Normally, after tensions between Iran/Iraq and the U.S. flare-up, Oil and Gold

rally quite extensively but reversed sharply lower by the end of the session.

Yes, Gold was 1% higher Monday and was up over $35 overnight, but Crude Oil

actually moved lower, which is a fairly strong indication that disruptions

in oil supply from the Middle East are not as concerning as they were 10+ years

ago. Traders and investors don’t believe this isolated targeted missile attack

will result in any extended aggression between the US and Iran.

When past conflicts in the Middle East happened, Oil would typically rally and

Gold would spike higher as well. Consider this a reflex action to uncertain oil

supply issues and concerns that global market uncertainty could crash the

markets. Gold seems like an easy expectation related to this type of uncertainty

as it continues to act as a hedge against many risks like missiles/war, financial

uncertainties etc…

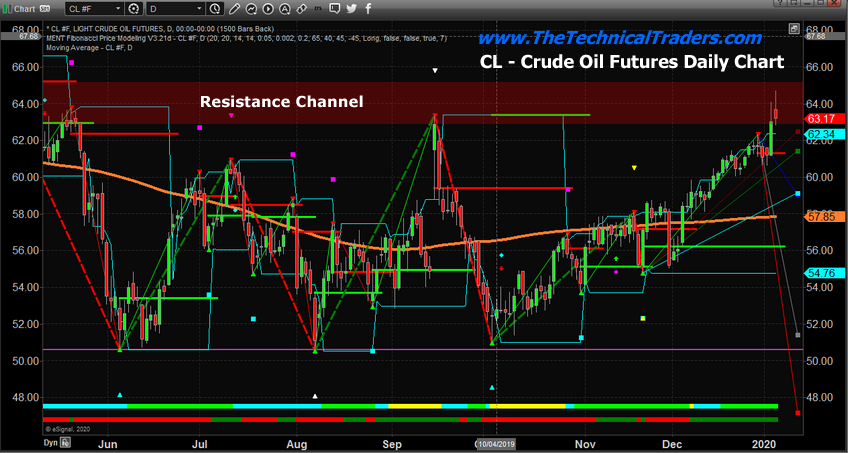

In my pre-market video report to subscribers today (Monday, Jan 6th) I pointed

out how the price of crude oil was testing a critical resistance area form the last

time there were missiles fired. Today’s reversal is not a huge surprise and in

fact, it looks like an exhaustion top.

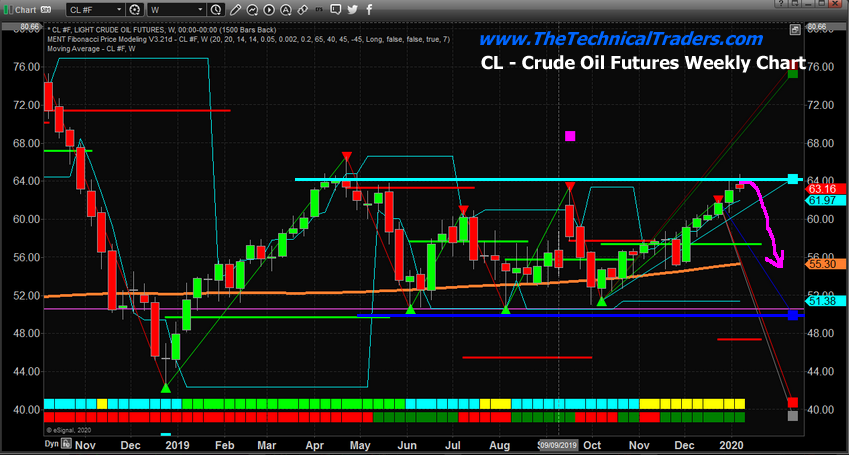

Oil, on the other hand, has experienced one of the longer price declines in

recent history, from the peak price near $147 near July 2008 to levels currently

near $63. But we saw a low price for oil below $30 (near February 2016).

Our proprietary Fibonacci Price Modeling system is highlighting similar levels near $64 and $50. This price modeling system maps and tracks price rotation using a proprietary adaptive Fibonacci price theory model. These levels, highlighted on this chart, represent immediate price target levels for any upside move (CYAN, already reached) and any downside move (BLUE, suggesting a move back towards $50 may be in the works).

If Oil is not capable of breaking above this Resistance Channel, then Fibonacci Price Theory would suggest price must turn lower and attempt to establish a new LOW PRICE level that is below recent low price levels.

If this Resistance Channel continues to act as a solid price ceiling, Crude Oil may turn lower over the first few quarters of 2020 and attempt to target levels near or below $50 fairly soon. Skilled traders should prepare for this type of move and identify opportunities for profits in the near future.

In fact, I also gave subscribers a head up that GDXJ and TLT were going to gap higher and likely be under pressure all session. Also, I showed how the S&P 500 was going to gap lower deep into oversold territory and likely rally strongly just like last Friday, all of these things happened perfectly today.

Pre-market GDXJ, SPY and TLT warning of price gaps into extreme territories beyond the small colored lines: Red (overbought level), and Green (oversold level).

PRE-MARKET CHART ANALYSIS

If this Resistance Channel continues to act as a solid price ceiling, Crude Oil may turn lower over the first few quarters of 2020 and attempt to target levels near or below $50 fairly soon. Skilled traders should prepare for this type of move and identify opportunities for profits in the near future.

In fact, I also gave subscribers a head up that GDXJ and TLT were going to gap higher and likely be under pressure all session. Also, I showed how the SP500 was going to gap lower deep into oversold territory and likely rally strongly just like last Friday, all of these things happened perfectly today.

Pre-market GDXJ, SPY (NYSE:SPY), TLT warning of price gaps into extreme territories beyond the small colored lines: Red (overbought level), and Green (oversold level).

END OF DAY MARKET MOVEMENTS

My point is my team and I have a good pulse on the major markets and can profit during times when most others can’t, which is why you should join.