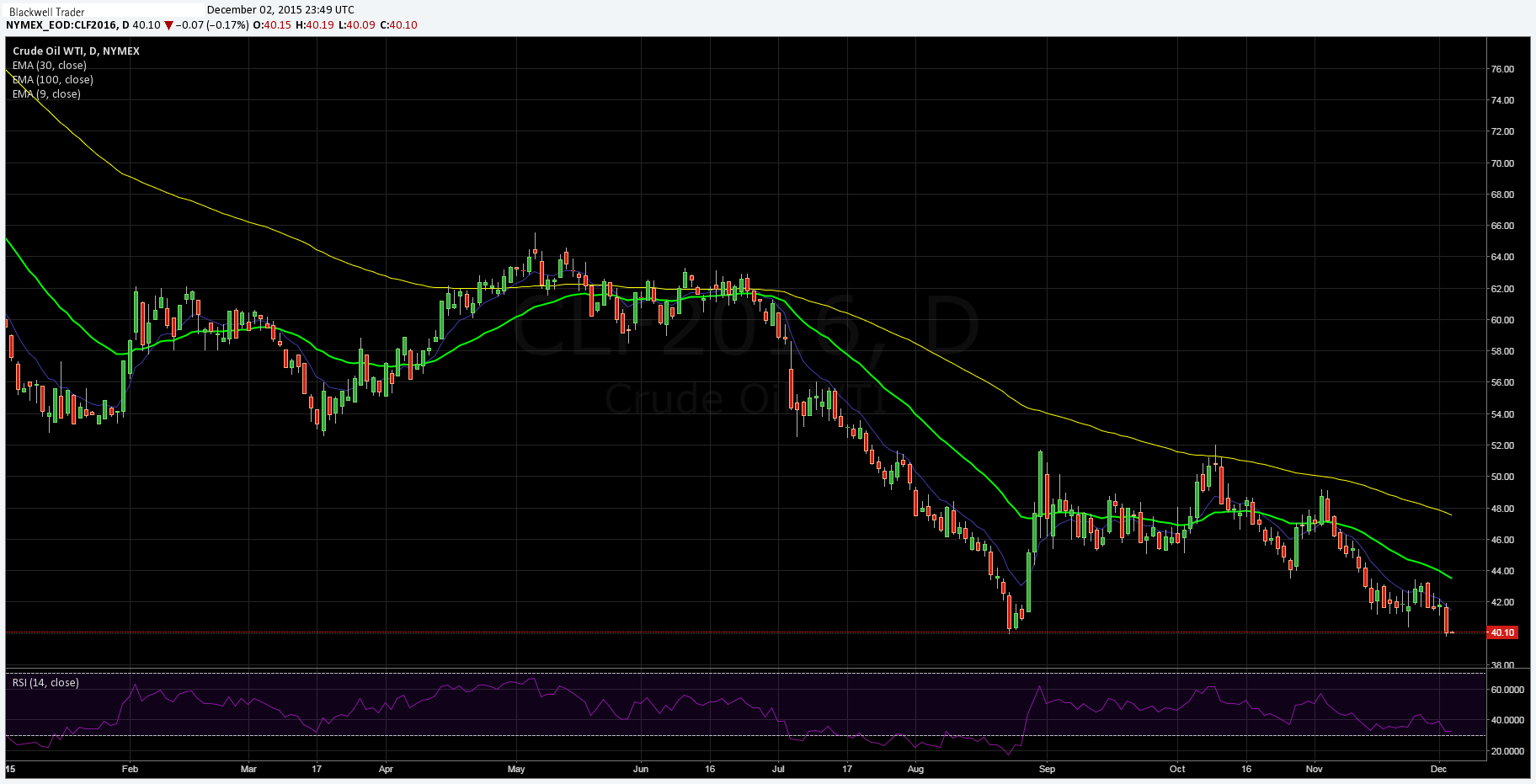

Crude oil prices continued to slide overnight, forming new lows not seen since early August, as concerns over a supply imbalance weighed upon the commodity. There continues to be mounting evidence that the oil glut is here for the long term as OPEC waivers on any consensus to cut production.

WTI Crude oil futures were hit relatively hard overnight as an EIA report demonstrated a further 1.18m barrel build in inventories. Despite significant declines m/m in the rig count, there seems to be no end in sight as oil analysts point to 2016 being a year of pain for the black gold. There is also mounting evidence that the oil industry will have to tolerate a savage over-supply that is likely to lead to a slump that exceeds anything seen during the GFC.

In addition, OPEC’s initial strategy of driving down production costs to damage the fledgling US shale industry has reached a critical point where a pivot is now required. In fact, it would appear that Middle Eastern producers are now facing the prospect of maintaining supply to defend their current market share against the innovative US sector.

However, the outcome of any such strategy is likely to end up further enlarging the current supply glut. Subsequently, 2016 is likely to be a year of severely depressed oil prices and continued production in an attempt to defend their respective market shares. The full effect of lower prices is yet to be felt through much of the oil producing world, but as supply continues to increase so will the impact further down the supply chain.

The next few months are going to be critical for oil prices and it is hard to see much in the way of upside for the commodity. This is especially salient given the coming seasonal weakness as the US bids goodbye to the bullish summer months. This fact, coupled with the continuing global oversupply, provides plenty of fuel to the case for weaker crude prices.

Subsequently, I reiterate my medium term forecast for WTI futures to trade within the $35.00 - $39.00 a barrel range during the early part of 2016.