On the final Monday of August, oil prices continue to move upwards; Brent is trading to reach $101.90 per barrel.

Everything is looking relatively calm. The news published last week, such as expectations of OPEC’s active interference in oil production, the appearance of Iranian oil in the commodity market, and the strong USD factor has already been priced in.

The oil market will closely monitor the demand for commodities for the upcoming season. If no slowing factors appear, investors will continue to buy.

Last Friday’s report from Baker Hughes showed that over the past week, the Oil Rig Count in the US added three units, up to 765. Before that, the indicator had been falling for three weeks.

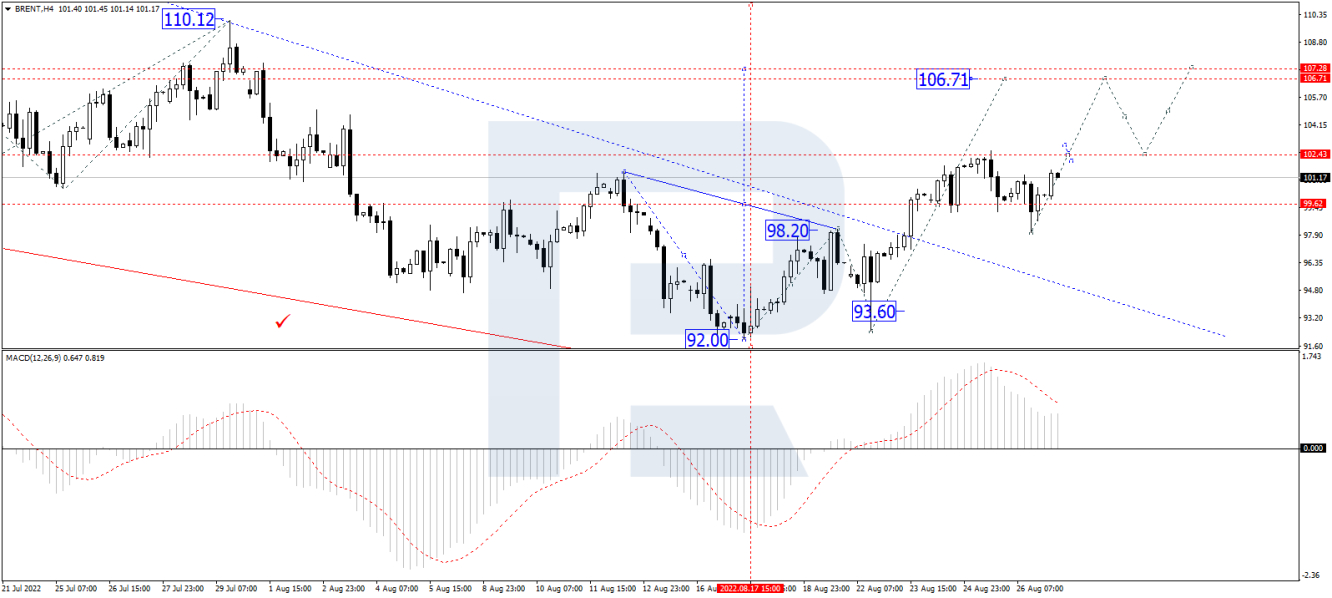

On the H4 chart, having completed the correctional wave at 98.05, Brent is trading upwards to break 102.44 and may later continue growing with the short-term target at 106.80. After that, the instrument may start another correction down to 102.50 and then resume trading upwards to reach 107.30.

From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving above 0 and may continue trading to reach new highs later.

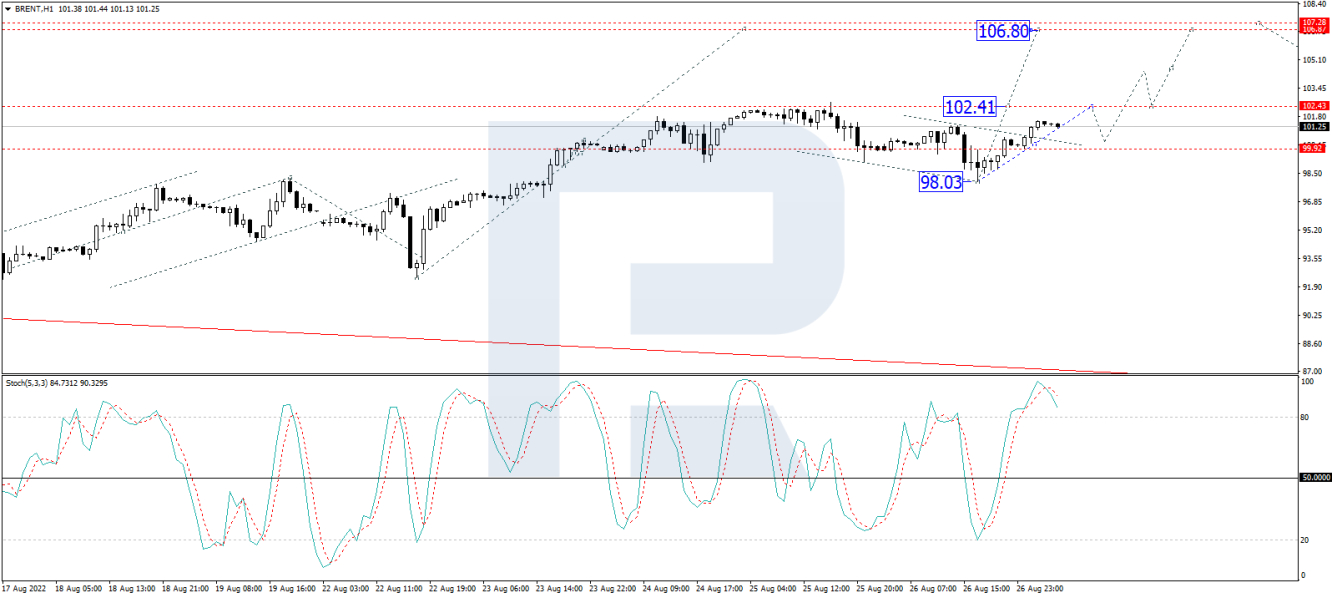

As we can see in the H1 chart, after finishing the correction at 93.05 and breaking the correctional channel at 100.05, Brent is expected to test the latter level from above. Later, the market may start another growth towards 102.44 or extend this structure to reach the first upside target at 103.20.

From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is moving near the highs above 80. Later, the line may fall to rebound from 50 and resume growing to reach new highs.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.