Cryptocurrencies are volatile and trading requires a decent understanding of technical analysis and the discipline to master the emotions of fear and greed. Many people are content to be buy-and-hold investors because they can’t cope with the rollercoaster ride of crypto trading. However, buy and hold crypto investing also requires a great deal of unwavering conviction that the value of the coins you are "hodling" will increase with time.

However, new suites of crypto investment vehicles are emerging as the cryptocurrency industry continues to mature. Staking, airdrops, crypto lending, and crypto bonds are some of the emerging investment vehicles for crypto "holders" interested in potential earnings. Crypto is evolving.

Similar to traditional fixed income assets, crypto staking rewards investors based on how much crypto they want to stake and for how long they intend to hold the stake. For instance, if the total number of coins staked by an investor amounts to 7% of the total coins staked on a Blockchain, the investor’s node will get to mine 7% of transactions for new blocks.

Most staking systems only require investors to hold the tokens in their wallets to get a fixed return. However, some staking models also use an inflation rate to spread the operational costs of the network to all token holders on a pro-rata basis.

Tokens analysis and their staking performance

NEO (NEO/GAS)

NEO, formerly Antshares, was launched in 2016 as an open-source Chinese blockchain project developed to rival Ethereum. NEO supports the development of smart contracts, tokenization of assets, and the creation of DApps. The up limit for the NEO token is 100 million coins but passive income from staking NEO coins is paid in another token called GAS.

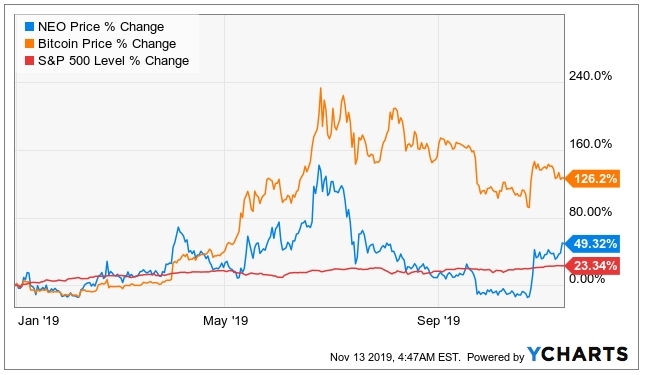

Price performance

The chart above shows the price performance of NEO in the year-to-date period. While Bitcoin has delivered a 126% price gain, NEO has only managed to deliver a 49% increase in its trading price. However, the performance of NEO doubles the performance of Wall Street’s S&P 500, which has only returned 23% in the same period.

Staking rewards

Neo is currently trading around in the $12 to $13 range even though its year-to-date high is around $19.49. The minimum staking requirement on the NEO blockchain is 1 NEO and the staking reward evens out at about 1.51% per annum.

LiquidApps (DAPP Token)

LiquidApps was launched earlier in 2019 to optimize the growth and mass-market adoption of Blockchain technology through innovative services that empower developers to build scalable DApps. LiquidApps leverages the DAPP Network, which included DSPs, the DAPP Token, and vRAM to solve the inherent scalability challenge of Blockchains.

Price performance

Since being launched in the middle of this year, the DAPP tokens has delivered a commendable 160% price gains from $0.0046 to its current trading price around $0.012. The performance of the token exceeds the 126% performance of Bitcoin and it dwarfs the 23% gain in the S&P 500.

