The commodity market is beginning the week with a decline: the news is disturbing nervous investors again. Brent is returning to 94.70 USD per barrel.

A couple of days ago, it was heard about new outbreaks of the coronavirus in China. This makes the authorities tighten the quarantine restrictions. The market already has experience reacting to such cases: business and consumer activity drop in large cities. This, in turn, will hurt fuel consumption in China.

Baker Hughes announced on Friday that the number of drilling rigs had dropped by 2 to 610 units. In October, this index demonstrated growth for the first time since July this year; however, this does not change the global stagnation. Shale producers abstain from increasing investments in the sector because crediting in the US is becoming more expensive.

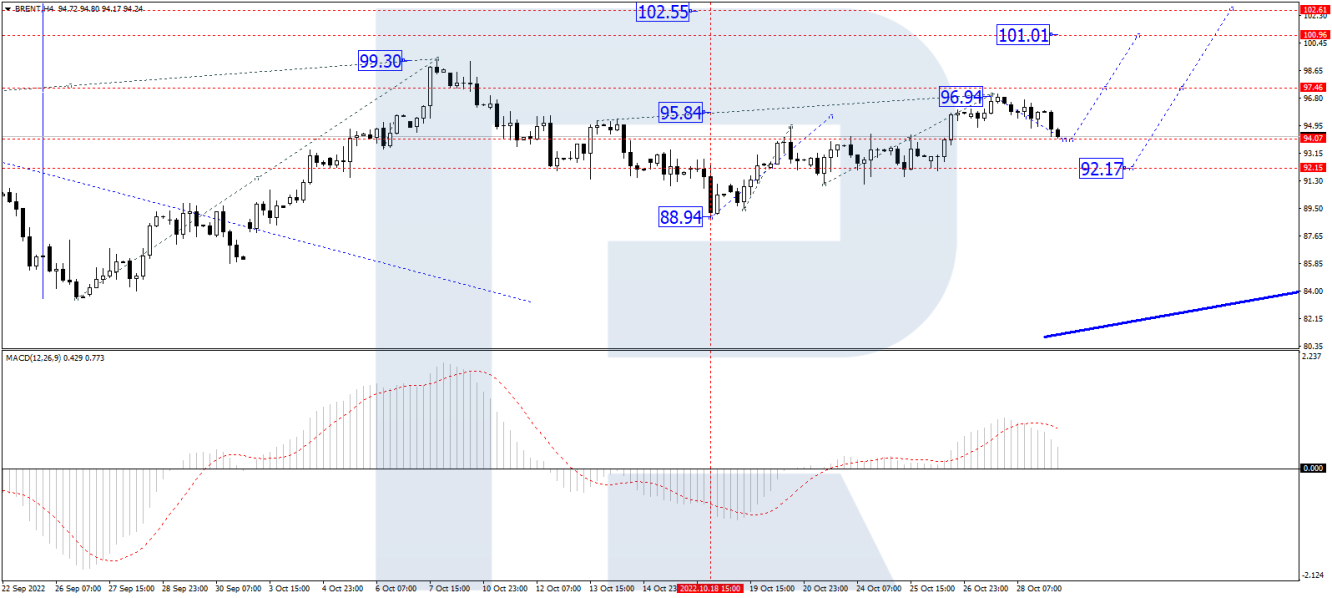

On H4, Brent completed a wave of growth to 97.07. Today the market continues developing a correction. Crude oil is expected to reach 93.70, with a consolidation range possibly forming around. With an escape downwards, correction may continue till 92.66. Technically, the scenario is confirmed by the MACD: its signal line has escaped the histogram area and is headed directly down.

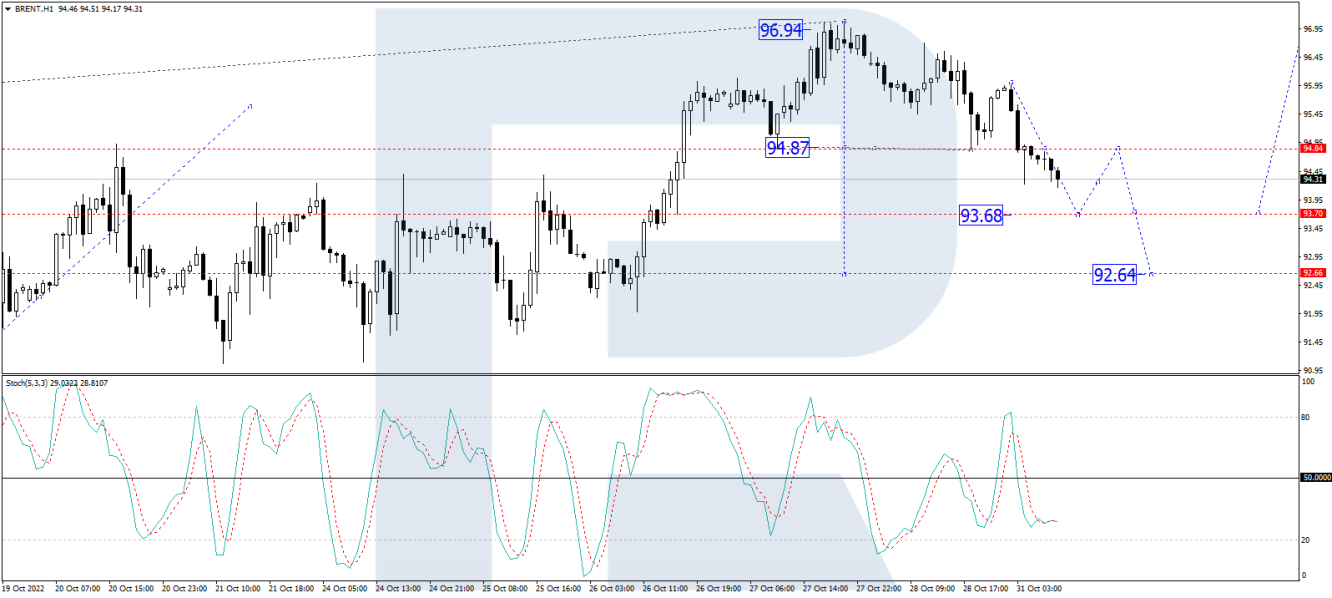

On H1, Brent is forming a consolidation range of around 94.84. A wave of correctional decline is likely to continue to 93.66. The goal is local. The growth to 94.84 is expected (a test from below), followed by a decline to 92.66. Technically, the scenario is confirmed by the Stochastic oscillator: its signal line is under 50. Further decline to 20 is expected.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.