- Crude oil rose about 4% last week with WTI taking out the $80 and Brent the $85 barrier, reaching levels last seen in November.

- Factors supporting oil prices include optimism over China, a bullish forecast from the IEA, and general strength in commodities.

- Financial markets face a key test this week with several central bank meetings and market-moving data to come.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

After climbing 4% last week, crude oil will be looking to extend those gains as we start a busy week.

We already had mixed-bag data from China overnight, revealing relatively weak consumer and real estate numbers.

However, the unexpectedly robust investment and industrial data suggest a potential change in growth drivers for 2024 ahead of a potential stimulus rollout.

The stronger industrial data helped to keep hopes over a stronger demand recovery for commodities alive, sending crude prices modestly higher during Asian hours.

The rest of Monday’s session is relatively quiet in terms of macro events but expect to see lots of volatility as we head deeper in the week.

Financial markets face a key test this week

In the upcoming days, the economic agenda brims with significant central bank gatherings and key economic indicators from various countries including Australia, China, the UK, the Eurozone, the US, and Canada.

Expect increased market volatility across asset classes. Major central banks scheduled for announcements include the Bank of Japan and Reserve Bank of Australia on Tuesday, followed by the US Federal Reserve on Wednesday, and concluding with the Swiss National Bank and Bank of England on Thursday.

Notably for oil traders, global manufacturing PMI data will take center stage on Thursday among the upcoming economic reports.

What factors are supporting oil prices and can the rally last?

For crude to sustain its recent gains, we will need to see stronger PMI data on Thursday to justify the recent bullish demand forecasts from the International Energy Agency (IEA) and oil’s advance.

A weaker US dollar will probably also help the cause, although the greenback has made a comeback in recent days with FX investors wary of the Fed being potentially more hawkish in its assessment of inflation trends at its upcoming FOMC policy decision in mid-week.

The recent surge in oil prices closely follows a sharp uptick in copper and silver prices, coupled with gold reaching a record high a couple of weeks ago. Copper’s gains were also attributed to reports of an agreement being reached among some Chinese smelters to cut production due to a collapse in processing fees, raising fears about a shortage of refined metal.

As well as support from the general commodities complex, support for oil has also been bolstered by various other factors in recent weeks, including the International Energy Agency (IEA) warning of a supply shortfall throughout the year, optimism surrounding robust demand from China, and unexpected declines in US crude inventories.

The IEA revised its previous forecasts of oversupply due to expectations that OPEC+ will extend production cuts later in the year. Furthermore, the IEA raised its projections for global oil demand growth in 2024 by 110,000 barrels per day to 1.3 million barrels, citing a stronger US economic outlook and increased demand for marine fuel. This uptick in demand is attributed to ships choosing longer routes to avoid Houthi attacks in the Red Sea.

In the US, inventories fell by 1.5 million barrels, marking the first decline in seven weeks, with a reduction in stocks at the Cushing hub also providing bullish support for oil prices.

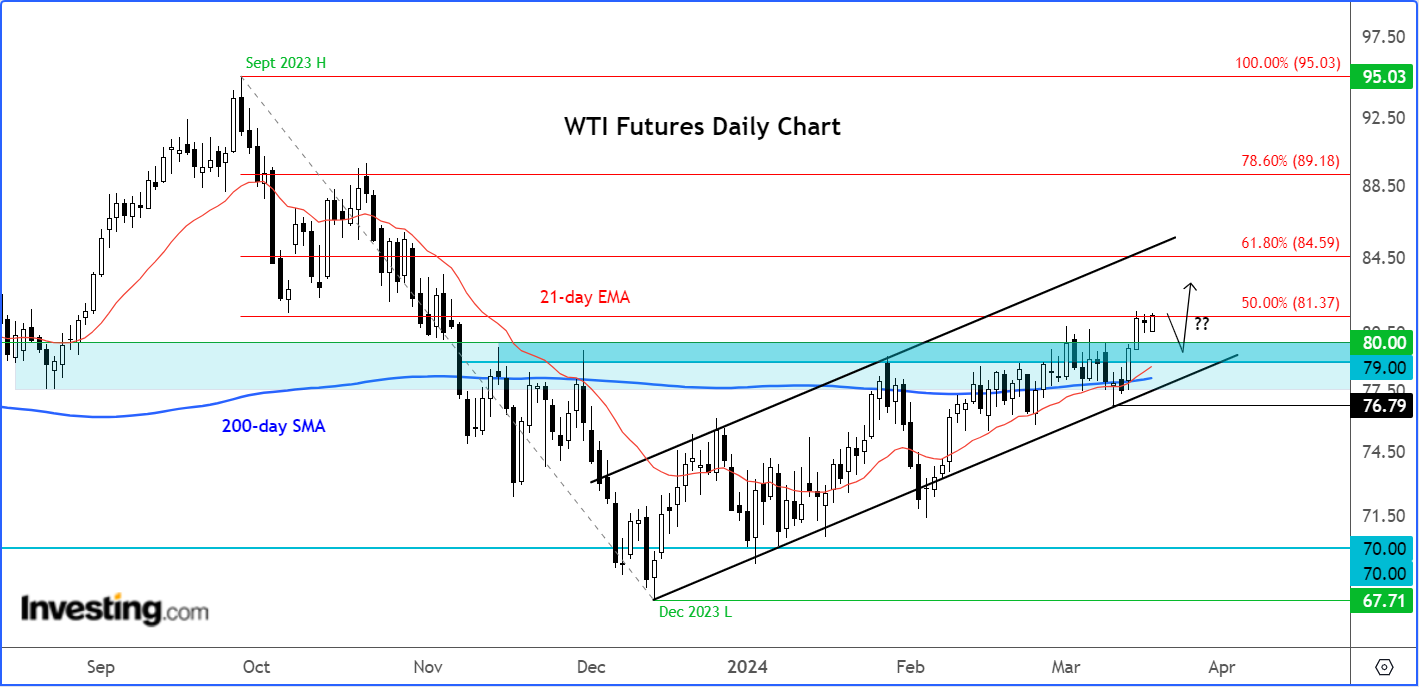

WTI technical analysis and trade ideas

From a technical perspective, WTI appears promising after rising in these two and half months of the year, in what has been a less-than-ideal bullish trend with many interim downswings.

WTI had faced repeated sell-offs around the $79.00 mark since November, as attempts to hold above the 200-day average repeatedly failed.

However, in more recent weeks, WTI has held above the 200 MA more often than below it, and those interim sell-offs have been progressively getting less severe. With a decisive breach above that $79 threshold last week, and also through the psychologically important $80 area, the technical outlook suggests a clear path of least resistance towards higher levels.

So, moving forward, what the bulls would like to see is oil’s ability to now hold above the broken $79.00-$80.00 area on any short-term dips. If these levels are defended then the bullish momentum will be sustained, potentially leading to a move towards the mid-$80s next.

At the time of writing, WTI was testing the $81.40 area. This level is bang in the middle (i.e., 50% retracement) of the last major downward swing that started from the peak of $95.00 reached in September. The next measured target is at $84.60, corresponding to the 61.8% Fibonacci retracement level of the same price swing.

If you are bearish on oil, then it may be best to await a clear reversal pattern first or look for a lower low to form. In this regard, the line in the sand for many bulls would be last week’s low at $76.79. A potential breach of this level could trigger a sharp drop, although such a scenario is not my primary expectation.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.