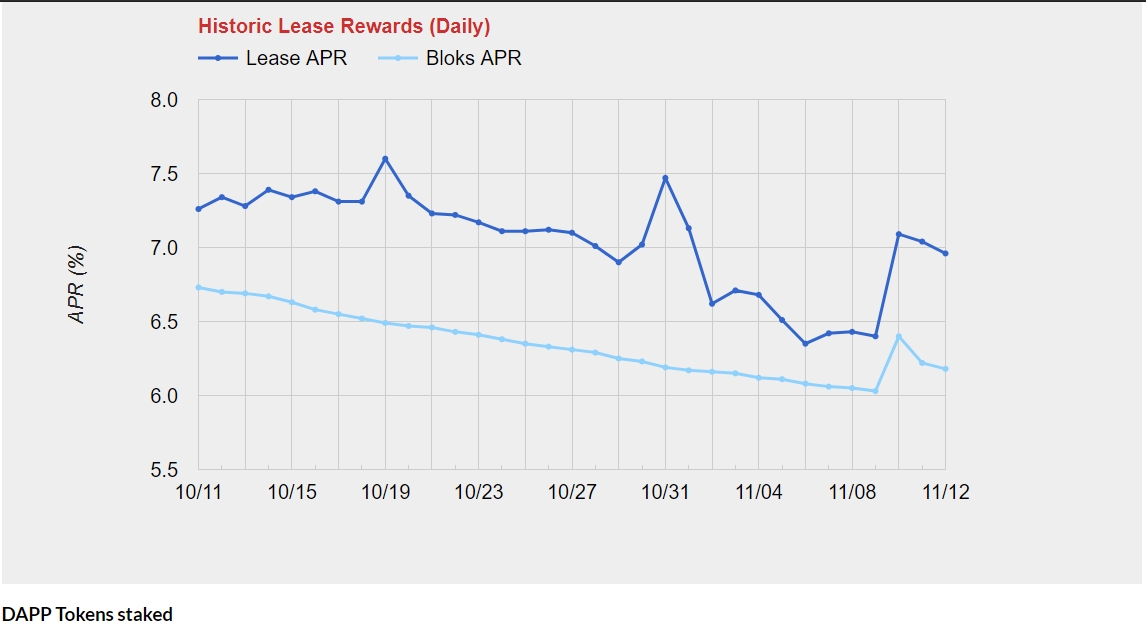

Staking reward

DAPP token is currently trading in the $0.011 to $0.013 range even though its year-to-date high is around $0.023. DAPP investors, however, get better performance on the staking reward of the token, which hovers around 6.96% per annum.

Qtum (QTUM)

Qtum is an open-source Blockchain backed by its Singapore-based QTUM foundation to promote the applications of Blockchain technology such as Smart Contracts in enterprise and institutional use. The Qtum network is especially interesting because it is a hybrid network that combines Ethereum’s EVM with Bitcoin’s UXTO model.

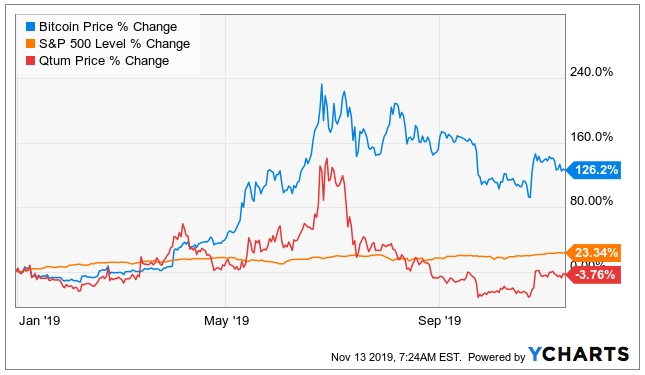

Price performance

Qtum has mostly caused long-term hodlers to lose money in the year-to-date period even though some traders might have found pockets of opportunity for profit. Qtum opened for trading this year around $2.15 but it's trading price has declined by almost 4% to grossly underperform Bitcoin and general Wall Street equities.

