After a wild winter that refused to back down through spring, here in Baltimore, at Wall Street Daily’s headquarters, summer finally seems just around the corner.

Next week, Memorial Day will mark the “unofficial” start to vacation season.

And, as they do every year, millions of Americans will make their way to destinations all over the world.

This year, however, the rapid spread of the Zika virus is weighing heavy on the minds of travelers.

The virus has been linked to serious birth defects and neurological diseases all over the world.

Worst of all, no vaccine or cure has been developed to slow or stop the spread of this deadly new virus.

Despite the very real threat that Zika poses for vacationers across the globe, the travel industry remains a profitable realm for investors this upcoming season – if you know the right moves to make.

Over this past month, I’ve focused on uncovering several opportunities for investors to profit during the summer slump in stocks.

Today, we’ll finish off this series with a stock that’s sailing right into the perfect storm of downside…

Losing the Race

Carnival Corp (NYSE:CCL) is one of the world’s largest cruise line companies. Based out of Miami, Florida with ports ranging from London to Panama, the company operates nearly a hundred ships around the world and serves 11 million guests every year.

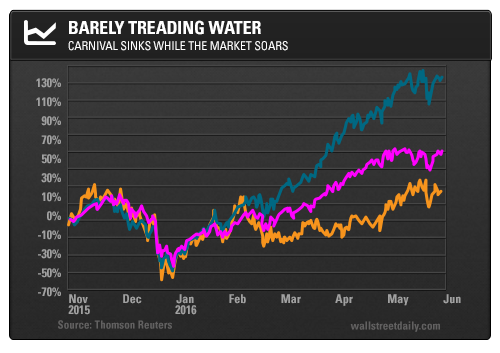

Over the past decade, the stock has notably lagged on the market.

Carnival’s stock has gained just 24% since 2006, while the S&P 500 Index rose 62% and the consumer discretionary soared 132%.

Additionally, in the last several years, Carnival has come under heavy pressure from popular rivals Royal Caribbean Cruises (NYSE:RCL) and Norwegian Cruise Line Holdings Ltd (NASDAQ:NCLH).

This comes as no surprise, considering the company’s growth has trailed its competitors by a hefty margin.

Since 2011, Carnival’s earnings have grown just 7.1%. That’s less than half of Royal Caribbean’s 18.1% clip, and 11 times shy of Norwegian’s 84.1% growth.

Revenue has also stagnated. In the last five years, Carnival’s top line has risen 1.7%. Again, this is well below Royal Caribbean’s 4.2% gain and Norwegian’s blistering 16.6% clip.

With shares valued at 13.8 times forward earnings and 1.6 book value, you might just be tempted to hop on board.

But, if its fundamentals haven’t given you pause, here are two even more compelling reasons to think twice about Carnival…

Fear Is Contagious

Viral disease outbreaks are kryptonite to the leisure industry, let alone Carnival’s stock.

In the thick of 2014’s deadly Ebola virus outbreak, Carnival shares shed nearly 20% from their January high to their October low.

This is crucial to note because the majority of Carnival’s southern ports are located in World Health Organization-certified Zika-active transmission zones, including the Caribbean, Mexico, and South America.

As we inch closer to the start of the 2016 Rio Olympics, it is likely that widespread fear could result in another Ebola-type market selloff.

In short, Carnival’s enormous downside exposure to Zika this summer could be a recipe for disaster for its valuation.

Running Into the Stampede

Most investors are familiar with the famous Warren Buffett quote, “Buy when there’s blood in the streets.”

Well, profitable short sellers “sell” when the herd is buying.

And Carnival is ripe for a downturn on several fronts…

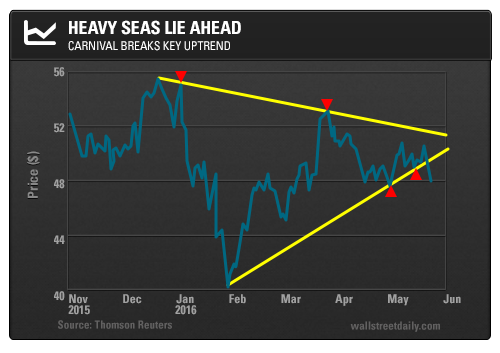

After gaining 27% this year from their February bottom to their April peak, shares just broke down below their four-month uptrend line.

Carnival’s relative strength index, and its moving average convergence divergence (MACD) line, also broke their uptrends.

From a technical perspective, this indicates a possible momentum shift to the downside.

And even if shares do recover from the trend break, they will face stiff medium-term resistance at $51.

Even more ominous for shares, Carnival has posted an average decline of 0.1% in June over the last 10 years.

In fact, since 2006, the stock has averaged a gain of just 0.06% from June to October.

The timing of a short sale on this underperformer couldn’t be better.

So if you’re looking for what could be the juiciest fear play of the year, short the fun ship and don’t look back.

On the hunt.