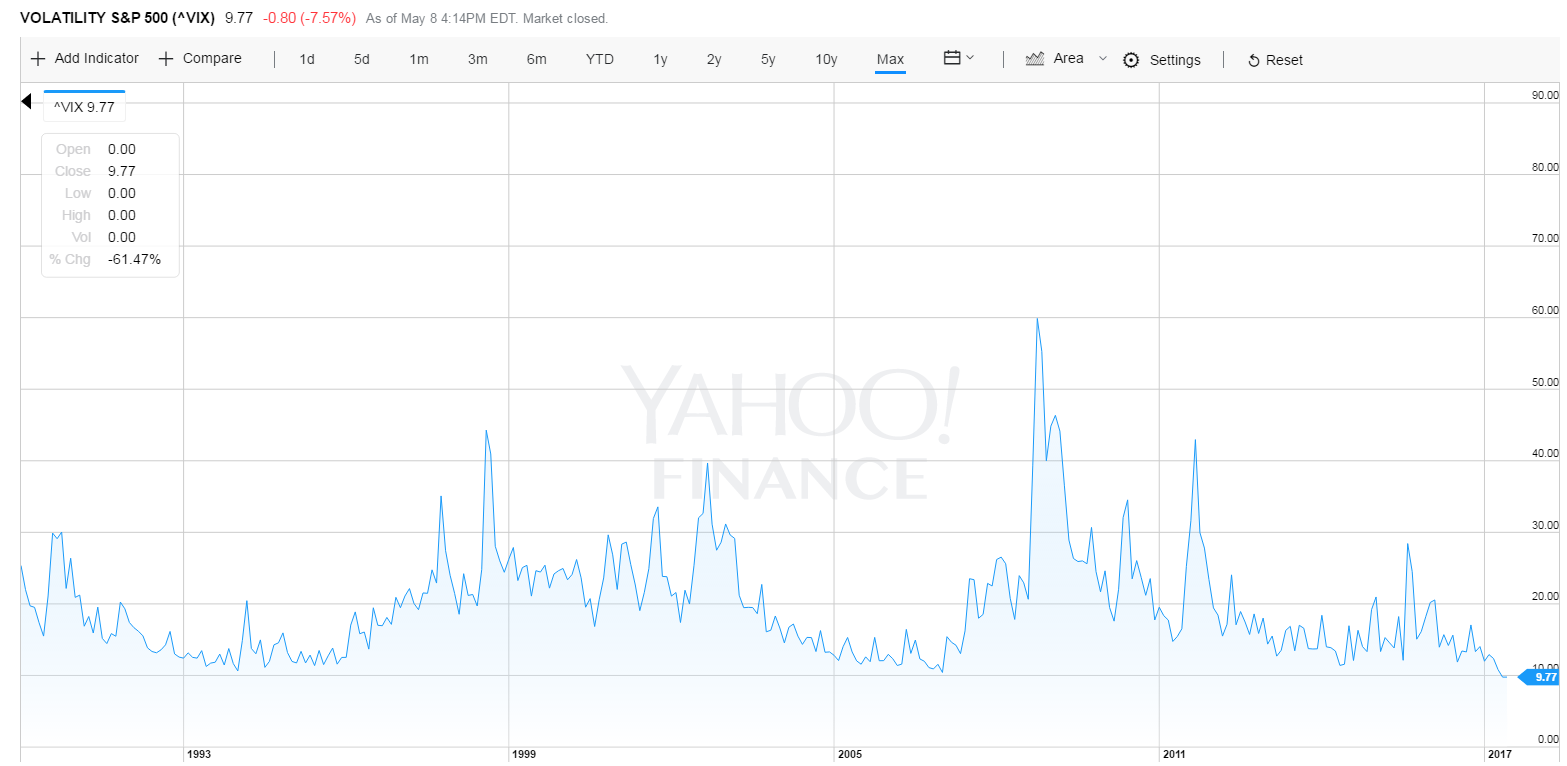

Volatility has suddenly dropped to record lows. The VIX volatility/fear index closed yesterday below 10 points marking the lowest reading ever.

Fear is dead but greed hasn't yet kicked in. So far, all that's happening is a bunch of calm and silence from the stock markets. Many major stock indexes are trading on or near their all time highs.

The largest company in the world has broken its own record high. The total of all Apple shares in circulation is now worth $800 Billion!

Thanks Alvin for posting the article. ;)

Currency Down Under

The Australian Dollar has continued its freefall, dropping more than a few jaws along the way. Lower commodities and a stronger US dollar is a bad recipe for the Aussie.

This could provide a unique opportunity for carry traders.

Here take a look at the AUD/CHF on the long term chart...

A buy position on this pair currently pays 52 cents a day on every 10,000 units making it one of the most attractive targets for high equity clients to make steady low-risk returns.