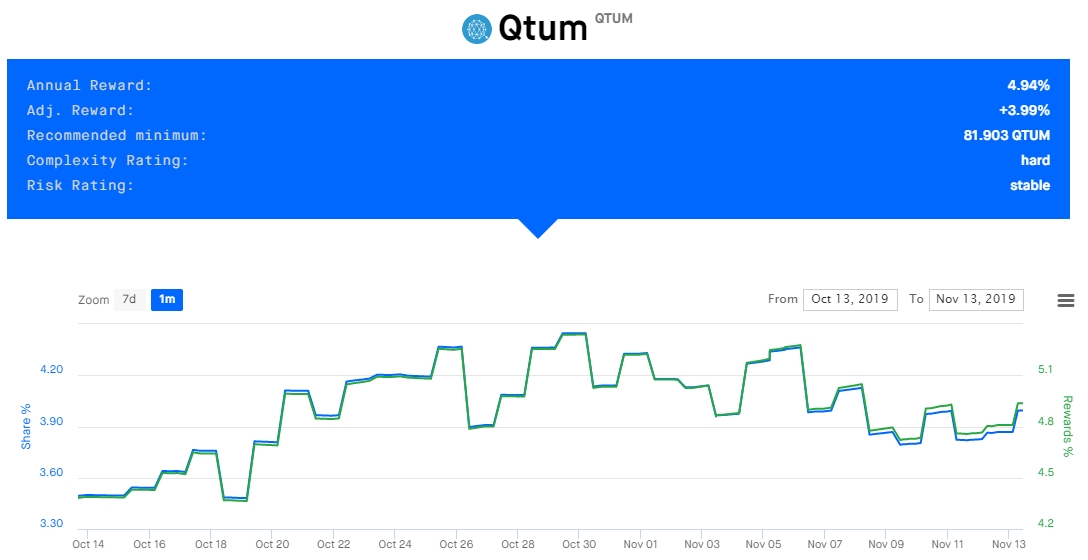

Staking rewards

Qtum doesn’t have a minimum staking requirement; an investor can start by staking 1 Qtum coin they’ll be eligible for rewards. Qtum currently pays about 4.49% in annual staking rewards and as much as 19.30% of its circulating supply is staked by "hodlers".

Algorand (ALGO)

The Algorand Foundation, the organization behind the Algorand Protocol and open source software is trying to deliver on the promise of Blockchain by creating an inclusive system that engenders a truly equitable and borderless economy. The Algorand network requires minimal computational resources and holding Algo tokens qualifies investors to participate in block consensus.

Price performance

Algo tokens became available in the crypto market in the middle of this year but it has mostly recorded steep losses from around $3.28 to its current trading price around $0.27, which marks a massive 91% decline in its trading price. The loss recorded in the price of Algo token is disheartening when compared to the 126% performance of Bitcoin and the 23% gain in the S&P 500 in the year-to-date period.

Staking rewards

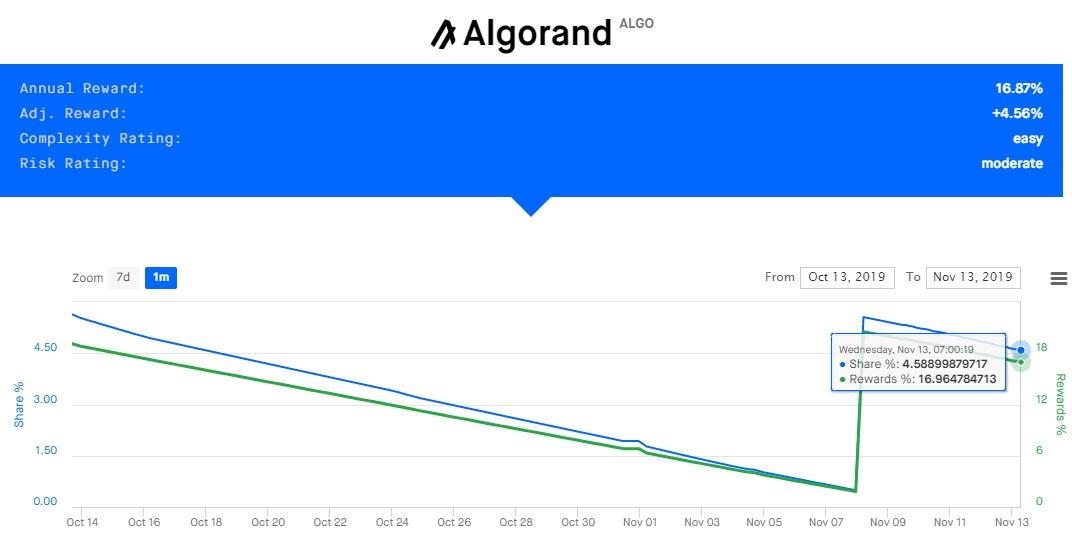

However, what Algo lacks in price gains, it makes up for it with an enviable staking reward for investors. Investors staking Algo tokens currently can expect to receive about 17% in annual rewards inasmuchas they maintain the minimum wallet balance.

Conclusion

From the foregoing, staking is another way to unlock additional streams of revenue for long-term crypto investors who don’t want to be bothered with day trading. However, crypto staking also has some potential downsides such as an inability to sell staked coins if there’s a sudden downturn. More so, the rewards from staking may not cover price losses in the event if an extended bear market. And there’s also the risk of coin theft in delegated staking or mining pools.

Nonetheless, long term crypto investors are typically unperturbed by short-term market volatility. Hence, 1% to 16% rewards on staked coins provide earnings which otherwise wouldn’t have accrued if the coins were lying fallow in a wallet without being staked.