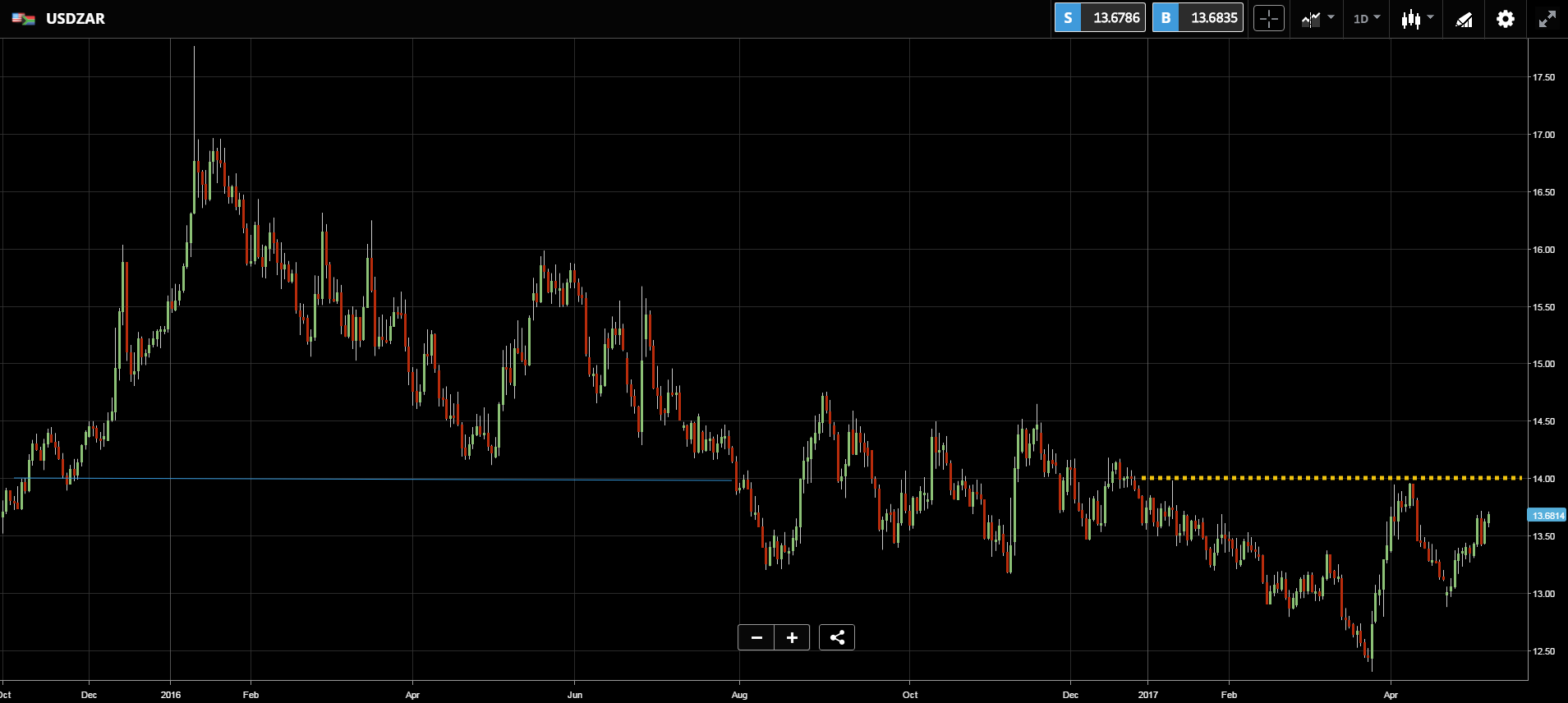

South African Rand

As we've been watching over the past month or so, the President of South Africa has been running into some trouble. Well, that hasn't really gone away.

At the moment, we're watching the chart for a technical breakout of 14 rands to the dollar. This level has been a very important psychological barrier in the past. A breakout here would certainly make a few headlines and would give the impression of a rapidly depreciating currency.

The Safe Haven of the Encrypted World

Following the twin attacks on Kraken and Poloniex, alt-coins are getting hammered. Ethereum is bearing the brunt but eight out of ten of the top valued cryptocurrencies are dropping today.

Even my favorite number is being affected. The total market cap of all cryptocurrencies, a number that has been rising steadily over the last few months, hasn't gone up at all over the past 24 hours.

However, this gives us a unique opportunity to get some insight into the correlations of this market.

The top valued cryptocurrency, (bitcoin), has been rising strongly this morning and on some exchanges is already well past $1700 a coin.

This displays a clear indication that bitcoin is the safe haven of cryptocurrencies.

Let's have an awesome day!!

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.